Coinbase Will Let You Stake and Trade Ethereum 2.0 Tokens

Just hours before the launch of Ethereum 2.0, Coinbase, America’s leading cryptocurrency exchange, decided to give a warm welcome to the evolution of the world’s largest blockchain after Bitcoin.

Now, traders and hodlers waiting for the ETH2 upgrade had confirmation from Coinbase that the exchange would enable an ETH2 currency staking service. Of course, being a non-contentious upgrade, Coinbase also guarantees the trading of these new tokens.

Stake —and trade— ETH2 in Coinbase

The Coinbase team also confirmed the future interoperability between the ETH and ETH2 tokens, so users will be able to trade both at will. However, it is essential to highlight that in case they have decided to stake their coins in the Ethereum 2.0 smart contract, the funds will be blocked for a still undefined time.

While staked ETH2 tokens remain locked on the beacon chain, Coinbase will also enable trading between ETH2, ETH, and all other supported currencies providing liquidity for our customers.

Coinbase has nothing to do with this “lockout” ; instead, developers set this norm in the basic code of Ethereum 2.0. The network will leave the tokens blocked for some time. However, the community seems comfortable with this condition and even met and exceeded the minimum goal to start the PoS algorithm implementation with over 855,000 staked ETH.

Coinbase said they would communicate more details “closer to the launch of each feature.” For the time being, they only revealed that these features will be available “in early 20201” and that they will be available only for specific jurisdictions.

What is Ethereum 2.0?

Ethereum 2.0 is an evolution of the original Ethereum blockchain. It was necessary for blockchain to continue working as intended and envisioned.

It’s important to remember that unlike Bitcoin and other blockchains, there are many interactions taking place in the Ethereum blockchain as a result of tokens swapping hands, contracts developed, and decentralized applications running on this network.

Ethereum’s success turned out to be its main weakness. The network was dangerously approaching its limits and was on the verge of collapse. Under current conditions, Ethereum was not ready for global adoption.

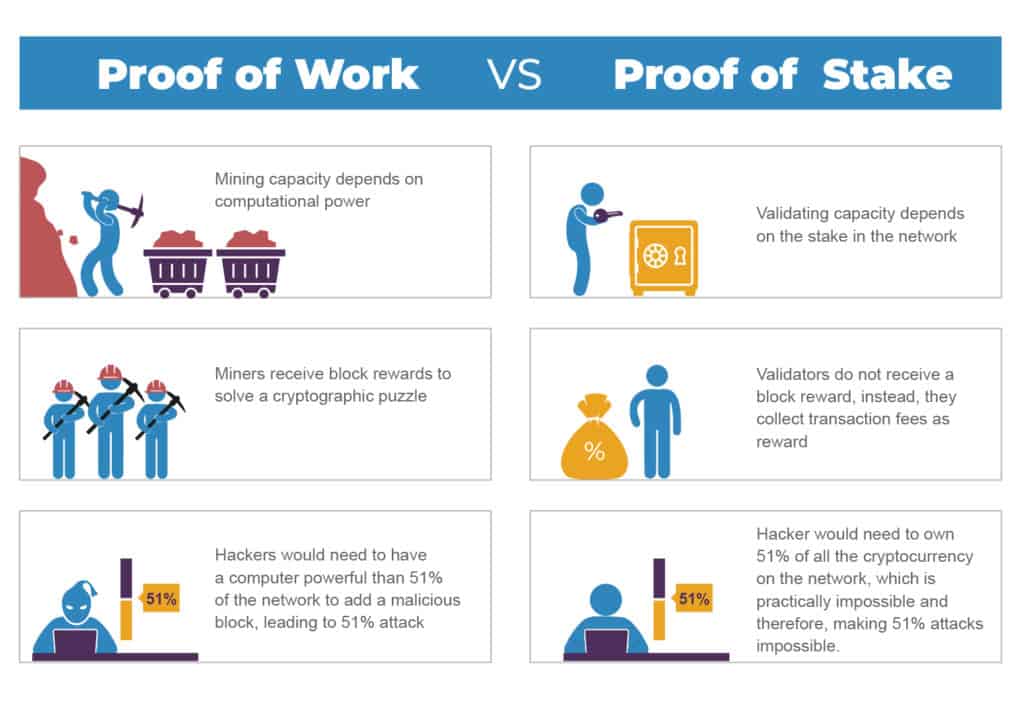

Ethereum 2.0 seeks to change this. Firstly, the move from PoW to PoS will make the consensus algorithm much more efficient with no unnecessary energy costs. Similarly, it makes a 51% attack more complicated as there would be a higher level of risk for the malicious attacker.

Now, those who stake their coins —in Coinbase or any other wallet— will get rewards for validating transactions in the same way that a miner receives Bitcoin for doing the same.

On the other hand, Ethereum 2.0 is compatible with several layer 2 solutions that will allow you to process thousands of transactions per second, putting Ethereum potentially above Visa, Mastercard, and any modern payment processor.

So it comes as no surprise that staking compatibility would be a major feature for the Ethereum ecosystem, and Coinbase sure wanted to jump in.