Coinbase Shares Sink 9% on Report CME to Consider Listing Spot Bitcoin

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

-

Shares of Coinbase fell nearly 8% on Thursday to a price of $202.49.

-

The drop came after a report from the Financial Times that futures exchange CME was considering offering spot bitcoin trading to its clients.

1:00:39

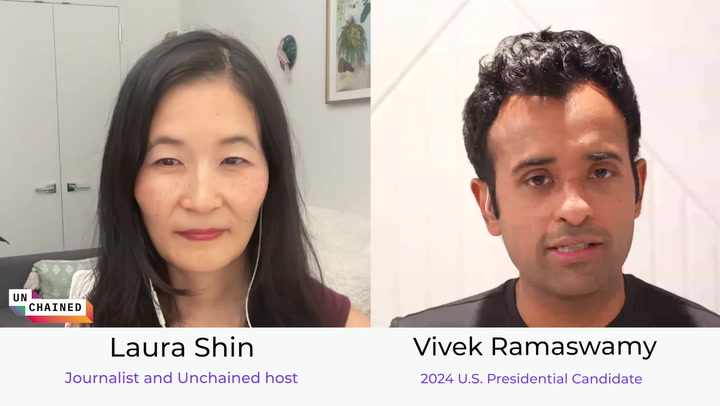

Why Presidential Candidate Vivek Ramaswamy Is So Pro-Crypto

1:02:43

Why Financial Advisors Are So Excited About a Spot Bitcoin ETF

02:21

When Could Traders See the Arrival of a Spot Bitcoin ETF?

01:10

Bitcoin’s Triangular Consolidation Offers Bullish Outlook: Technical Analysis

Shares of Coinbase dropped nearly 8% to $202.49 during U.S. morning hours on Thursday after a Financial Times report that the Chicago Mercantile Exchange (CME) might soon offer spot bitcoin trading amid strong interest from clients.

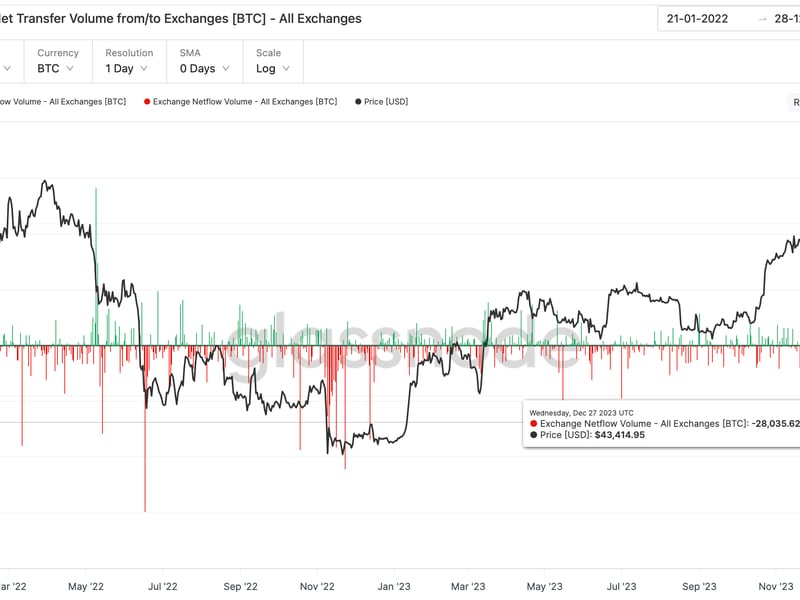

Cryptocurrencies were up on the day. The CoinDesk 20 Index, which tracks 20 of the largest digital tokens by market capitalization, is 0.91% higher over the past 24 hours. Bitcoin (BTC) was up by half a percent as it continued to profit from Wednesday’s better-than-expected inflation report. COIN is up 29% year-to-date as crypto prices have rallied since the beginning of the year.

Chicago-based CME, with a history dating back more than a century, is the largest futures exchange globally and a financial powerhouse. Until recently, Coinbase profited strongly from being the most trusted crypto exchange in the U.S., but that advantage could change if CME comes into play.

The CME has been designated by U.S. regulators as a “systemically important financial market utility,” a designation that implies it’s subject to more strict supervision. Many investors also assume that the designation implies the government would never let the CME fail in the event of financial duress.

CME is already the biggest bitcoin futures exchange by open interest in the U.S.

The exchange said that it has been holding meetings with traders who wish to trade bitcoin on a regulated marketplace, people familiar with the matter told the Financial Times.

A common reason for traders not wanting to touch digital assets is the lack of trust in crypto exchanges, especially after a series of bad players were outed in recent years, including the once highly-popular crypto exchange FTX.

Recently launched spot bitcoin exchange-traded funds (ETFs) gave traders a safer way to invest in the token, which over 500 institutions took advantage of within only the first three months of existence, allocating over $10 billion in the funds alone. The rest, over $40 billion, came from retail traders.

Edited by Bradley Keoun.

Disclosure

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

CoinDesk is an

award-winning

media outlet that covers the cryptocurrency industry. Its journalists abide by a

strict set of editorial policies.

In November 2023

, CoinDesk was acquired

by the Bullish group, owner of

Bullish,

a regulated, digital assets exchange. The Bullish group is majority-owned by

Block.one; both companies have

interests

in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin.

CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6d05e6ca-ca9b-44d0-97e6-b6bdceee3d6f.png)

Helene is a New York-based reporter covering Wall Street, the rise of the spot bitcoin ETFs and crypto exchanges. She is also the co-host of CoinDesk’s Markets Daily show. Helene is a graduate of New York University’s business and economic reporting program and has appeared on CBS News, YahooFinance and Nasdaq TradeTalks. She holds BTC and ETH.

Follow @HeleneBraunn on Twitter

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.