Coinbase to Benefit From Long-Term Adoption of Blockchain Technology: Oppenheimer

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

-

Coinbase price target hiked to $276 from $200.

-

Digital asset adoption continued after the approval of spot bitcoin ETFs, the report said.

-

Risks include the exchange’s ongoing lawsuit with the SEC, Oppenheimer said.

Coinbase (COIN) is well positioned to benefit from the long-term adoption of blockchain technology, broker Oppenheimer said in a research report on Wednesday raising its earning estimates for the crypto exchange.

1:21:23

A16z Crypto’s Chris Dixon on How Blockchains Can Save the Internet

52:38

Why the SEC’s Case Against Coinbase Is So Significant for Crypto

00:45

Switzerland Takes Top Spot for Crypto Innovation, Partisia Blockchain Foundation’s Chief of Growth Says

10:18

Coinbase Exec on Spot Bitcoin ETFs

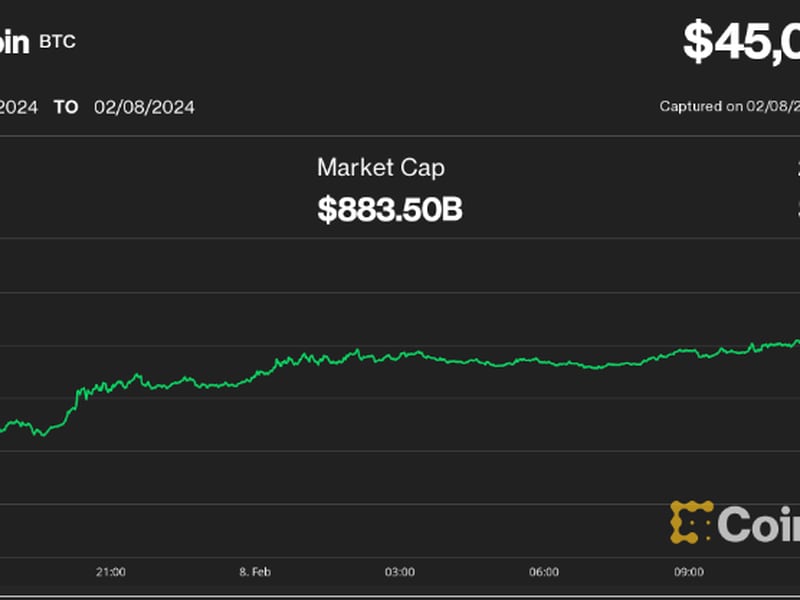

“We estimate that COIN’s 1Q24 trading volume would be up 95% quarter-on-quarter and 107% year-on-year to $300B,” analysts Owen Lau and Guru Sidaarth wrote, noting that the “adoption of digital assets continued after the approval of spot bitcoin (BTC) exchange-traded funds (ETFs) in January.”

“More importantly, liquidity in this space has continued to increase, with the average market cap of USD Coin (USDC) increasing 12% quarter-on-quarter to $28b (or $31B at 1Q24-end),” the authors wrote. USDC Is a stablecoin issued by Circle, which is itself backed by Coinbase. The exchange earns gross interest income on USDC outstanding balances.

Given the company’s improving outlook, the broker raised its price target for the stock to $276 from $200. Coinbase shares were trading 2.5% higher at $258 at publication time.

Oppenheimer notes that since January the stock is up over 100% versus a measly 6% rise for the S&P 500 index. “At this level of trading, we are cautious about the near-term volatility, but remain positive on the long-term adoption of blockchain technology.”

Still, there are some potential headwinds. While the stock may have strong momentum behind it, there are risks that investors need to be aware of, the report said. The broker had previously expected approval of a spot ether (ETH) ETF in May, but now says there is a low probability of this happening.