Coinbase Goes to Court Against the SEC

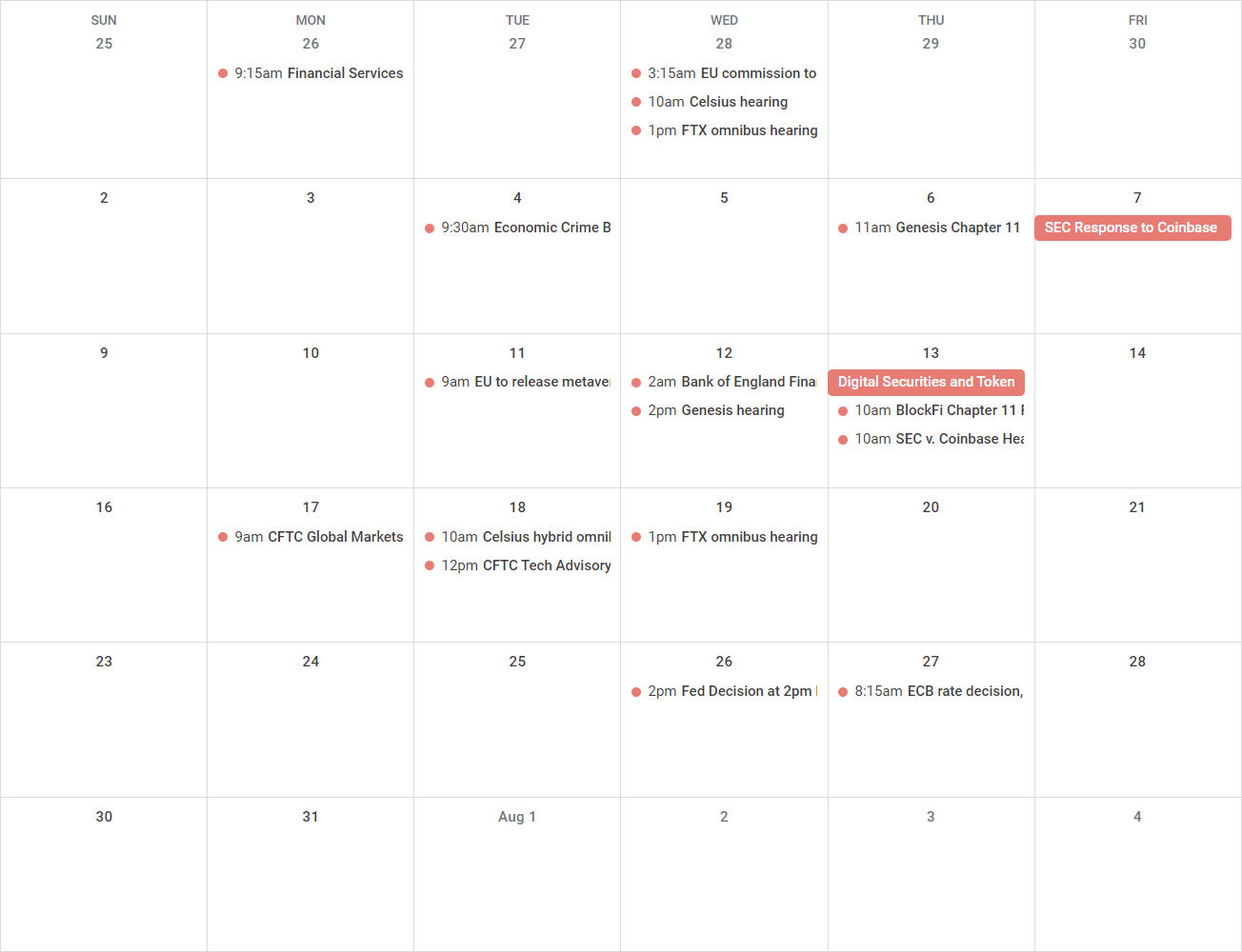

Coinbase (COIN) and the Securities and Exchange Commission will meet in court this week. The hearing – the questions asked and the answers given – should provide some hints on how the case may go (for now, anyway).

You’re reading State of Crypto, a CoinDesk newsletter looking at the intersection of cryptocurrency and government. Click here to sign up for future editions.

Coinbase and the Securities and Exchange Commission will meet in court this week. The hearing may give us a sense of how the judge is looking at the case in its earliest stages.

The case just began, and is likely to drag on for years if the parties don’t settle (see: SEC v. Ripple Labs, which is now halfway through its third year). Still, in the interest of reading tea leaves, the questions Judge Katherine Polk Faila asks and how attorneys for the SEC and Coinbase respond will indicate what issues may take prominence during the start of this legal battle.

Coinbase and the U.S. Securities and Exchange Commission (SEC) will meet in court this Thursday for the first time in the federal regulator’s lawsuit against the crypto exchange.

To quickly recap: The SEC sued Coinbase in early June alleging that the cryptocurrency trading platform was simultaneously operating as a broker, an exchange and a clearinghouse for unregistered securities – namely, 13 different cryptocurrencies the SEC alleged met the requirements of the Howey Test, the 1940s precedent laid down by the U.S. Supreme Court.

Coinbase has telegraphed the SEC lawsuit for months, publishing a blog post when it first received a Wells Notice from the regulator and maintaining a legal effort to convince a court that there isn’t enough regulatory clarity right now for crypto industry participants to know whether or not they’re running afoul of federal securities laws.

The exchange continued that effort in its first formal response to the SEC last month, when Coinbase argued that the SEC was violating its due process rights and simultaneously trying to preempt Congress by bringing a lawsuit.

Coinbase also argued that the allegations shouldn’t even apply to its operations.

“Like all securities, an economic arrangement can qualify as an investment contract only if it involves an ongoing business enterprise whose management owes enforceable obligations to investors. Absent such obligations, the contract is just an asset sale,” Coinbase argued. “Because no such obligations are carried in the transactions over Coinbase’s secondary market exchange, and because the value that Coinbase purchasers receive through these transactions inheres in the things bought and traded rather than in the businesses that generated them, the transactions are not securities transactions.”

The SEC was not swayed by this argument. In its response to the answer, the SEC said “Coinbase attempts to construct its own test for what constitutes an investment contract.”

The filing took aim at other substantive parts of Coinbase’s arguments, including Coinbase’s at this point oft-repeated assertion that the SEC had a chance to weigh in on the exchange’s operations when it reviewed the company’s paperwork before it went public.

In the regulator’s view, the lawsuit is proper – and moreover, it pointed to Coinbase’s public disclosures that it might get sued as evidence that the exchange has already acknowledged the possibility.

The SEC was also unimpressed with some of Coinbase’s filings, calling one of them “improper” and asking the judge overseeing the case to ignore it for now.

The parties will meet in court this Thursday, at 10:00 a.m. ET, in a pre-motion hearing.

-

13:00 UTC (3:00 p.m. CEST) The European Union is set to formally publish its metaverse strategy.

-

06:00 UTC (7:00 a.m. BST) The Bank of England will publish its regular financial stability report.

-

18:00 UTC (2:00 p.m. EDT) The federal court overseeing Genesis Global Holdco’s bankruptcy will hold a hearing on voting procedures and whether or not its disclosure statement is sufficient.

-

14:00 UTC (10:00 a.m. EDT) The federal court overseeing BlockFi’s bankruptcy will hold a hearing on its chapter 11 bankruptcy plan.

-

14:00 UTC (10:00 a.m. EDT) The federal court overseeing the SEC’s case against Coinbase will hold a hearing on Coinbase’s petition to file for a motion (see above).

-

(Semafor) Twitter has threatened to sue Meta (formerly Facebook) over its new Threads product.

-

(New York Times) The Times’ Erin Griffith and David Yaffe-Bellany went deep into Tom Brady’s ties to FTX – as well as some other celebrities.

-

(The Washington Post) GQ first heavily rewrote, and then pulled an article by a freelance film critic about Warner Brothers Discovery CEO David Zaslav (i.e. the person who appointed Chris Licht to oversee CNN) because it appears to have been overly critical of the media executive and a spokesperson for Zaslav complained.

-

(Zero Day) The U.S. Securities and Exchange Commission has sent Wells Notices to SolarWinds, indicating the regulator believes it has enough evidence of wrongdoing to file a suit against the software company. Interestingly, the SEC has sent notices to individual employees, including SolarWinds’ chief information security officer.

If you’ve got thoughts or questions on what I should discuss next week or any other feedback you’d like to share, feel free to email me at nik@coindesk.com or find me on Twitter @nikhileshde.

You can also join the group conversation on Telegram.