Chinese Listed Companies and Bitcoin Mining: Partner or Predator?

This article was originally published by 8btc and written by Lylian Teng.

Some Chinese listed companies have jumped on the bandwagon of bitcoin mining following the bitcoin bull run throughout 2017, either under the guise of cloud computing or providing mining hosting services, in an effort to bypass regulations considering the country’s tough stance on bitcoin.

A recent report indicating that Huatie HengAn, a subsidiary of Chinese publicly listed company Huatie, lost over $23 million for its secret bitcoin mining business has caused quite a stir among investors and triggered investigations from regulators.

In this follow-up report, it’s apparent that more listed companies in China have been involved in cryptocurrency mining, though the country is considering a ban on this “wasteful” activity.

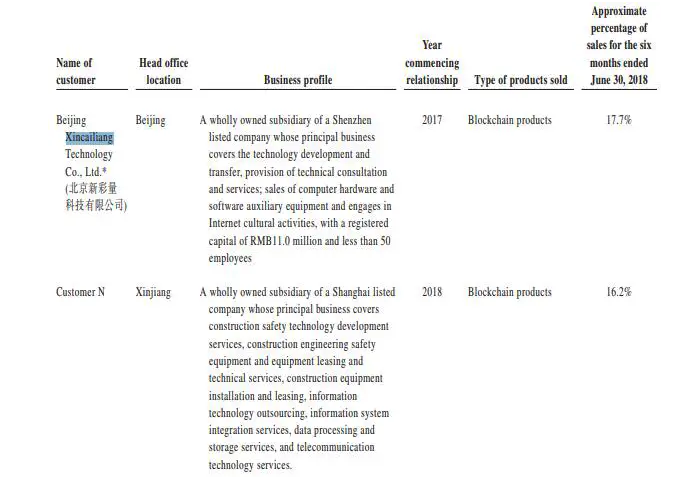

Per a prospectus from leading bitcoin mining machine manufacturer Ebang, its second largest customer, an anonymous Xinjiang-based company, is very likely to be the aforementioned Huatie HengAn, as it fits all the description shown in the prospectus. It is worth noting that its largest client, Beijing Xincailiang Tech, is a subsidiary of Shenzhen-listed technical company Wholeasy. The firm contributed 17.7 percent of Ebang’s miner sales for the first half of 2018.

Varied from Huatie HengAn, who apparently secretly mined bitcoin in 2018 under the guise of cloud computing, Xincailiang has built crypto mining farms overseas and offers miner host services. But public information shows Xincailiang is mainly engaged in case planning and big data traffic distribution in the field of mobile games in China.

Partner?

In August 2018, Wholeasy released an announcement that Mobcolor Technologies USA LLC, a subsidiary of Xincailiang, had reached a cooperation with California power supplier 3G Venture LLC and Singapore-based enterprise Vast Day Industry Trade Company PTE.Limited (VDIT) to “construct [a] mining center for digital cloud computing.”

According to the agreement, 3G Venture could offer 100,000 square feet for Mobcolor with a rental cost of $18 million per year and 90 MW of power capacity at $0.055/kWh, and Mobcolor’s Chinese parent company bought 65,000 mining rigs from Ebang and then resold them to VDIT who entrusted the mining operation to Mobcolor. The Chinese company’s U.S. subsidiary charged VDIT $0.075/kWh and a $24 million rental fee per year.

Having jumped on the bitcoin mining bandwagon amid the sluggish market in 2018, the company seems quite confident about the prospect of cryptomining.

Predator?

Indeed, Wholeasy is not the only Chinese listed company looking to build mines overseas.

“A plurality of bitcoin mining farms in Iran and the Middle East are run by a company named RHY, which is a NEEQ-listed Chinese company,” a miner named Ma Jingguo said.

According to its official website, RHY is a “large-scale blockchain mine.” It claims to be the largest mining company in the world, having a power supply capacity of 450 MW which could power up to 300,000 miners at the same time.

“In 2016, the company has invested in the construction of large-scale substations and natural gas power stations in energy-rich countries dominated by the Middle East,” Ma said. “It has become the core blockchain data center with the most competitive electricity rates in the industry. As the majority of its mines are located in Iran, #MininginIran was first hyped by the company.”

It is tough for Chinese companies to conduct bitcoin mining operations both at home and abroad, but they have advantages in capital, talent and other resources over bitcoin mining startups. Their only concern is to be compliant. In such a context, going overseas is a possible solution for them.

Considering the country is tightening its grip on cryptocurrency, these ambitious companies are making big investments overseas in bitcoin mining, a process they believe could secure better returns than crypto pump-and-dump ploys. Will they become big players in the crypto industry in the following years?

This article originally appeared on Bitcoin Magazine.