Charlie Shrem: What I Still Love About Crypto

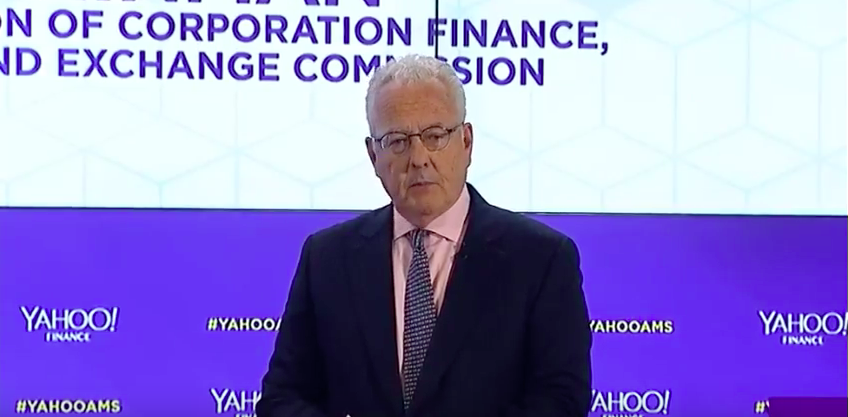

Charlie Shrem is the former founder of BitInstant and co-founder of cryptocurrency intelligence service CryptoIQ.

This post is part of CoinDesk’s 2019 Year in Review, a collection of 100 op-eds, interviews and takes on the state of blockchain and the world. Charlie Shrem is the former founder of BitInstant, co-founder of cryptocurrency intelligence service CryptoIQ and host of Untold Stories.

A central character in the early rise of bitcoin, Charlie Shrem is getting comfortable living in crypto’s slow lane.

Shrem earned his reputation, fortune and rap-sheet as the founder and CEO of one of the first bitcoin exchanges, BitInstant. In his early 20s, Shrem became a crypto celebrity. He travelled the world as a founder of the Bitcoin Foundation, and shored-up his nightlife by investing in EVR, the first bar to accept bitcoin in New York City.

This wild ride as a bitcoin evangelist took a left turn when, at 24, he was implicated in the Department of Justice’s investigation of the Silk Road. Shrem was sentenced for operating an unlicensed money transmitting business, after investigators found he had dealings with one of the darknet site’s market makers. Lionized instead of ostracized, Shrem’s celebrity only grew.

Following a one-year stint in prison, Shrem quickly adapted to the changes in the crypto industry. Though his early success was hard to replicate. His first post-prison venture, Intellisys Capital, a fund that planned to tokenized investments in manufacturing, real estate and sanitary waste firms, closed. At the height of the ICO boom, Shrem sat as an advisor for a number of projects. His own token offering was called off before the public sale, and Shrem returned funds to about a dozen private investors, he said.

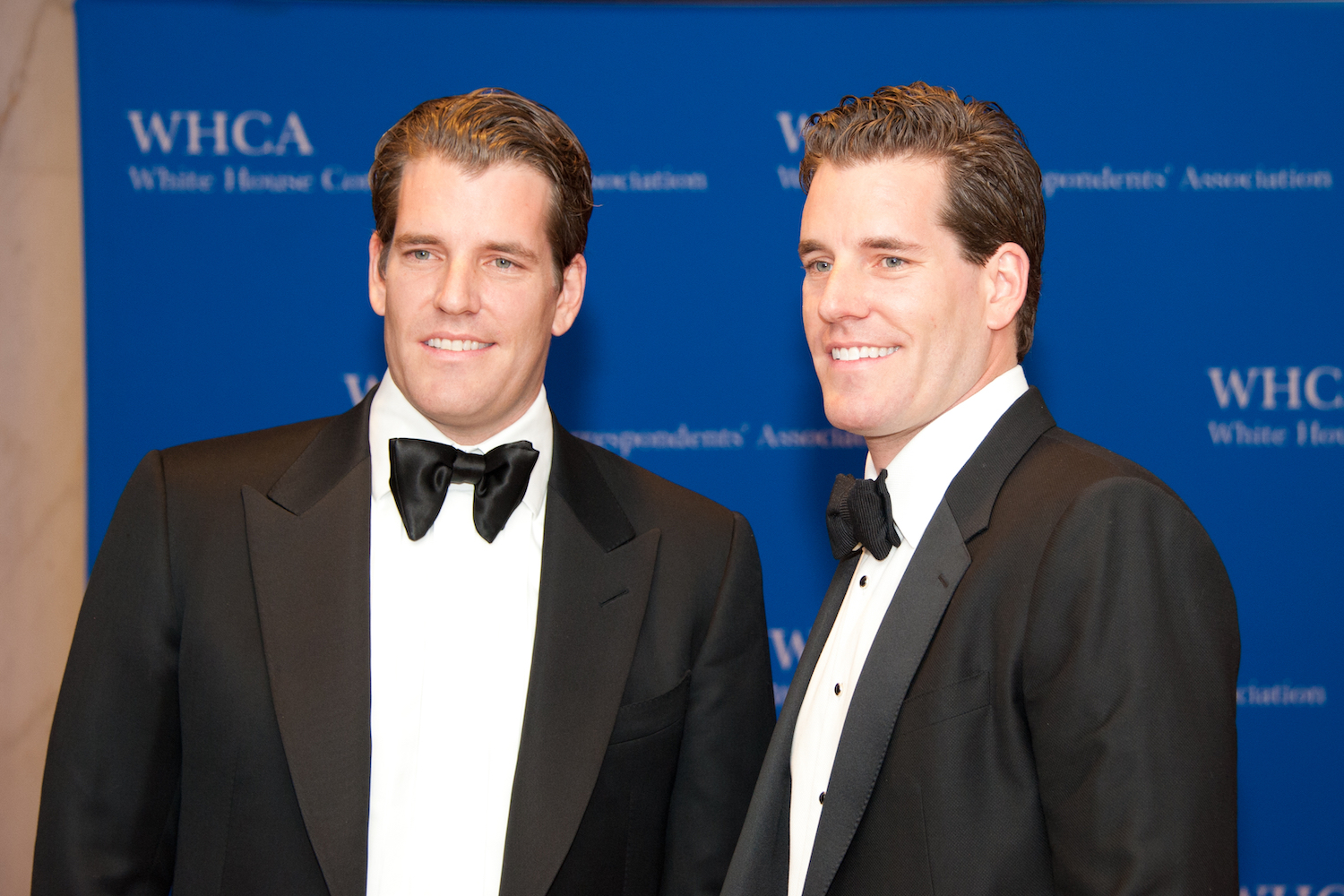

Then, in September 2018, Cameron and Tyler Winklevoss sued Shrem, alleging he had expropriated 5,000 bitcoins ($32 million at the time) from an earlier deal they made. The legal battle extended into the new year, when the parties decided to settle.

When he was “young and stupid” his ego told him he “could do everything and be the best at everything. My personality prefers when I make my own mistakes to learn lessons, and I definitely learnt from the consequences that came after,” Shrem said recently, when we spoke to him.

Bruised though not embittered, Shrem has taken a smaller role in the crypto industry. Since moving to Florida, he started two small businesses: CryptoIQ, a crypto advisory, and the Untold Stories podcast, which chronicles the history of the crypto industry. In a phone call, Shrem opened up about his regrets over the years, how the crypto industry has changed since he got his start and why he will never stop loving it.

CHARLIE SHREM: What can I do for you?

COINDESK: The idea is just to get your thoughts on the year. What stuck out for for you?

2019 for me was the year that everyone thought the bull market will come. It was a lot of building infrastructure, growing companies and products and bringing them to market faster than they probably would’ve, in preparation of a rally that never came. That’s why we’re sometimes seeing products flaws. But the bull market didn’t come.

You’ve been in crypto practically since the beginning. Did 2019 remind you of any other year?

I wasn’t around in 2015, so I don’t know what it felt like, but the people I spoke to told me it was just a sad year. A bubble burst the first month of 2014, so people thought the bull market would come. There are parallels from this year to 2014. A lot of companies were founded, raised money or grew that year. Ledger, Coinbase. A lot of companies we use today were founded or had exponential growth in 2014.

But then, we had a whole other year of bear market.

So the question is, do we have another year or are we at the cusp of a bull market. I hate to say it, Dan. Can I call you Dan?

You can call me Dan.

Dan, I don’t think we’ve seen the last of the bear market. Out of the seven bubbles I’ve been through over the past decade, this would’ve been the easiest one. Compared to how much we went down, how much people suffered. That’s your soundbite.

I think the recent volatility has made things exciting again.

You know why? In the last bull market people actually had to ask if bitcoin or crypto would continue to exist. There was fear. Now, even if bitcoin goes to zero, crypto is here to stay.

Were there any projects that launched this year you were excited about?

The answer is yes, but I have a policy not to name companies because I have sponsors. That’s my bread and butter. I’ll say this, the ones that I am most excited about are the ones that I allow to sponsor Untold Stories. I’ve said no to a lot of companies. I think we don’t give enough credit to companies that have been around a very long time in this space either. CoinDesk included. The longer you’ve been around, the more shit people give you.

I’ve learned that the people in our space are fucking brilliant.

What have you learned about the industry through podcasting?

I’ve learned that the people in our space are fucking brilliant. We attract some of the smartest and coolest people I’ve ever met. At this point, I’ve interviewed 41 executives from some of the most important companies in the space. They’re all very humble. Do you know how many times when I was interviewing CZ, he told me that it’s his team that does all the work. He’s right to a certain extent. I have a new appreciation for the people leading the industry forward. You’ll laugh, but I’m happy it’s not me anymore. I just turned 30 years old. I’m not in a position to be leading this industry forward. I have 10 more years before I feel like I could be in that situation.

I feel like a lot of the time the industry looks to the super-young to lead the industry. This isn’t exclusive to crypto, and applies to tech in general, but they’re always looking for child prodigies.

Yeah, but child prodigies don’t know how to be CEOs of companies. They’re brilliant, don’t get me wrong. Look at WeWork, the smartest entrepreneurs are the ones that realize they need to bring on real CEOs. Ledger, BitPay. Even CoinDesk. The companies that have brought on seasoned executives are the ones that are successful. That was my big mistake in 2012, when my investors started bringing on potential CEOs for BitInstant. I was 22 years old and my ego told me that I wanted to run this company. In hindsight I should have stepped back. That was one of my biggest regrets – one of the only regrets – I’ve had my whole life.

That’s a significant learning experience.

I was young and stupid. I thought I could do everything and be the best at everything. My personality prefers when I make my own mistakes to learn lessons, and I definitely learned from the consequences that came after. I like starting small, self sustaining businesses and employing people. This gives me a lot of happiness in life. Im proud to say I started two businesses here in Florida that employ almost a dozen people locally.

What still attracts you to crypto?

I don’t know. It’s my thing. Crypto and bitcoin are my life and legacy. I had no career before bitcoin, except an electronics startup I had in high school. The reason I love bitcoin and crypto is the same reason why you love a baby you’ve raised. If that child turns bad, you’ll still love it. I have an unconditional love for this industry. Even recently when I’ve started to get burnt out.

What’s changed most since you got in?

The narratives are changing, for better or worse. If you look at the story told the past 10 years – that exchanges are too centralized we shouldn’t keep money on them – that was the narrative. Now all the distributed exchanges are saying to keep your money on exchanges, ‘you’ll earn staking and interest rates. You can borrow and loan money, so long as you let us hold your money.’ I think that’s a dangerous perspective. I think we need to take a step back, we’re only six years past Mt. Gox. I mean what has changed. Just today UpBit got hacked for $50 million dollars. How many times is this going to happen?

Do you feel a certain responsibility now that your publicly-facing in the media?

I’ve always been public facing, and there was a certain responsibility there, especially with transparency. But now that I’m doing the show I say publicly that I am not a journalist, it’s not a gotcha program, it is purely entertainment. But every aspect is highly produced. I don’t just run on the mic and start talking. I sometimes have people making claims that I can’t verify.

I think the title of the program kind gets to the point – Untold Stories. The stories are meant to be entertaining, but you’re also a historian to some extent. Who do you most want to bring on?

Jack from Twitter, because I feel crypto Twitter is so important. I want to understand what it’s like being on the inside. If not him, a higher up in products at Twitter, who’s aware of what’s going on. Crypto Twitter didn’t really become a thing until 2015, and I really want to document that on the history books of Untold Stories.

Disclosure Read More

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.