Coinbase, MicroStrategy, Marathon Stocks Buckle 5%-10% as Bitcoin Tumbles Below $42K

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

Shares of cryptocurrency-related companies were sharply lower Monday following bitcoin’s (BTC) swift overnight drop.

MicroStrategy (MSTR), which holds nearly 175,000 BTC in its treasury, is lower by 6%, while crypto exchange Coinbase (COIN) was down over 5%.

Nasdaq-listed bitcoin miners Marathon Digital Holdings (MARA), Riot Platforms (RIOT), Hut 8 (HUT) and CleanSpark (CLSK) suffered even steeper losses of 10%-15% in late-morning Monday action.

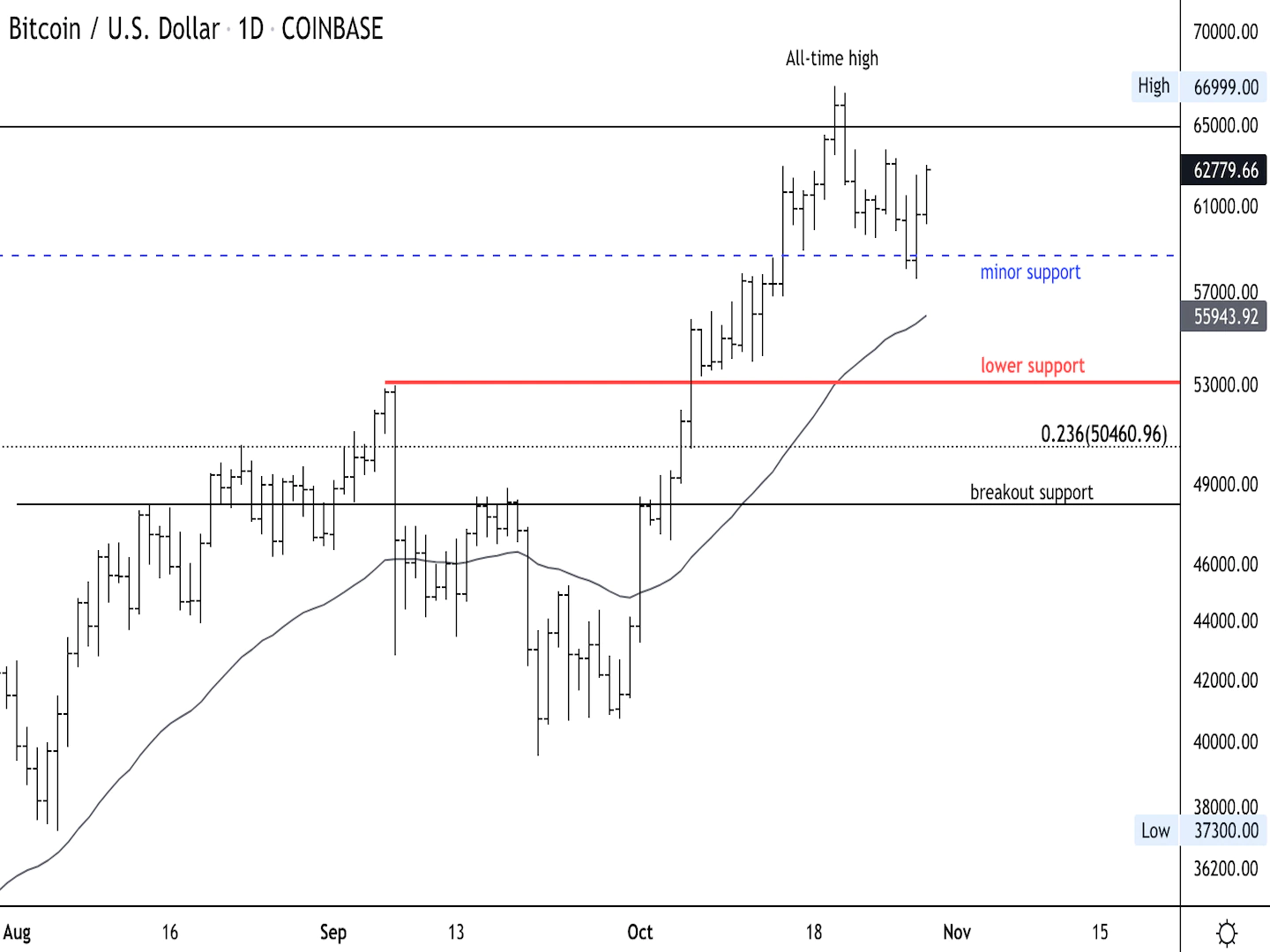

The price drop followed a swift correction in crypto markets Sunday evening, with BTC dropping nearly 10% from the $44,000 level in the space of a few minutes in what might be termed a “flash crash.” At press time, bitcoin was trading at $41,700, down about 5% over the past 24 hours. The CoinDesk Market Index (CMI), a basket of almost 200 crypto assets, was also down 5%, highlighting the broad-market negative day.

Even with today’s losses, crypto stocks have still staged a massive recovery in 2023.

Several companies’ shares have more than doubled since the start of the year, fueled by the crypto market rally, declining interest rates and heightened anticipation for a potential regulatory approval of a spot bitcoin exchange-traded fund (ETF) approval in the U.S.

Edited by Stephen Alpher.