CoinDesk Indices Unveils Bitcoin Trend Indicator

Featured SpeakerAlex Thorn

Head of Firmwide ResearchGalaxy

Hear Alex Thorn share his take on “Bitcoin and Inflation: It’s Complicated” at Consensus 2023.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/7c0b0bd4-6cb4-4d93-8bc4-1db61149c9d1.png)

Featured SpeakerAlex Thorn

Head of Firmwide ResearchGalaxy

Hear Alex Thorn share his take on “Bitcoin and Inflation: It’s Complicated” at Consensus 2023.

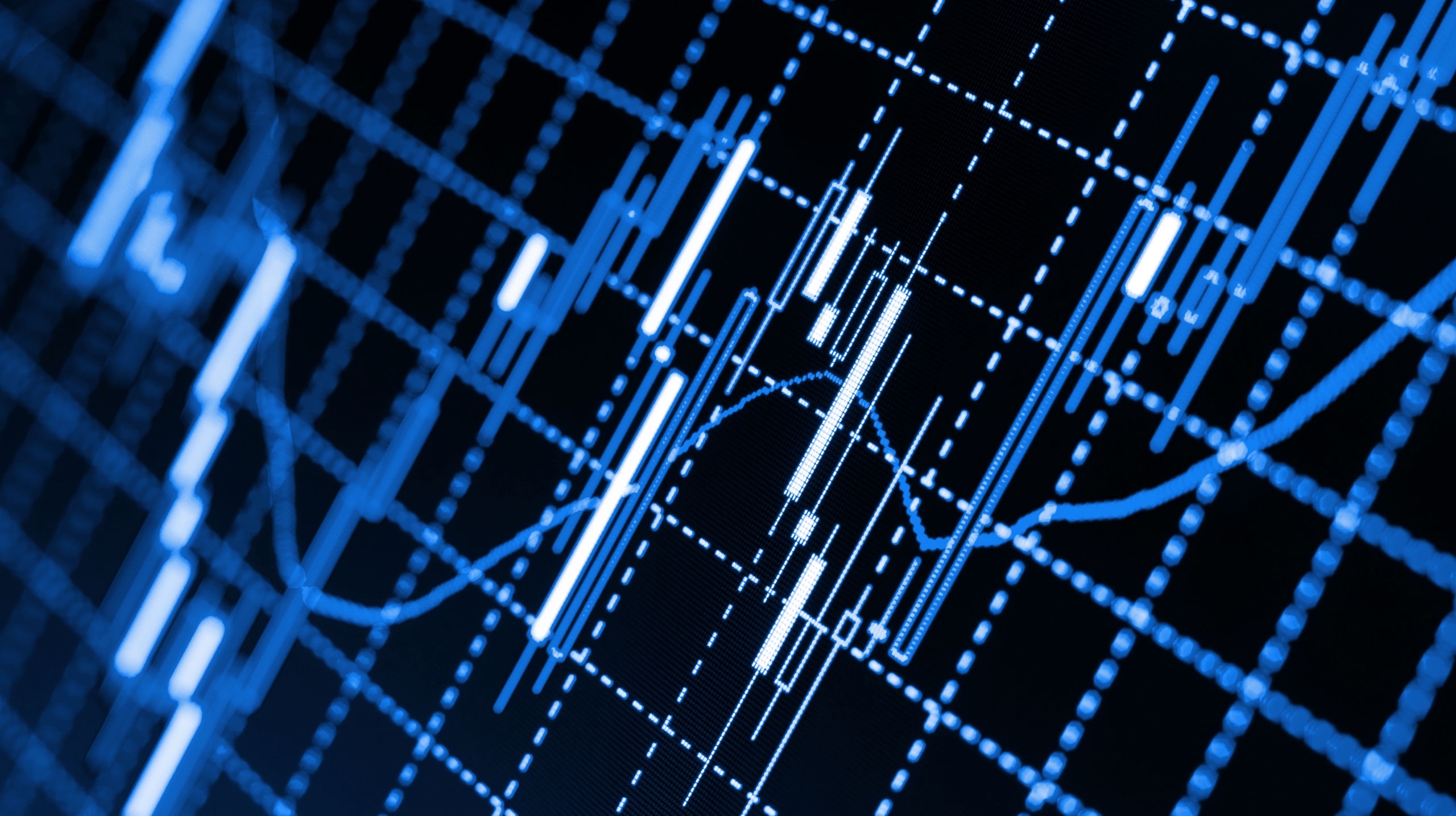

CoinDesk Indices, a CoinDesk subsidiary, is starting the Bitcoin Trend Indicator (BTI), an online tool to help investors determine where the price of bitcoin is going.

BTI generates one of five possible values, each representing a particular direction and strength of bitcoin’s price trend, ranging from significant downtrend to significant uptrend. It is generated via historical data from the CoinDesk Bitcoin Price Index (XBX), using a non-discretionary algorithm.

“We are excited to offer the Bitcoin Trend Indicator, which has been rigorously researched and constructed,” Andy Baehr, CFA, managing director at CoinDesk Indices, said in a press release. “We designed the BTI to help identify trends in the price of bitcoin, assisting asset managers to create new dynamic products, and helping investors make better-informed allocation decisions over a long-term horizon.”

The BTI has been backtested over a five-year period using XBX data.

BTI can be used by asset managers and investors for long-only dynamic allocation strategies. Employing the widely used method of moving average crossovers, BTI’s algorithm identifies trends by comparing short-term price averages with their long-term counterparts.

According to CoinDesk Indices, a hypothetical BTI-directed portfolio of bitcoin and cash demonstrated reduced exposure during downturns – less “crypto winter” – in the cryptocurrency market, while still catching the market upswings.

BTI is one part of CoinDesk Indices’ portfolio, alongside the Digital Asset Classification Standard (DACS) and the CoinDesk Market Index (CMI).

“The BTI is for everyone,” Baehr said. “It’s a simple way to get a feeling for price momentum in Bitcoin. For advisers and asset managers, it’s a powerful tool to build rules-based strategies that can help their clients navigate crypto seasons.”

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/7c0b0bd4-6cb4-4d93-8bc4-1db61149c9d1.png)

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/7c0b0bd4-6cb4-4d93-8bc4-1db61149c9d1.png)