CNBC Puts Bitcoin In The Spotlight: The Last Time It Was A Bearish Signal For BTC

The recent Bitcoin price increases, and the upcoming halving have brought back media attention. CNBC recently explained the upcoming halving and made a bold prediction claiming that BTC could surge soon.

CNBC Believes Bitcoin Will Surge

Bitcoin made an appearance on CNBC’s Fast Money on Friday following the recent price surge. Crypto-friendly expert, Brian Kelly, outlined his views on the current situation and explained the halving:

“As the whole world is quantitative easing (QE), Bitcoin is about to be quantitative hardening. It doesn’t mean that the price of the asset will be cut in half, only that the daily supply is being cut in half.

In the past, this has been a catalyst for very big run-ups. We’ve had a tremendous run-up coming into this; it’s got some wood to chop around $9,000. But thinking from medium to long term, you now have an asset that will be more scarce than gold based on the stock-to-flow (S2F) ratio in an environment where the entire world is printing money.”

Referring again to the fact that Bitcoin miners will receive fewer rewards post halving, he added that the “weaker ones” might drop out. However, Kelly predicted that in thirty to sixty days from now, “we can see a nice run-up again.”

Quantitative Easing Vs Quantitative Hardening

Kelly also brought out the comparison between quantitative easing and hardening. The US governments recently committed to “unlimited” QE after lowering interest rates to zero.

Quantitative easing involves buying a predetermined amount of government bonds or other financial assets in order to add money directly into the economy.

However, the increased levels of QE could easily result in the devaluation of the currency. Popular American economist, Peter Schiff, recently predicted that the unprecedented high levels of printing money could cause hyperinflation.

Quantitative hardening, on the other hand, works exactly in the opposite manner. It reduces the liquidity injected into a market over time by decreasing the daily supply available. As basic economic principles dictate, if the demand stays the same or increases, while the supply drops, the value of the asset should, in theory, go up.

And this is where Bitcoin comes in.

Bitcoin’s QH And Upcoming Halving

Bitcoin’s total supply is hard-capped to 21 million. Moreover, roughly every four years, the reward that miners receive for adding new blocks to its network is slashed in half, hence reducing the supply of freshly minted bitcoins on the market and reducing inflation rates in half.

Now the inflation rate is at approximately 3.64% and after the upcoming third halving in less than two weeks, it will drop to 1.8%.

Kelly was also on point noting that following the previous two events, the price of Bitcoin indeed surged. This causes lots of speculation within the community that history will repeat itself.

Of course, the overall economic environment this year is particularly different than the settings back in 2016 and 2012. The spread of the novel coronavirus (COVID-19) is taking its toll and major economies are slowed down as countries are in mandatory or recommended lockdowns as entire industries are halted from operating.

Mainstream Media Has Adverse Effects On Crypto?

Bitcoin, and most of the cryptocurrency market, was overly reported by various giant traditional media outlets during the parabolic price increase in 2017/2018. Kelly himself has made several bold claims in the past, saying that he will continue buying Bitcoin at $20,000. In the following months, BTC lost 85% of its all-time high value.

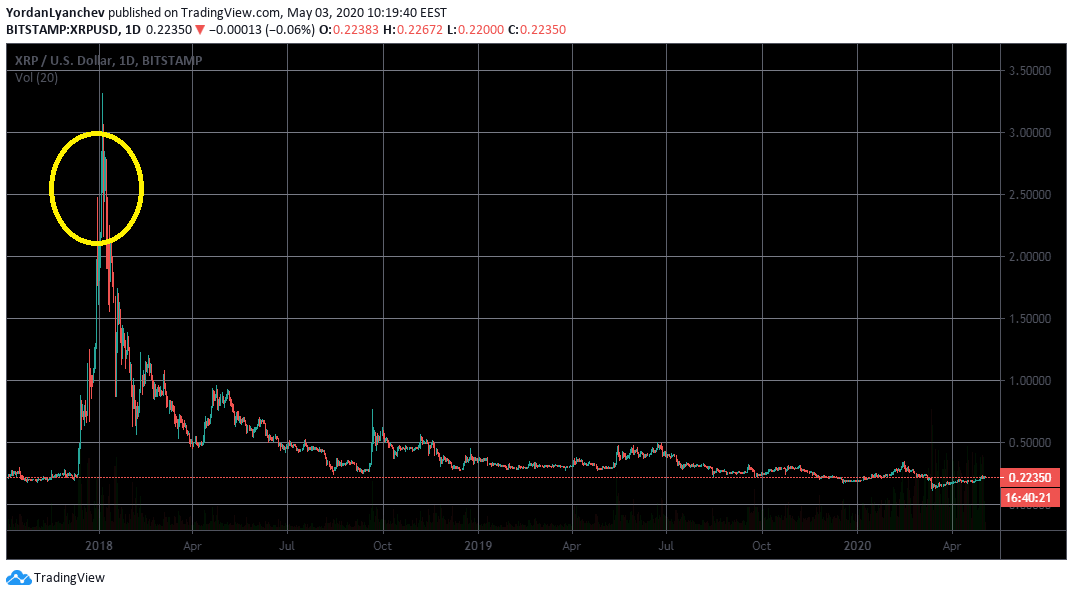

Another example includes Ripple’s XRP. Compiling a guide on how to purchase it at the time, the report made serious claims such as “XRP is one of the hottest new cryptocurrencies, and it only costs a bit over $2 per coin.”

Such reports could push retail investors to buy promptly, which might accelerate prices even further. The XRP guide was posted on January 2nd, 2018, and just a few days later, the asset reached its ATH. What followed, however, was a quick and painful slump. A month later, XRP dropped by 82% to $0,57, and in August it went further down to $0,23.

In any case, mass media does bring attention to the cryptocurrency market, but it’s still questionable if that’s the precise attention it needs. Just a couple of months ago in February, Bitcoin was again in CNBC’s spotlight and what followed was a massive sell-off taking its price down to $3,600 in a day.

The post CNBC Puts Bitcoin In The Spotlight: The Last Time It Was A Bearish Signal For BTC appeared first on CryptoPotato.