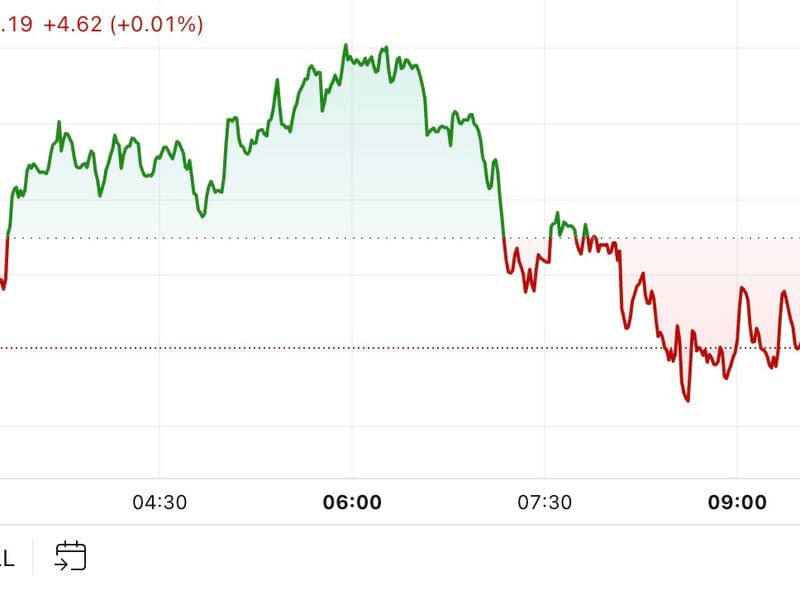

Coinbase’s Grewal Is ‘Quite Hopeful’ That Bitcoin Spot ETFs Will be Approved

Crypto exchange Coinbase’s (COIN) chief legal officer Paul Grewal is “quite hopeful” that bitcoin spot exchange-traded fund (ETF) applications will be approved by the U.S. Securities and Exchange Commission (SEC).

“I’m quite hopeful that these applications will be granted, if only because they should be granted under the law,” Grewal said in an interview with CNBC on Friday.

A spot bitcoin ETF will follow the price of bitcoin rather than the prices of bitcoin futures, giving investors direct exposure to the largest digital cryptocurrency without owning it themselves. The optimism surrounding a potential spot bitcoin ETF was started earlier this year when TradFi giants like BlackRock filed for spot ETF with the SEC.

If a spot bitcoin ETF is approved, the asset managers will need to buy, own and store the digital assets for its clients, similar to a physically backed gold ETF, potentially boosting the price of the underlying cryptocurrencies and the whole sector.

The bitcoin price could rise to between $42,000 and $56,000 if the BlackRock ETF is approved, according to crypto services provider Matrixport. Such bullish price action would also help crypto-linked stocks such as Coinbase, MicroStrategy (MSTR) and miners including Marathon (MARA), Riot Platforms (RIOT).

Grewal didn’t speculate when the approvals will come but said that given some of the key TradFi firms have applied for spot bitcoin ETFs, it is only a matter of time.

“I think that the firms that have stepped forward with robust proposals for these products and services are among some of the biggest blue chips in financial services,” Grewal told CNBC. “So that, I think, suggests that we will see progress there in short order,” he added.