CNBC’s Jim Cramer Believes Bitcoin and Ethereum’s Selloff Could Be Over

Jim Cramer, the host of CNBC’s Mad Money show, believes the selloff in the cryptocurrency market could close to an end. This comes amid the massive price declines among all assets, with BTC losing over $10,000 in just days at one point.

Is The Selloff Over?

The past five days were nothing short of a volatile rollercoaster for the crypto market. Bitcoin went from above $43,000 to a six-month low below $33,000 in this time frame before it bounced off to its current stance at around $36,000. The altcoins went through even more severe price fluctuations with massive double-digits slumps.

Overall, the cumulative market capitalization of all digital assets declined by over $500 billion at one point. Aside from the mass pain for over-leveraged traders in terms of liquidations, this correction also brought the general sentiment down to an extreme fear state.

However, CNBC’s Jim Cramer believes that this price decline, at least for bitcoin and ether, could be over soon.

“When the charts, as interpreted by Tom DeMark, say that both bitcoin and ethereum could be looking at downside trend exhaustion bottoms this week, if not today, I think you need to take him seriously.”

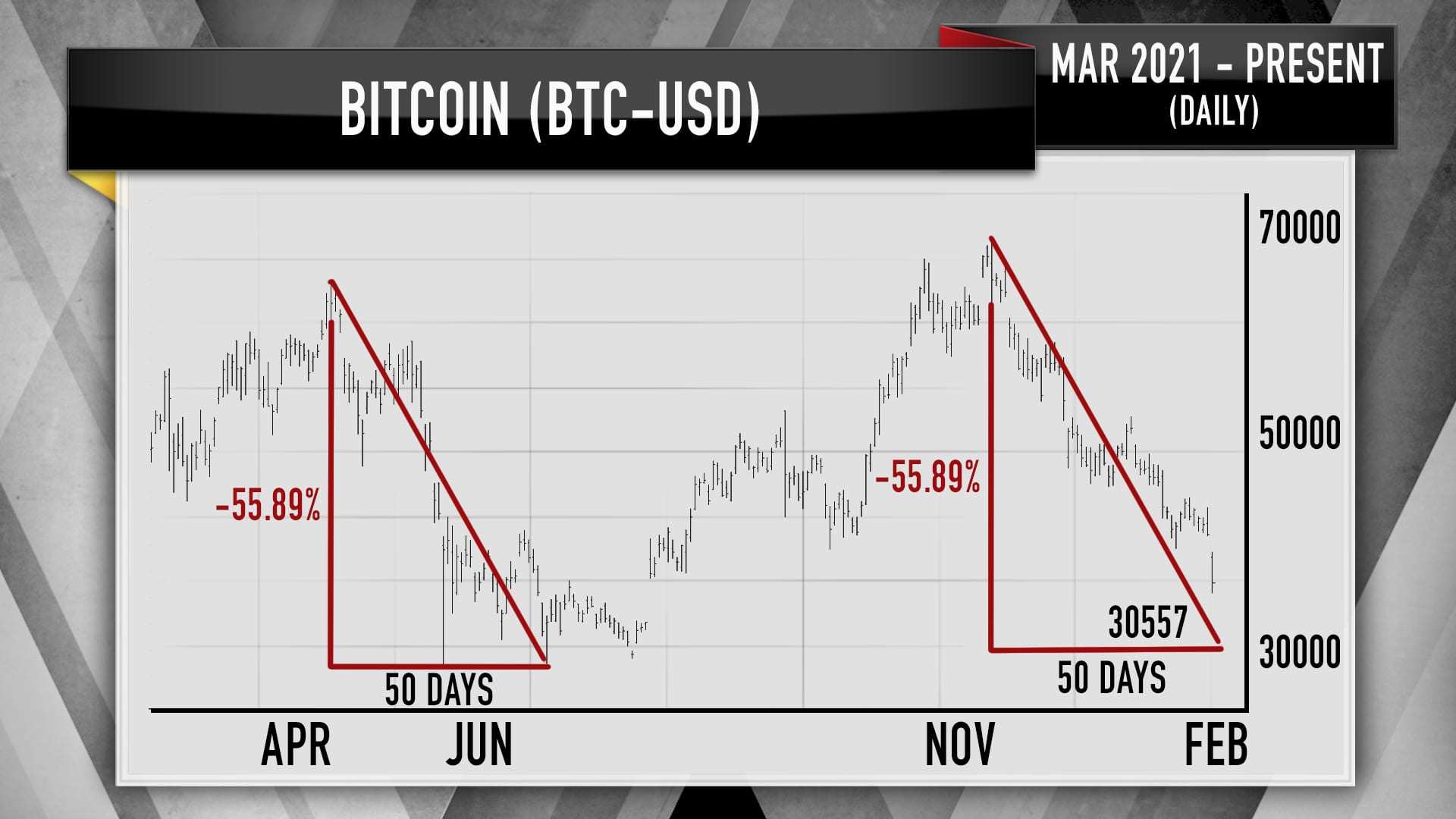

By touching upon DeMark’s words, Cramer outlined a previous similar correction in which BTC declined by more than 50% in less than two months. He believes that “history can repeat itself” and bitcoin can bounce off soon.

Is It Time to Buy?

Cramer already has a somewhat controversial history with the cryptocurrency space. He went from calling bitcoin an “outlaw currency” to buying some portions of the asset and then using the profits following BTC’s price appreciation to pay off his mortgage.

He also seemed bullish on the second-largest crypto, advocating for it on numerous occasions. At one point, though, he revealed that his BTC and ETH investments were just pure gambling.

While asserting that the most recent price slides could be over soon, Cramer now said that he will consider re-entering the market.

“To me, that says it might be too late to sell, and you need to consider buying. I know I am, especially if we get a final leg down.”

This final leg, according to DeMark’s analysis, could take BTC below $30,000 before the asset starts regaining value again.

Featured Image Courtesy of CNBC