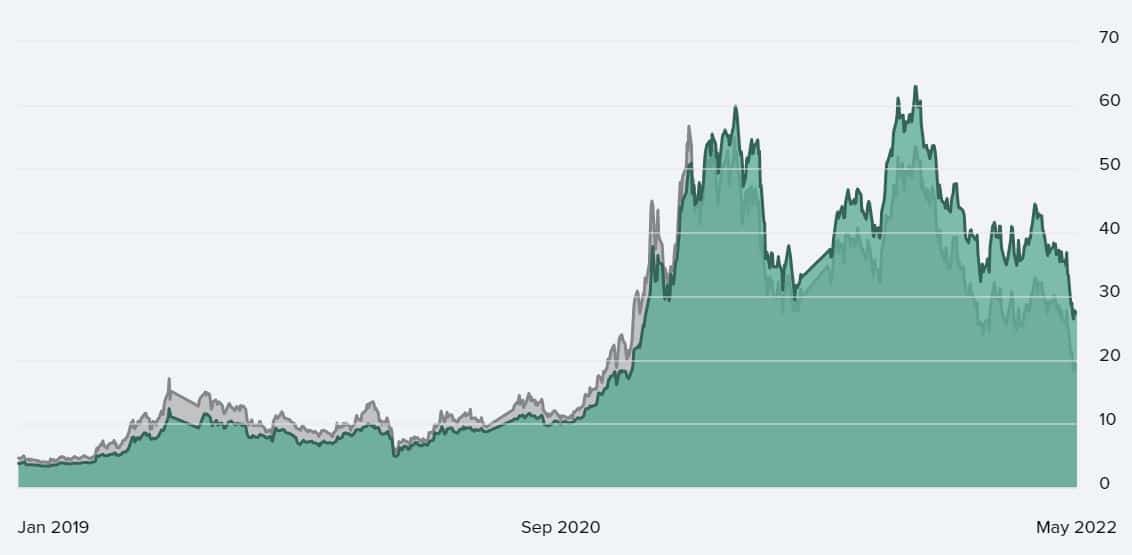

Cheaper Bitcoin: GBTC Discount Extends to 27%

Shares of the Grayscale Bitcoin Trust are trading significantly below BTC spot prices as the asset circles around $30K. Since the beginning of the year, GBTC is down some 45%.

- Grayscale is the world’s leading digital asset manager, and its Bitcoin Trust is the company’s flagship product.

- It allows investors to receive exposure to the price of BTC without having to worry about safekeeping it. Eligible shares are also quoted on OTCQX – the top marketplace for trading stocks over-the-counter.

- The minimum investment requirement is set at $50K, and each share represents 0.00092439 BTC.

- At the time of this writing, obtaining BTC through GBTC shares is roughly 27% cheaper than buying it on the open markets.

- As mentioned above, since the beginning of the year, GBTC plunged by some 45%, whereas the BTC spot price is down only about 34% – a considerable discrepancy.

- Grayscale tends to be used as a reference for institutional demand, and with the discount being as large as it is, a somewhat plausible assumption could be that the latter is currently at a low point.

- Of course, it’s also worth mentioning that GBTC shares come with a 6-month lock-up.