Coinbase to Face ‘Reality Check’ as Retail FOMO Is Fading, Mizuho Says

A rising bitcoin (BTC) price has generally driven up retail engagement, but fear-of-missing-out (FOMO) on the part of these investors appears to be fading, causing an unprecedented bifurcation between the BTC price and Coinbase (COIN) volumes, Mizuho Securities said in a research report on Tuesday.

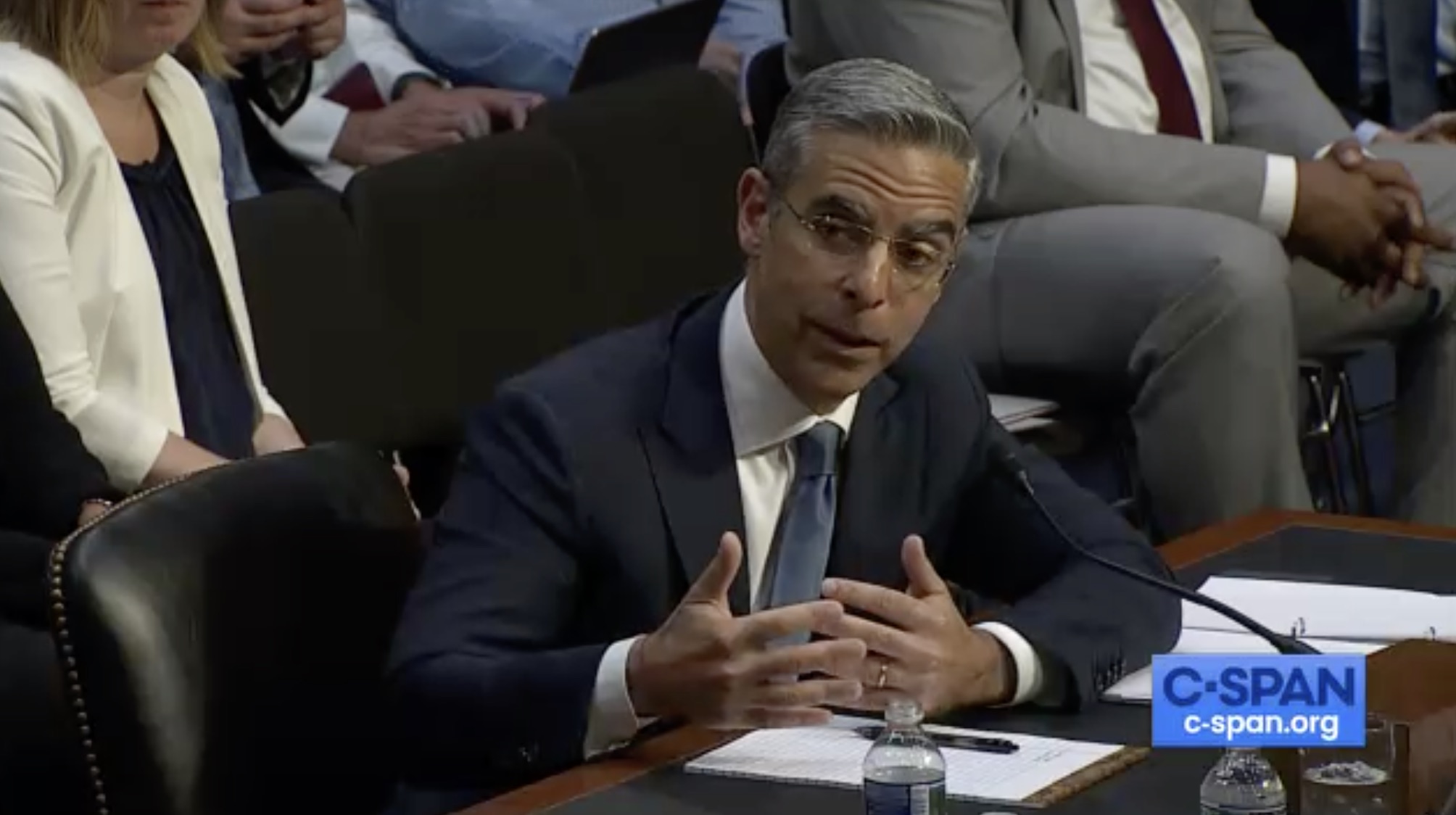

“Trading volumes on COIN have historically tracked in tandem with changes in the price of bitcoin,” analysts led by Dan Dolev wrote. “Both peaked in 4Q21, for instance, when COIN volumes reached nearly $550 billion and the average price of bitcoin was greater than $55,000.”

The report said that starting in the first quarter of 2023, there is a “stark bifurcation between COIN volumes and the price of bitcoin.” The exchange’s volumes dropped from $145 billion to $92 billion by the second quarter and are heading towards around $80 billion for the third quarter. In the same period, bitcoin rose to an average price of $28,500.

Mizuho says this indicates potential fatigue among retail customers, and in contrast to previous cycles, fear-of-missing-out no longer “entices investors to trade bitcoin when prices rise,” as it did in prior years. “This could prove problematic for COIN, as it generates around 95% of its transaction revenue from retail trades,” the note said, adding that the year-to-date rise in the shares is unsustainable. “We expect a reality check to follow.”

The investment bank has an underperform rating on Coinbase stock, with a price target of $27. Coinbase shares were trading at $82.49 at the time of publication. The stock has risen about 125% this year, while bitcoin climbed nearly 60%.

Edited by Aoyon Ashraf.