China 2016 Bitcoin Boom Comeback? Yuan Hits 11-Year Lows Against The USD

Bitcoin has marked a spectacular increase of around 10 percent over the past couple of days in a move that was nothing but sudden. Comparing Bitcoin’s situation now and back in 2016, analysts and industry experts think that the instability of China’s yuan against the USD could soon shift the country’s position in that regard.

China’s Bitcoin Fever in 2016-2017

Many are comparing the parabolic movement of Bitcoin in 2019 to that back in 2016 and 2017, at the end of which the cryptocurrency had reached its all-time high price of around $20,000. Now that Bitcoin is up more than 270 percent since the beginning of 2019, it seems only reasonable to do so.

However, many industry experts and analysts, including veteran Alex Saunders, CEO and Founder at Blockchain Education ever since 2012, said that one of the key differentiating factors between now and then is the position of China on the matter.

Most crypto participants weren’t around in 2016 when China really had #Bitcoin fever. If their currency continues to weaken, you can bet they will be chasing that $BTC feeling again. Breaking the 7 peg today is significant… pic.twitter.com/u1xQlZG90v

— Alex Saunders (@AlexSaundersAU) August 5, 2019

T

Notably, back before China issued a blanket ban on all crypto trading and exchange operations, the country was among the leading factors in the market. Chinese investors represented a serious share of the overall market and they had a serious impact on its overall development.

Two of the world’s largest cryptocurrency mining chips manufacturers, Bitmain and Canaan are Chinese companies and they had a serious allocation of the overall hashrate of the network.

What followed, however, was a full-blown clash on cryptocurrencies, as the country’s central bank, the People’s Bank of China (PBoC) banned security token offerings as well. Later on, China went on to ban all crypto-related commercial activities as well.

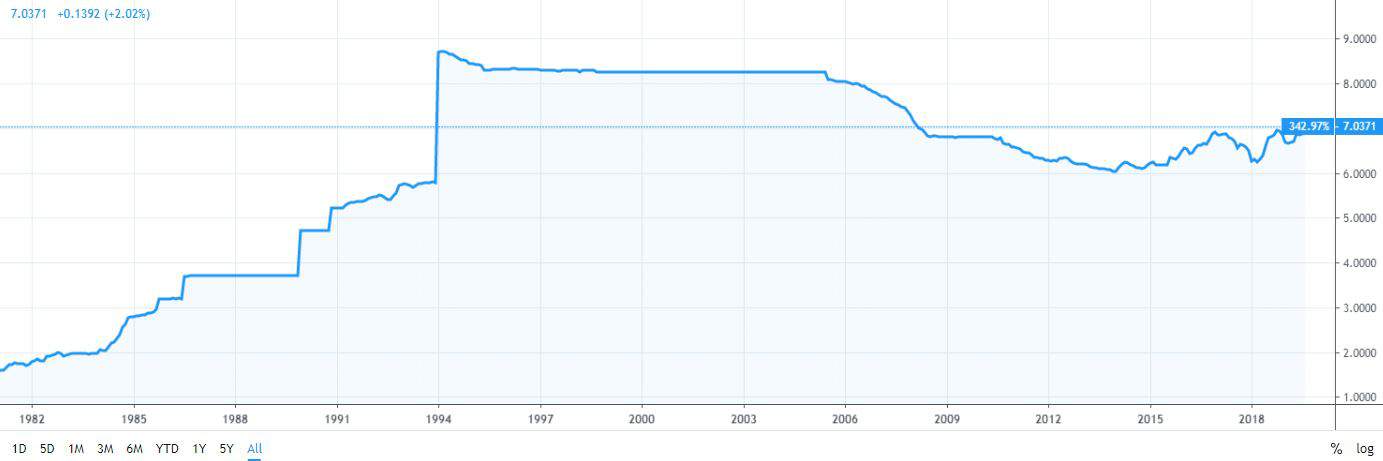

It’s also worth noting that the Chinese yuan was relatively stronger against the USD back then, as seen on the chart below.

Is Bitcoin Becoming a Hedge Amid Uncertain International Economics?

In 2019, however, the situation couldn’t be more different. The Chinese stance on Bitcoin and cryptocurrencies remains legislatively negative. However, there have already been some positive developments in this regard. Last year, President Xi Jinping called blockchain technology a part of a “new industrial revolution,” sparking expectations for a potential lift on the blanket ban.

Going further, there is a growing tension between China and the US, especially after US President Donald Trump recently announced yet another tariff imposition on $300 billion worth of Chinese goods intended for import within the US.

It’s also the case that the Chinese yuan is increasingly unstable against the US dollar, breaking below the 7-peg, hitting 11-year lows.

According to popular Bitcoin permabull and former Wall Street hedge fund manager, Michael Novogratz said that all of the above could be the reason for Bitcoin’s latest rally and that it could be well-justified.

With the yuan over 7.0, an FX war, instability in HKG and the beginnings of capital flight, $Btc rally could have real legs.

— Michael Novogratz (@novogratz) August 5, 2019

Now, the question that everyone is trying to figure out is whether we are on the forefront of yet another Chinese comeback, similar to the one that we saw back in 2016.

The post China 2016 Bitcoin Boom Comeback? Yuan Hits 11-Year Lows Against The USD appeared first on CryptoPotato.