Chainalysis Receives $100 Million in Funding At $1 Billion Valuation

Blockchain forensics firm Chainalysis announced today that it had raised $100 million in investments to expand the scale of its operations.

This would be Chainalysis’ third round of funding in 6 years since its launch. Now, the company has achieved a valuation of over $1 billion.

Addition Leads Chainalysis’ Latest Funding Round

This Series C round was led by Addition, an investment firm founded by former Tiger Global Management investor Lee Fixel. Other previous investors also joined in, including Accel, Benchmark, and Ribbit.

Michael Gronager, Co-Founder and CEO of Chainalysis, spoke enthusiastically after the success of this round. He noted that these funds will help expand the company’s operations and benefit its investors, especially Addition, which injected the most considerable amount of money. All thanks to Chainalysis’ contracts with several private and government agencies in search of monitoring what happens in the blockchain:

Speaking about this funding round Gronager said on declarations compiled by an official PR:

“Government agencies and the private sector need the right data, tools, and insights to responsibly oversee and participate in the cryptocurrency economy. We have established a network of government agencies in over 30 countries and more than 250 of the most important businesses around the world. Our partners at Addition understand the power of our platform and are a natural partner for this next phase of growth.

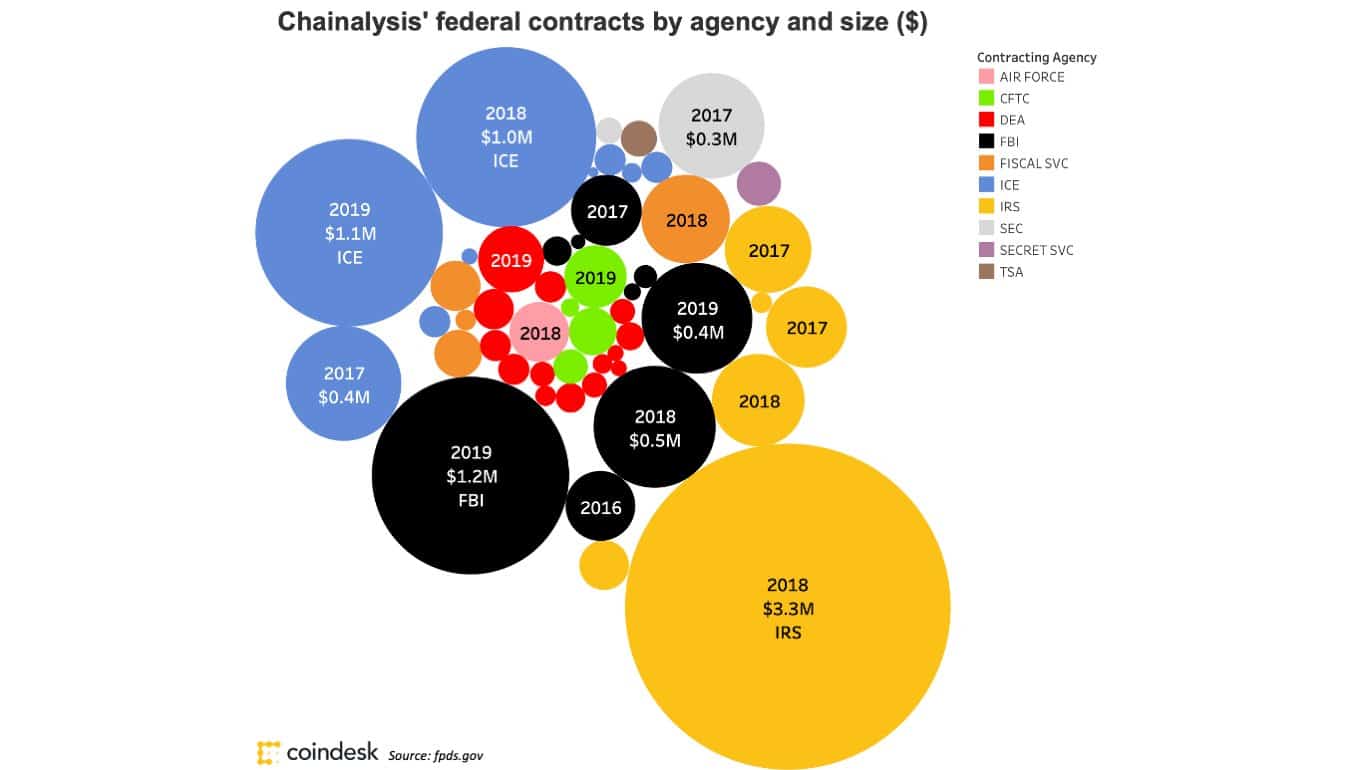

And without a doubt, investors seem to have hit the mark. The company is growing rapidly, and it’s not failing to deliver. Although there are no official figures, Forbes estimates that Chainalysis accounted for about $8 million in profits during 2018, growing almost 100% in 2019 and expecting to report similar growth year after year until 2022.

Tracking the Untraceable

Chainalysis has become famous in the crypto ecosystem for its efficiency in tracking transactions on the blockchain, solving crimes, and giving essential insights about the state of cryptocurrencies today.

Recently, Chainalysis, in conjunction with data forensics company Integra Fec. received a combined $1.25 million contract from the IRS to create tools to facilitate tracking transactions in Monero and on the Bitcoin Lightning Network.

Another company that is in the race to develop a tool capable of tracking Monero is Ciphertrace. Last week, the blockchain analysis company filed two patents aimed precisely at solving this problem. Ciphertrace also has contracts with United States government agencies.

However, there is still no magic solution for tracking these privacy-focused solutions. Chainalysis has remained secretive about its results whilst Ciphertrace has not yet received official patent approval and has not shared any great details about its developments.

With this round of funding, Chainalysis would also be fulfilling an indirect forecast from Forbes, Back in July 2020, the media company put Chainlaysis on its Next Billion-Dollar Startups List. It was the first blockchain company to ever made its way into such a prestigious list.

Seems like crime does pay, even if it happens on the blockchain.