Coinbase Shares Have Jumped Nearly 40% Since the SEC Lawsuit

The shares of Coinbase have increased by approximately 37% since the US Securities and Exchange Commission (SEC) filed a lawsuit against it at the beginning of June.

The agency claimed that the company offered trading services with unregistered securities such as MATIC, ADA, SOL, and more.

- Despite the war the US SEC waged on Binance and Coinbase three weeks ago, the shares of the US-based cryptocurrency exchange have performed quite well.

- COIN was hovering around $50 on June 6 (the day when the Commission filed its lawsuit), whereas it is currently worth $70, representing a 37% increase.

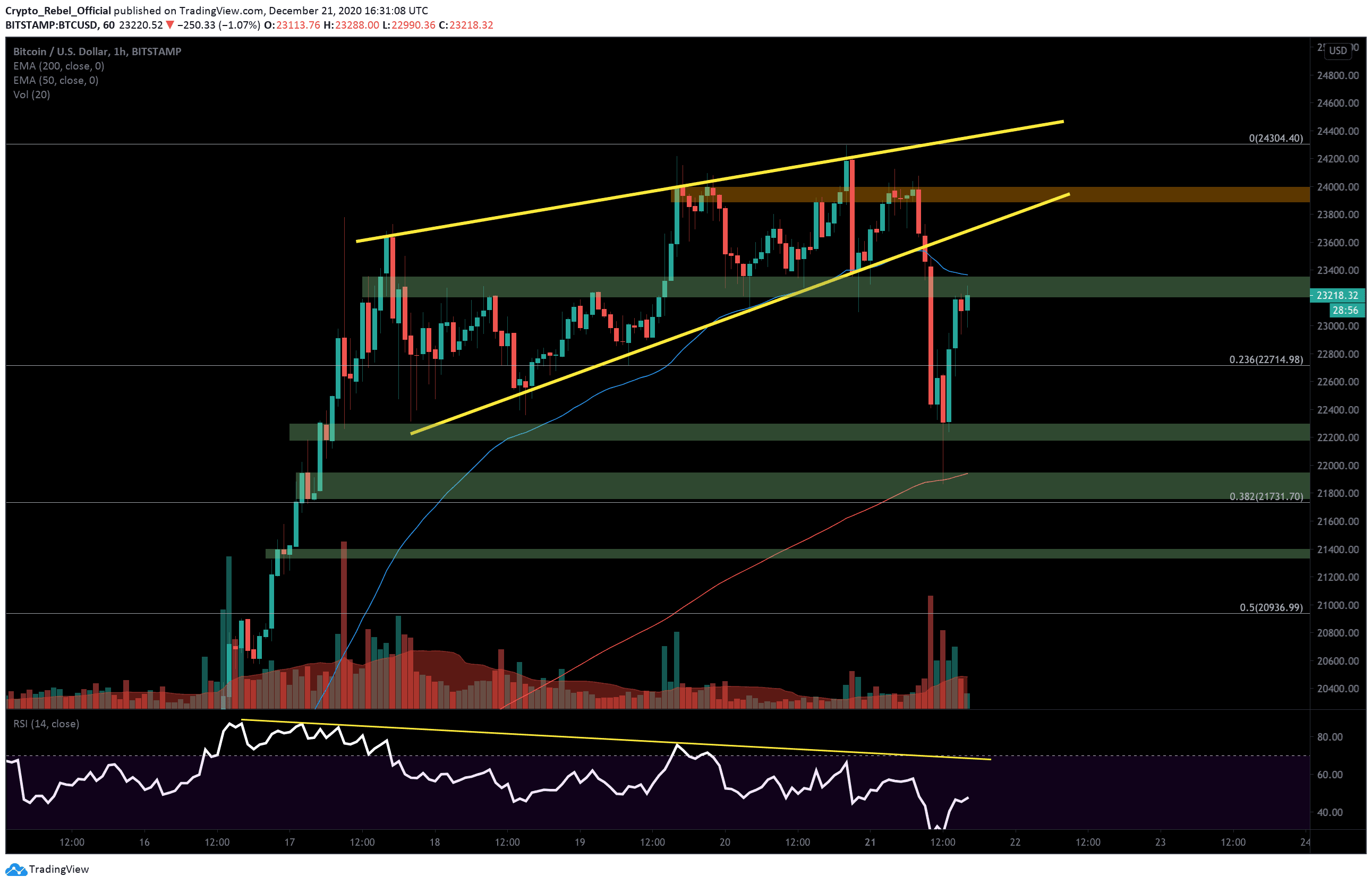

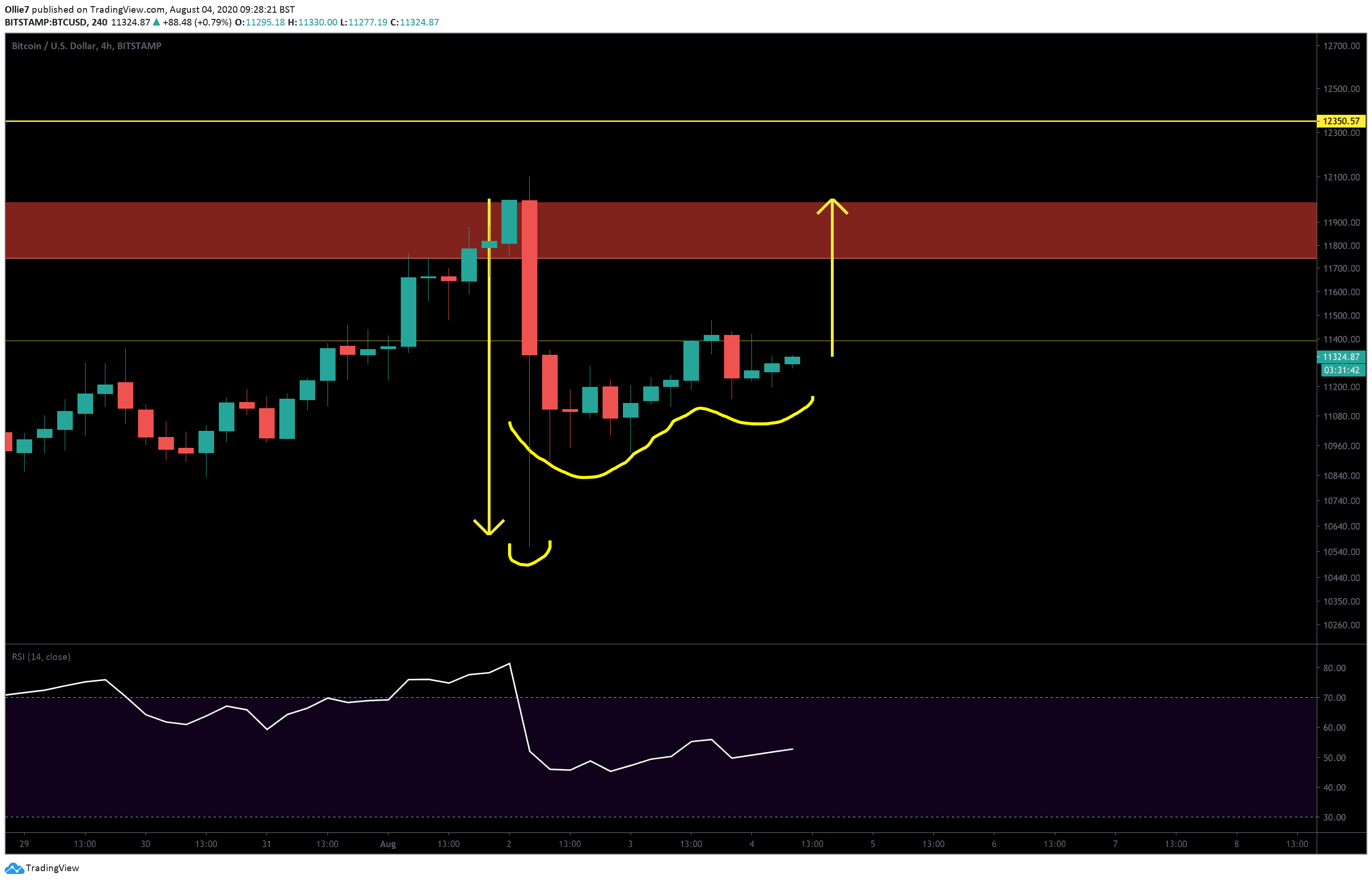

COIN Price, Source: Yahoo Finance - Moreover, the last time the shares reached that level was in mid-April. The cryptocurrency market then showed signs of revival while Bitcoin hit a nearly one-year high, surpassing $30,000.

- Still, COIN trades far from its glory days in April 2021 and November 2021, when the USD valuation was well above $300.

- It is worth mentioning that Coinbase is not the only crypto-related entity to see its shares rise after the SEC lawsuits.

- The American business intelligence company, which is heavily invested in Bitcoin – MicroStrategy (up 18%), and the cryptocurrency miner – Marathon Digital (a 44% surge) are some examples.

The post Coinbase Shares Have Jumped Nearly 40% Since the SEC Lawsuit appeared first on CryptoPotato.