Coinbase Sees $1,200 Deposits Peak Following First US Stimulus Package Distribution

The most widely used American cryptocurrency exchange, Coinbase, reported increased $1,200 deposits yesterday. Interestingly, this coincides with the stimulus checks for the same amount that the U.S. government began sending this week to fight the financial struggles caused by the coronavirus pandemic.

Record $1,200 Coinbase Deposits

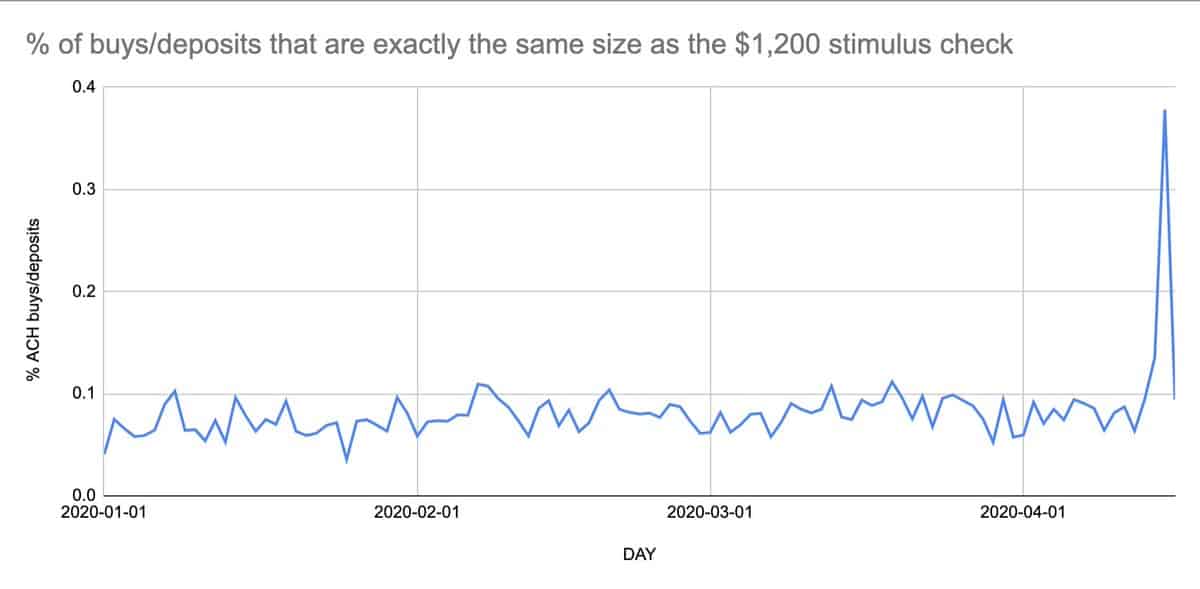

According to data provided by Coinbase CEO Brian Armstrong, the popular exchange received a record number of $1,200 deposits yesterday.

As the graph above illustrates, the exact amount of $1,200 typically accounts for about 0.1% of all deposits on the platform. Now, however, the number has quadrupled to nearly 0.4%.

What’s curious about the situation now is the $2.2 trillion coronavirus stimulus package signed by President Trump in March. It aims to help ease the financial pain prompted by closing the economy to fight the novel coronavirus. Per this emergency plan, adults making under $75,000 a year will receive a check for the amount of $1,200.

And, even more compellingly in this scenario is the fact that the U.S. government started sending those checks to American citizens this week. According to Treasury Secretary Steven Mnuchin, 80m people should have received a direct deposit in their bank accounts by Wednesday – April 15th.

Netspend, which processed about $1 billion in relief payments, said that most customers are using those funds for “groceries, fast food, pharmacies, gas, as well as withdrawing cash from ATMs.”

But with the increased number of $1,200 deposits on Coinbase, some community members are speculating that U.S. citizens are utilizing the money for purchasing digital assets.

As prominent economist Peter Schiff recently pointed out, printing money in such extensive amounts in short periods could decrease the dollar’s value and bring hyperinflation. Therefore, people could be searching for an alternative.

Effects On Cryptocurrency Prices?

Another intriguing coincidence came yesterday when the price of the primary digital asset surged by $550 in just 90 minutes. Bitcoin went from a daily low of $6,470 to steadily trading above $7,000.

Moreover, most of the cryptocurrency market is well in the green. The second-largest coin by market cap, Ethereum, is 11% up in the past few days. Binance Coin (BNB), Litecoin, Bitcoin Cash, EOS, and Bitcoin SV are up by approximately 8% in the same timeframe.

Consequently, the total market capitalization has jumped in a day by 8.5% from $187B to $203B.

Nevertheless, the connection between Americans receiving $1,200 stimulus checks, increased deposits for the same amount on Coinbase, and cryptocurrency price surges is merely speculation at this point. However, it’s interesting to follow if future checks would influence the market in the same manner.

The post Coinbase Sees $1,200 Deposits Peak Following First US Stimulus Package Distribution appeared first on CryptoPotato.