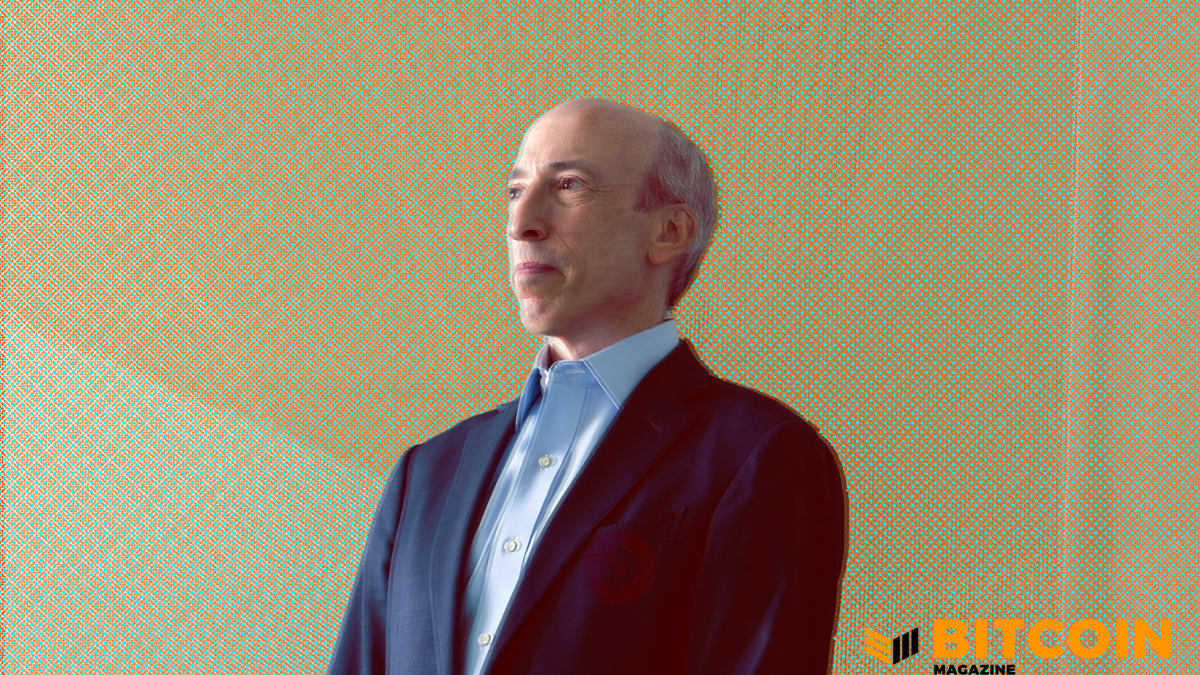

Climate-Advocate CFTC Chair Wants To Change Bitcoin

In a recent interview, Rostin Behnam revealed that if Lummis-Gillibrand were to be enacted, the CFTC could advocate for a less energy-intensive Bitcoin.

Commodity Futures Trading Commission (CFTC) Chair Rostin Behnam seemingly wants to leverage its probable future position as watchdog of the Bitcoin market to encourage a reduction of the peer-to-peer (P2P) currency’s energy use and incentivize consumers to find less energy-intensive alternatives.

The regulating agency will oversee Bitcoin if the Lummis-Gillibrand landmark legislation gets approved. The bill, which was introduced yesterday, needs to go through four committees in the Senate before being put to a vote on the Senate floor.

“In terms of the relationship between the current use case [of cryptocurrencies] and the energy consumption from mining, I think there’s a pretty significant dislocation right now; and we need to remove that dislocation,” Behnam said in a live interview with The Washington Post on Wednesday.

Bitcoin’s energy consumption has been debated fiercely since last year when Tesla stopped accepting payments in BTC for its electric vehicles a couple of months after enabling the option. The car maker’s CEO, Elon Musk, tweeted at the time that the decision arose from sustainability concerns in relation to bitcoin mining and its associated emissions.

Behnam hinted at two avenues that the regulatory body could explore to make the case for a different Bitcoin if it received the extra powers provisioned under Lummis-Gillibrand: the backboning technology and consumer behavior.

“On the one hand we need the industry to transition and change and understand that the energy consumption is too big, but we also need consumers to understand and appreciate what’s at stake so that through economic incentives they can steer their choice away from the more energy-consumptive behavior,” he said.

Lummis-Gillibrand, also called the Responsible Financial Innovation Act, grants the CFTC with exclusive jurisdiction over the spot markets of digital currencies classified as commodities – which would be the majority of existing coins per the current text, including Bitcoin.

As a result, bitcoin exchanges would need to register with the CFTC to provide the services they provide today for U.S. consumers as well as abide by specific rules set by the regulator in areas such as custody, customer protection, prevention of market manipulation and information-sharing.

According to Behnam’s claims, the CFTC could leverage its regulatory umbrella over exchanges to create “an information flow” to consumers about a myriad of topics related to cryptocurrencies, including energy usage.

“And that is sort of an age-old theory that if we create that information flow, incentives and disincentives will move the market in the right direction, and given the climate crisis and the issues around climate change, I think that with the right and accurate disclosures, incentives will move people away from that energy-consuming behavior.”

Climate Change: A Personal History

Behman has been personally involved in advocacy about climate change-related issues in the context of financial markets in the past.

Before he was named chairman in January 2021, Behman served as a commissioner for the CFTC since September 2017 – a time during which he spearheaded the climate-related market risk subcommittee of the market risk advisory committee (MRAC).

The subcommittee’s efforts culminated in the release of the “Managing Climate Risk in the U.S. Financial System” report in September 2020.

“The central message of this report is that U.S. financial regulators must recognize that climate change poses serious emerging risks to the U.S. financial system, and they should move urgently and decisively to measure, understand, and address these risks,” the report’s executive summary read.

The report makes policy suggestions in regards to climate change in the U.S., including establishing a price on carbon – which it said is “the single most important step to manage climate risk and drive the appropriate allocation of capital.” Other suggestions include principles for the development of rules on climate risk disclosures, such as having them be “specific and complete” and “comparable among companies within a sector, industry, or portfolio” to inform investor decision.

“Effective and well-functioning markets should allocate capital efficiently to net-zero emissions investments, spur innovation, and create and preserve quality jobs in a growing net-zero economy,” the report reads. “These recommendations seek to meet these goals by improving the functioning of markets by reducing structural barriers and catalyzing private sector innovation.”

Homework Is Piling Up

Given Behnam’s comments during the interview, it seems the CFTC chairman is interested in cryptocurrency and blockchain but lacks foundational knowledge about Bitcoin.

Not only is Bitcoin’s innovation arguably proof-of-work (PoW), a change to proof-of-stake (PoS) – deemed as a “greener” alternative – could undermine most of the P2P currency’s features.

While it is unclear whether Behnam would follow suit on his comments and push changes on the technological side and on the consumer behavior front, the community should remain vigilant and, above all, active in educating regulators, lawmakers and industry players on the benefits of Bitcoin and the context in which its energy usage should be studied.