Chainlink Chosen as Technology Partner for HKDR Hong Kong Dollar Stablecoin

On May 7, the crypto oracle solutions provider announced that RD Technologies was integrating Chainlink CCIP and Proof of Reserve to power its Hong Kong dollar stablecoin.

Chainlink’s Cross-Chain Interoperability Protocol will be integrated to enable secure and reliable cross-chain transfers of HKDR and easier access to the new stablecoin.

Additionally, the firm is also adopting Chainlink’s Proof of Reserve (PoR) to help provide reliable on-chain verification of HKDR’s reserve backing, according to the announcement.

Chainlink Delving Deeper Into RWA

The collaboration aims to enable more businesses and merchants to settle payments in HKDR, enjoy faster and cheaper cross-border payments, and enable reliable transfer of tokenized real-world assets (RWA) using the stablecoin.

The Hong Kong-based fintech firm stated it had made agreements with “several globally renowned cross-border payments, virtual assets, and wealth management players” to use the HKDR for cross-border payments.

.@RD_Technologies is integrating #Chainlink CCIP and Proof of Reserve to power HKDR, a stablecoin backed 1:1 by the Hong Kong dollar.

Explore how this strategic collaboration unlocks secure cross-chain and cross-border payments of HKDR

— Chainlink (@chainlink) May 7, 2024

RD Technologies CEO Rita Liu said that the “integration will help facilitate the adoption of HKDR in cross-border payments, real-world assets tokenization, and other on-chain finance applications.” It will also help facilitate the development of Hong Kong as a global Web 3 and virtual assets hub, she added.

Colin Cunningham, Head of RWA and Alliances at Chainlink Labs, added:

“Settling transactions across chains with HKDR will accelerate the adoption of tokenized assets and enable faster, more cost-efficient cross-border payments.”

Chainlink CCIP allows smart contracts to securely access data from external systems to facilitate trustless data connectivity between blockchains.

In April, Chainlink launched a new CCIP-powered cross-chain bridge app called ‘Transporter’ to improve token transfer safety.

On May 6, Chainlink’s adoption update revealed that there were seven integrations of four Chainlink services across three different chains: Arbitrum, BNB Chain, and Polygon.

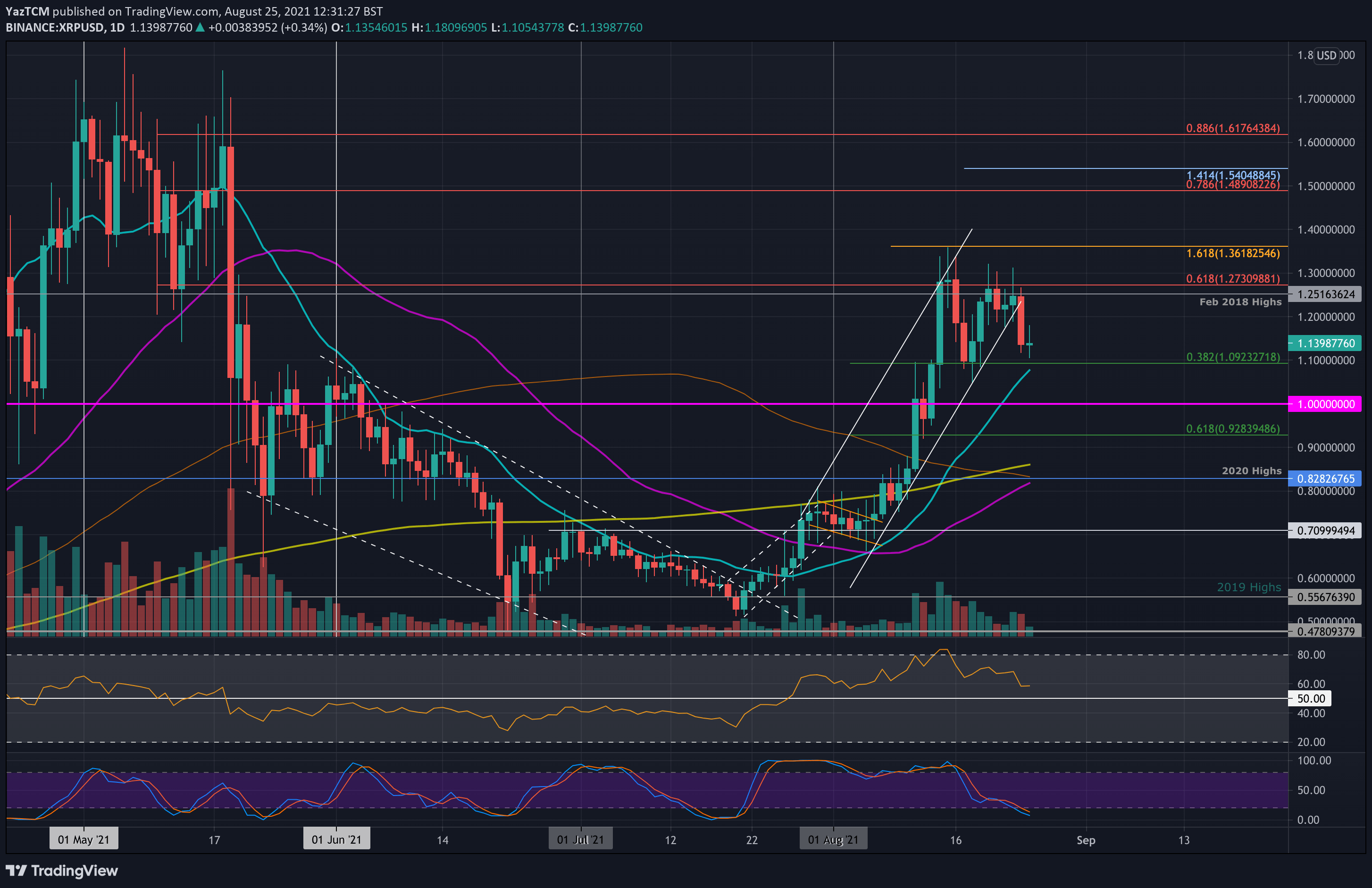

LINK Price Outlook

The network’s native token, LINK, did not react to the news, however. The asset had dropped 2% on the day in a decline to $14.28 at the time of writing amid a broader altcoin market retreat.

LINK prices have been weak recently, having lost almost 30% over the past month as crypto markets corrected from their mid-March highs.

LINK remains down 73% from its May 2021 all-time high of $52.70 and has failed to gain much traction in 2024 despite Bitcoin hitting a new all-time high.

However, analysts have predicted that the altseason is just around the corner when this asset usually performs well.

The post Chainlink Chosen as Technology Partner for HKDR Hong Kong Dollar Stablecoin appeared first on CryptoPotato.