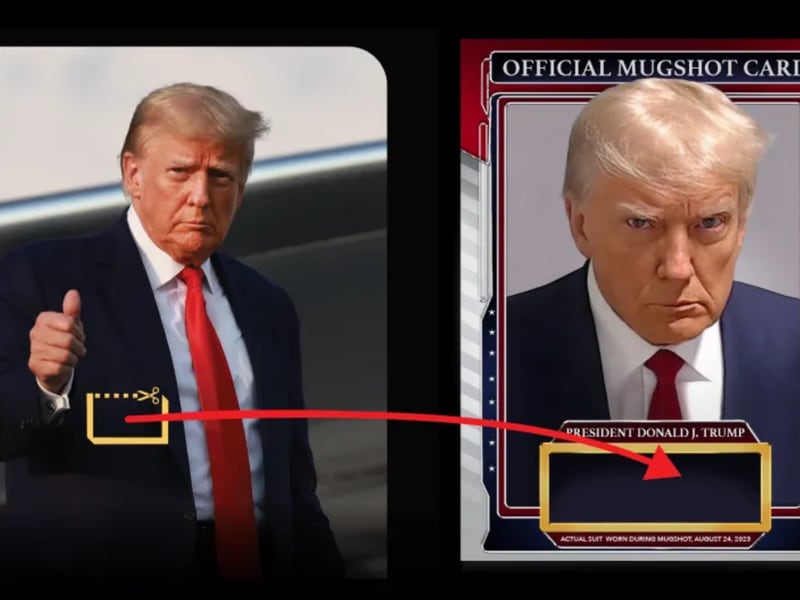

CME Topples Binance as Top Bitcoin Futures Exchange as Crypto ETF Excitement Soars

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

On Thursday, the regulated Chicago Mercantile Exchange (CME) took the top spot on the list of biggest bitcoin (BTC) futures exchanges, replacing Binance for the first time in two years.

CME ranked first among futures and perpetual futures exchanges with an open interest (OI) of roughly $4.07 billion, up some 4% in the past 24 hours and representing a 24.7% market share, CoinGlass data shows. Meanwhile, OI on Binance stood at $3.8 billion, down 7.8% during the same period. CME offers trading in traditional futures contracts with pre-determined expiry. Binance and other exchanges offer conventional futures and perpetual contracts or futures with no expiry.

The change in rankings occurred as the crypto market endured a major leverage flush out amid wild price swings, which saw the aggregate bitcoin open interest drop $2 billion from $12 billion. The decline impacted Binance traders disproportionately more than CME market participants.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/C5UPZGWWEVFTDA7NY6HNMIKG5A.png)

Bitcoin first surged to an 18-month high of almost $38,000, then sharply retraced toward $36,000 after a filing showed a corporate entity named “iShares Ethereum Trust” had been registered in the state of Delaware. A similar move happened before BlackRock – the owner of iShares – filed for a spot BTC exchange traded fund (ETF) in June.

CME’s rise to the top happened gradually this year and is a significant development as it highlights the growing demand from institutional market participants to trade the largest and oldest crypto asset. A paper published by Bitwise Asset Management in 2020 said that the CME bitcoin futures market leads the spot market in a consistent and statistically significant manner.

“The CME has been gaining market share for almost all of 2023, but these gains intensified over the past few weeks as market excitement around the BTC spot ETF applications soared,” David Lawant, head of research at trading platform FalconX, told CoinDesk in a note.

“Given the CME is a venue used almost exclusively by large traditional financial institutions, it shows how much interest there has been from this audience in crypto,” Lawant added.

CoinDesk reached out to Binance for comment and awaited a response at press time.

Edited by Omkar Godbole.