Coinbase Violated State Securities Laws With Staking Program, Alabama Regulator Alleges

Crypto exchange Coinbase (COIN) has 28 days to explain to the Alabama Securities Commission (ASC) how it is not violating state securities laws with its staking program, the regulator said on Tuesday.

The ASC’s “show cause” order alleges Coinbase and its parent corporation Coinbase Global broke the law by offering the staking rewards program “Earn” to state residents, and the regulator wants the entities to show “why they should not be directed to cease and desist from selling unregistered securities in Alabama.”

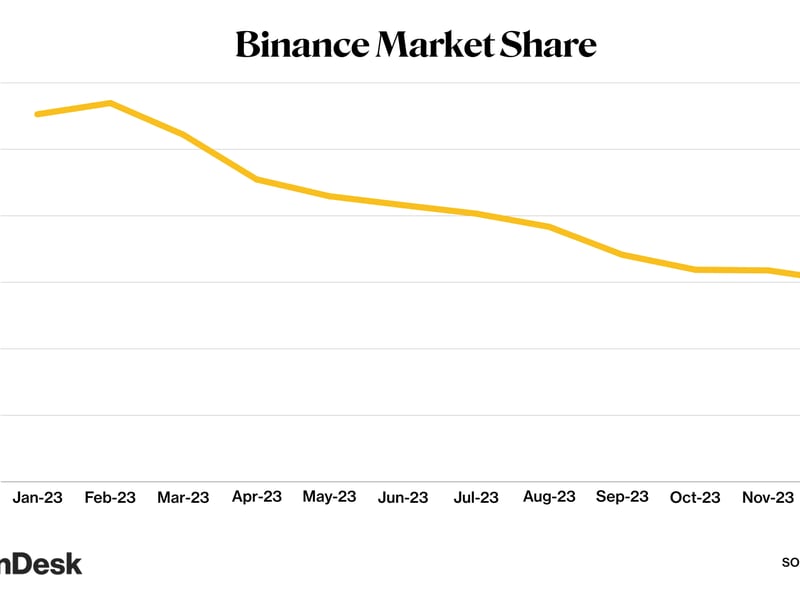

Earlier in the day, Coinbase was sued by the U.S. Securities and Exchange Commission for the alleged sale of unregistered securities, a day after the regulator took similar action against Binance, the world’s largest crypto exchange by market cap.

The ASC action doesn’t forbid Coinbase from offering staking as a service as long as it complies with the law, but the order itself was the result of a task force of ten state securities regulators in the U.S., namely Alabama, California, Illinois, Kentucky, Maryland, New Jersey, South Carolina, Vermont, Washington and Wisconsin.

“The ASC is committed to protecting Alabama consumers and investors, including those who choose to invest in the decentralized finance space. This action is another step toward ensuring that investors in crypto asset products are offered the same protections under our laws and are fully aware of the risks involved in these investments,” said ASC Director Amanda Senn in a press statement.

The ASC issued a similar order to now-bankrupt crypto lender Celsius back in 2021, also suspected of violating state securities laws with its “Earn Rewards” program.

Edited by Parikshit Mishra.