Coincheck Launches Bitcoin OTC Trading Desk 15 Months After Hack

The Tokyo-based cryptocurrency exchange Coincheck has launched a Bitcoin over-the-counter (OTC) trading service for its users, per a post published on its official blog.

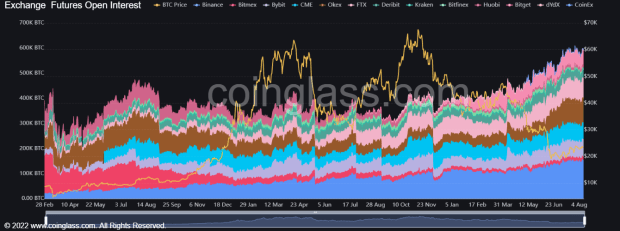

The platform’s OTC trading desk will serve the needs of large-scale and institutional investors that want to trade large volumes of digital assets. Trading starts from 50 BTC (worth about $207,900 USD at press time) via Coincheck’s web interface.

Currently the OTC trading desk serves only investors who want to trade in bitcoin. However, according to the company, there are plans to launch OTC trading for other digital assets as well.

A Long Road to Redemption

This announcement is a continuation of Coincheck’s revival efforts following a security breach last year during which the exchange lost about $532 million in NEM (XEM) tokens.

In the wake of the attack, the exchange was forced to shut down its operations for a few months. About three months later, the platform was purchased for 3.6 billion yen (roughly $33.6 million USD at the time) by Monex Group, a Japanese online brokerage dealer that went on to perform a complete overhaul of its management.

With executives from Monex at the helm, Coincheck kicked off its rebuilding efforts, starting with reimbursement of funds to customers who were affected by the hack.

The exchange reopened to customers in November 2018, and it was issued a regulatory license from the Kanto Local Finance Bureau under Japan’s Payment Services Act. Coincheck’s platform was also restructured by “security experts” to ensure it adhered to best practices on security measures. The exchange also joined the Japan Network Security Association in a bid to redeem its image.

With this new move, Coincheck has joined major cryptocurrency exchanges like Huobi and Coinbase in operating an OTC trading desk for institutional investors.

This article originally appeared on Bitcoin Magazine.