CoinDesk Market Index Q2 Review: Quiet Appreciation, Regulatory Uncertainty

It’s been a bit of a choppy ride for the cryptocurrency market this past quarter, coming off a strong first quarter. Over the past three months, the CoinDesk Market Index (CMI), which spans over 90% of the crypto market capitalization, appreciated 2.2%, while both bitcoin (BTC) and ether (ETH) outperformed the broad benchmark, posted a gain of 7%, and 5.2%, respectively.

The CoinDesk Market Index (CMI) is a broad-based index designed to measure the market capitalization weighted performance of the digital asset market subject to minimum trading and exchange eligibility requirements.

This underperformance in the CMI, relative to BTC and ETH can be largely attributed to the quarter which saw significant regulatory action against large cap alternative tokens, combined with positive developments for Bitcoin, resulting in a bifurcation in the crypto market between bitcoin and ether versus all other digital assets.

Within the sector framework of the CoinDesk DACS, we continued to see evidence of this separation by market capitalization over the quarter, with sectors containing bitcoin and ether [Currency (CCY, +6%) and Smart Contract Platform (SMT, -2.4%), respectively] outperforming small capitalization sectors such as Digitization (DTZ, -28%) and Culture and Entertainment (CNE, -35%).

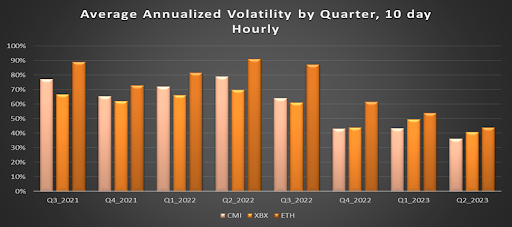

Both April and May were relatively muted months as the market traded within a price range established after the response to the Silicon Valley Bank collapse in March. The range-bound market also exhibited lower than average realized volatility, with Q2 2023 exhibiting the lowest volatility quarter for CMI, Bitcoin (XBX) and Ether (ETH) in the past 2 years (see Figure 2 for average volatility by quarter, estimated using hourly return data).

While AI themes were playing out within traditional equity markets, digital asset traders were focused on newly-minted meme tokens, such as PEPE and BRC-20 ordinal tokens which drove on-chain activity to the benefit of staking node validators and miners.

In May, we began to see some slight weakness across the asset class due to the macro headwinds of rising interest rate expectations, as market expectations for interest rates repriced higher and for longer, as the U.S. 2-year yield increased ~30bps and the U.S. treasury yield curve eliminated rate cuts expectations for the rest of the year.

The range-bound market persisted into June, where the lows of the range were first tested by the Binance and Coinbase SEC announcements, then later the highs with the announcement of the BlackRock filing of a Bitcoin spot ETF. This latter event focused attention and demand for bitcoin, which had positive knock-on effects for both the Currency Sector and broad CMI cap weighted index.

This Bitcoin positive development, combined with the SEC action against Coinbase for allegedly listing specific alt coins as unregistered securities, resulted in an increase in the ratio of Bitcoin Market Cap to Total Crypto Market Cap (“Bitcoin Dominance”, see Figure 3) to accelerate above 50% to levels not seen since 2021 and a dramatic underperformance of small cap vs large cap crypto tokens.

Where we go from here: outlook

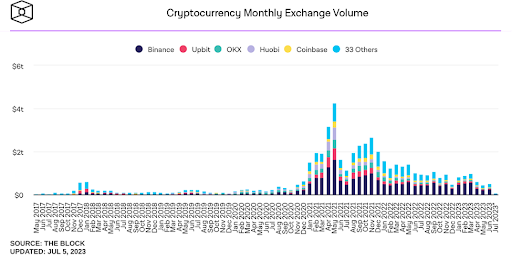

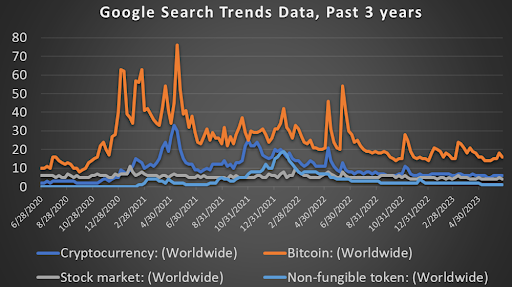

Monthly crypto exchange trading volume (see Figure 4) and Google Search Trend data (see Figure 5) have not recovered to 2020-2021 levels, which suggests that retail interest in crypto continues to stagnate due to the lower token price levels relative to the 2021 bull market period. This reduced interest is supported by the lower levels of realized volatility across bitcoin (XBX), ether (ETX) and the broad CMI index, as markets that move less are less attractive to traders.

With the recent flurry of Bitcoin Spot ETF filings, and newer institutional exchange offerings (such as EDX), we can hope that this interest gets revitalized by new institutional entrants into the market, which will bring new focus and attention to the asset class, as well as more consistent trading activities and volumes.

Within our suite of CoinDesk Indices indicators, both Bitcoin and Ethereum Trend Indicators are currently estimating strong upward trends and are suggestive of a move towards higher prices from current levels, while the macro-economic environment is more neutral over the near term, as positive U.S. credit conditions are offset by recent moves higher in nominal and real interest rates.

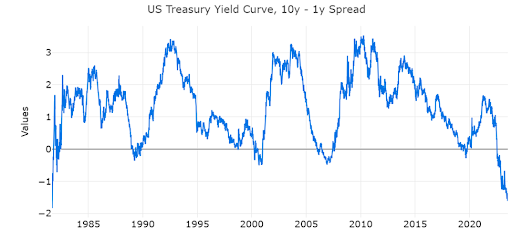

These net positive nearer term indicators should also be weighed against a substantially inverted US yield curve (see Figure 6 below), which is the most inverted since the early 1980s. An inverted yield curve has historically preceded most U.S. recession by 6-18 months, with the current inverted condition beginning in July of 2022.

Figure 6: US Treasury Yield Curve Spread, 10yr – 1yr Rates, Source: FRED

While this is not a perfect recession indicator, it does suggest a likely recession within the next 6-12 months, which would likely impact market risk sentiment and investor demand for cryptocurrency and digital assets. For this reason, we continue to suggest utilizing the Bitcoin and Ethereum Trend Indicators signals to lean into positively trending markets and reduce risk during choppy and downward trending markets.

Edited by Ben Schiller.