Coinbase Adds Charles Schwab Advisor to Board of Directors

NEWS

Oct 2, 2018 at 16:30 UTC

| Updated

Oct 2, 2018 at 16:30 UTC

Coinbase’s leadership expansion continued Tuesday as it added Charles Schwab advisor Chris Dodds to its board of directors and tapped former Instinet CEO Jonathan Kellner to be its new managing director of the Institutional Coverage Group.

In one blog post, Coinbase CEO Brian Armstrong introduced Dodds, who sits on the board of directors at Charles Schwab, one of the largest brokerage firms and banks in the U.S. Dodds is also a senior equity advisor for the firm, and has spent more than three decades in the financial industry to date.

“His addition to the Coinbase board is part of our effort to expand our financial services capabilities as we head into this next chapter for the company and the cryptocurrency industry as a whole,” Armstrong wrote, adding:

“Chris brings world-class leadership skills, deep knowledge of the financial services industry, and significant financial and accounting experience. His extensive expertise will be an asset to the Coinbase leadership team as we focus on scaling our business.”

In a similar post, Coinbase president and chief operating officer Asiff Hirji welcomed Kellner, who will run institutional sales out of the company’s recently-opened New York office.

“[Kellner] will play an integral role in bringing our suite of institutional crypto trading products to professional investors,” Hirji wrote.

The move will support Coinbase’s efforts to launch institutional products using cryptocurrencies as a “fully-fledged, tradeable asset class,” he explained.

“Institutional investors of all types will play a critical role in the market … [and] will range from crypto-first institutions such as token issuers and crypto hedge funds, to more traditional finance players such as hedge funds, banks, asset managers and family offices,” Hirjii added.

The news comes a day after Coinbase hired former J.P. Morgan executive director Oputa Ezediaro to its Institutional Coverage Group. The move was first reported by Finance Magnates.

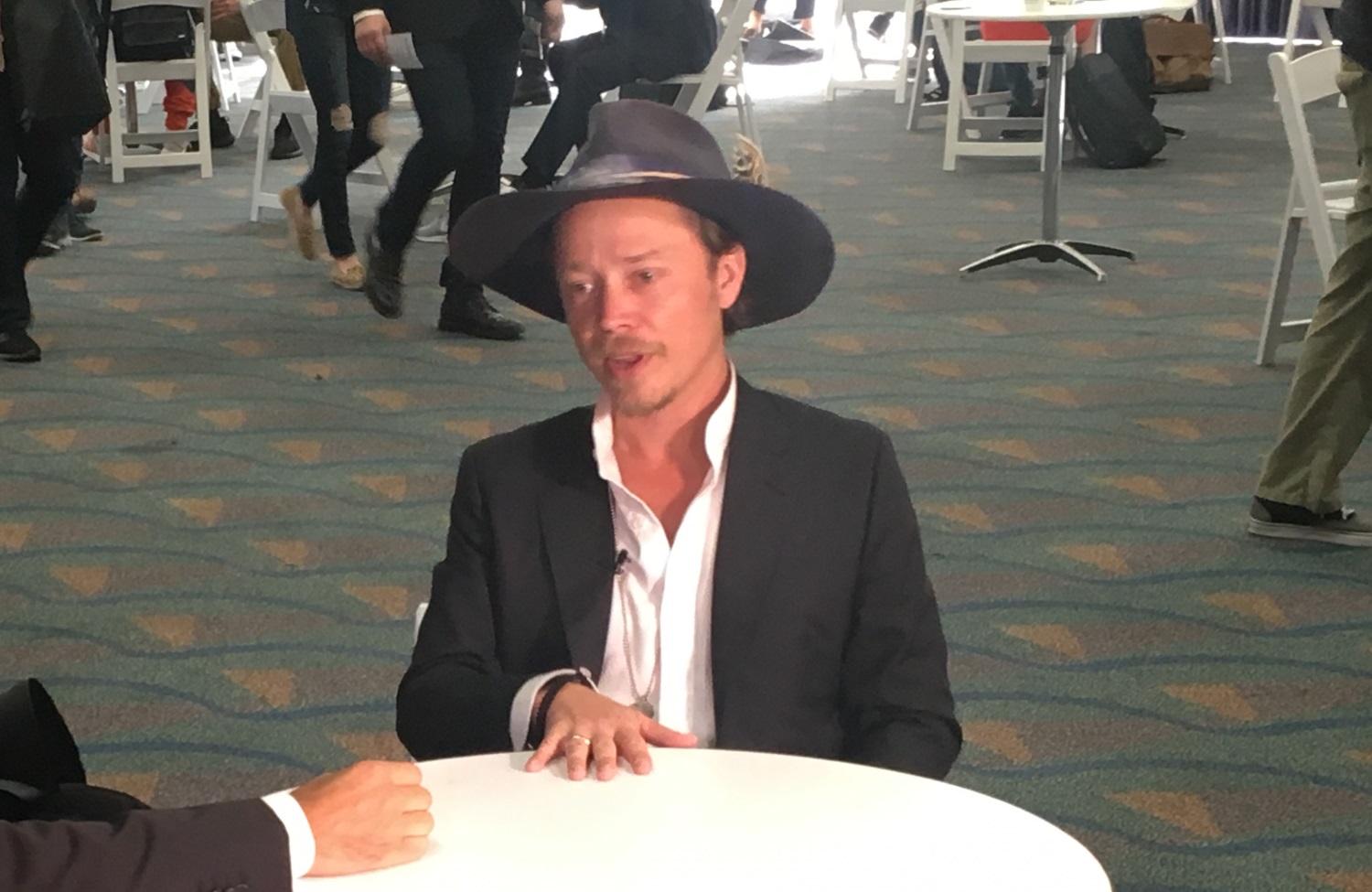

Brian Armstrong and Chris Dodds image courtesy Coinbase

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

CoinbaseChris DoddJonathan Kellner