Coinbase’s New Base Blockchain Gobbled Up $68M in Ether, and It’s Not Even Officially Live Yet

-

Traders have sent millions via a one-way bridge to Base blockchain in the hopes of unearthing handsome returns – even as the blockchain has not been officially open to the public yet.

-

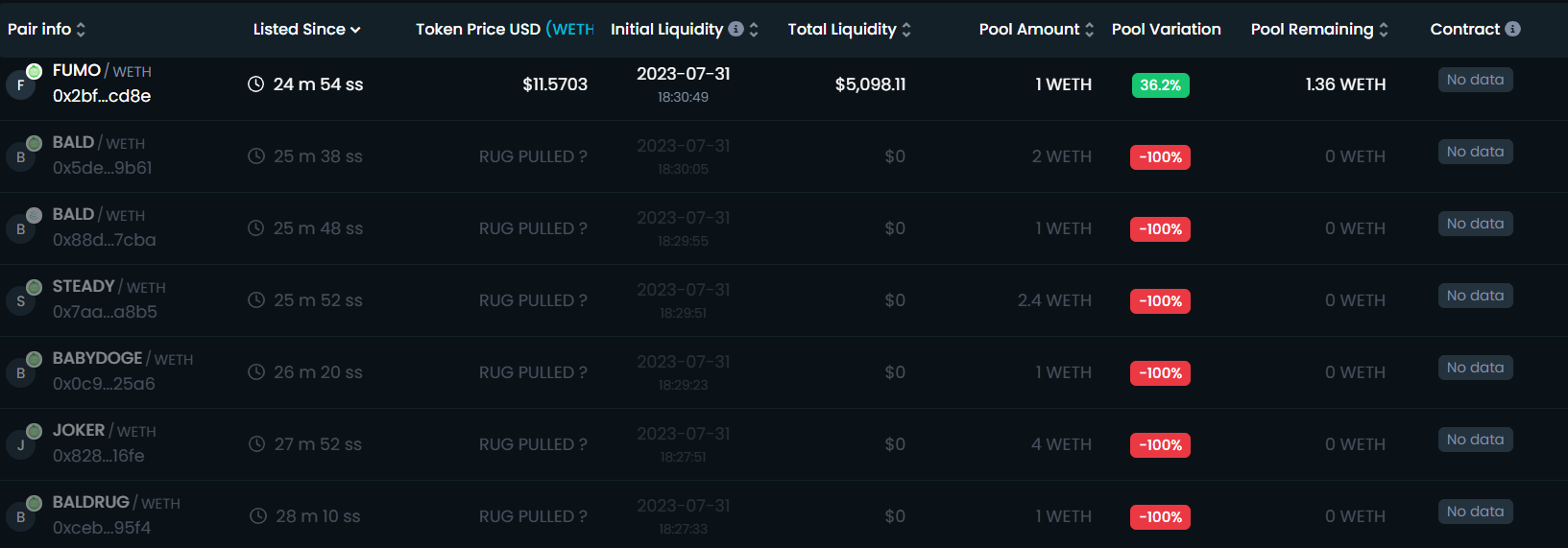

The landscape is filled with rug pulls and scams so far, however, doling out tears instead of dreams to many.

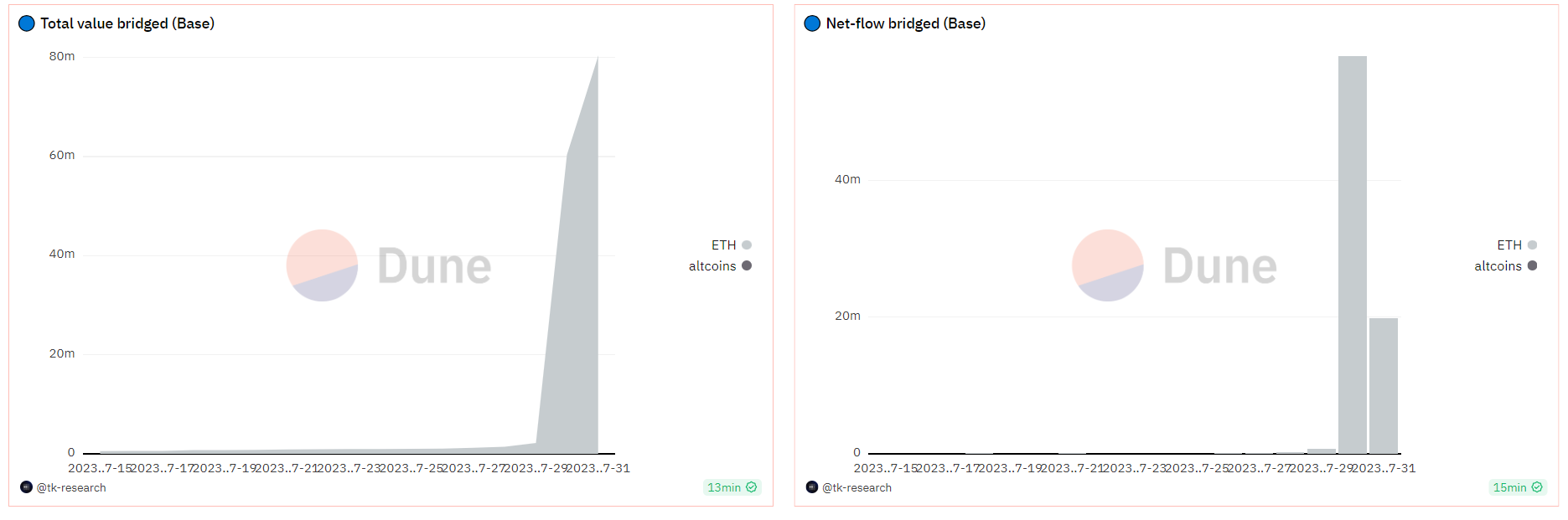

The lure of meme-coin fortunes in a starved market helped Coinbase’s new layer-2 blockchain Base attract some $68 million in ether (ETH), over $200 million in trading volumes and more transactions than popular networks such as Arbitrum over the weekend.

The twist? The network’s not even officially live yet, at least to the public.

So-called bridges like Base are blockchain-based tools that allow for the transfer of tokens between two or more networks. Base, built by crypto exchange Coinbase on OP Stack, went live for developers earlier in July so they could test applications and blockchain-based products before a planned launch later this year.

On-chain data shows over $68 million worth of ether was bridged to the network in the past 48 hours amid meme coin BALD’s massive surge. (Before the weekend, inflows only amounted to about $500,000 to $700,000 a day.) The most-active wallet moved $13 million in ether to the network; no one else exceeded $1 million.

BALD, tradeable via the LeetSwap decentralized exchange (DEX) built on top of Base, caught fire over the weekend, jumping about 4,000,000% from issuance to its peak price and seeing more than $100 million traded in 24 hours.

News of the surge went viral in crypto circles on social media application X, attracting scores of traders to bridge funds to the network – despite the lack of a functional two-way bridge – on the hunt for easy fortunes. One such trader managed to turn $500 to $1.5 million in under 12 hours, riling up the greedy parts of what is an already get-rick-quick market mentality.

Base-based tokens such as brian (BRIAN), toshi (TOSHI), basedbot (BOT) and several others jumped several thousand percent to earn early investors a huge multiple on their initial capital.

The lack of fundamentals behind these tokens, however, meant early buyers and influencers made the most gains – while followers were dumped on for exit liquidity.

Elsewhere, opportunistic developers deployed hundreds of tokens only to rugpull later on. Some users even complained they couldn’t sell popular picks, such as BALD and BOT, only to find out they purchased an imitation – one that couldn’t be sold on the open market.

Meanwhile, some traders told CoinDesk that the rush of capital was from token holders likely searching for a way to earn money in an otherwise flat market.

“Each investor has their own risk appetite, and these swings in volatility do offer excellent opportunities to lock in profits as well,” said Jeff Mei, chief operating officer of crypto exchange BTSE. “Clearly, meme coin culture is here to stay, as retail traders’ retain their influence on the crypto landscape, despite recent growing interest in crypto among TradFi.”

“That said, it’s important not to get blindsided by these FOMO rallies. Meme coins are a hyper-speculative and volatile class of crypto tokens. Generally, these coins lack practical uses compared to more established tokens like ETH,” Mei added.

Some like Mikolaj Zakrzowski, Web3 analyst at on-chain analytics tool CryptoQuant, were less upbeat about Base’s prospects, however.

“Most importantly, one address single-handedly bridged over $17 million worth of ether. An address ranked second bridged merely $2 million worth of ether,” Zakrzowski said in a Telegram message. “It appears that the rise of Base blockchain is not supported by fundamentals.”

“A single entity greatly influenced the total value locked in the Base protocol during recent days,” Zakrzowski concluded.

Edited by Nick Baker.