Chainalysis: DEXs Have Grown 550% in 2021 as Competition Among CEXs Heats

The DeFi sector has seen a massive amount of money flowing onto its ecosystem this 2021 alone. So much that trading activity on large decentralized exchanges (DEXs) has increased by over 500% – outpacing trading volumes on popular centralized crypto exchanges (CEXs), according to a new report from analytics firm Chaynalysis.

2021 Is The Year Of Decentralized Finance

The report highlighted the fierce competition amongst centralized exchanges this year, with traders seeking the best platforms to trade amid the crypto boom since January. The transaction volume on crypto exchanges has increased significantly throughout the year, and while it isn’t constant, it shows a general upward trend.

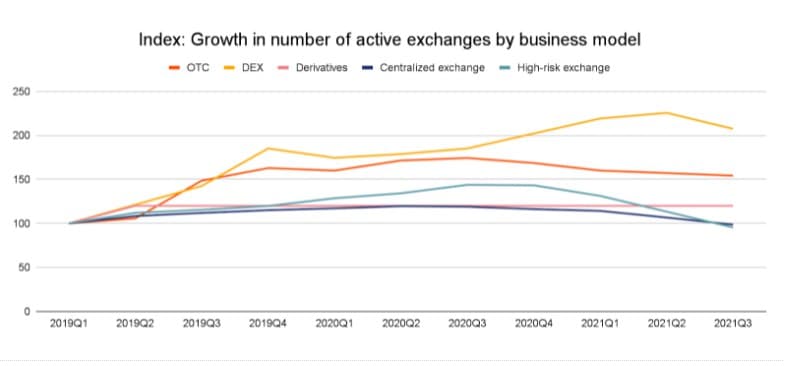

However, centralized exchanges have been outpaced by DEXs, with large protocols like Curve, PancakeSwap, and Uniswap surging by roughly 550% during Q1 and Q2 of 2021. Decentralized trading platforms were the most active exchanges compared to other business models since Q1 2019.

The graph below shows the comparison against other business models, like OTC, derivatives, CEXs, and High-risk exchanges (platforms with minimal KYC requirements).

Centralized Exchanges Fall Short to Their Counterparts

During Q1 2021, centralized exchanges have been competing fiercely as the crypto market boomed. But the number of active exchanges started to flatten out later on – only retail giants like Binance, Kraken, and Coinbase are leading the market. There isn’t an exact reason why the curve flattened out, but asset availability plays a big role in a platforms’ survival rate, said Chainalysis:

“This could be for a number of reasons. Perhaps new users are more likely to hear about bigger exchanges, and therefore flock to them when they decide to buy their first cryptocurrency.

Or, perhaps bigger exchanges’ superior liquidity allows them to attract the biggest traders. Our analysis suggests that the number of unique crypto assets available plays a big role in exchanges’ survival rate during the time period studied.”

In contrast, the number of DEXs and OTC (over-the-counter) brokers skyrocketed starting from Q1 2019. DeFi activity during 2021 has even eclipsed activity on centralized platforms, with the total value received by DEXes going from $10 billion in July 2020 to an ATH of $368 billion in May 2021.

Institutions Coming To DeFi

The DeFi sector is currently experiencing a boom, with more crypto-native institutions tapping into the ecosystem. In contrast, the institutionalization of Bitcoin made it less attractive to opportunistic traders.

What has made decentralized finance more attractive to institutions is the emergence of new L-1 protocols with better rates for stablecoins and ETH/BTC pairs. More institutions are using ETH to borrow and lend across various decentralized applications, as per a Q3 report from digital assets firm Genesis.

The DeFi sector is offering a wide range of technological innovations to serve the financial market. Multinational corporations are even trying to test DeFi technology. As CryptoPotato reported, the IGN is planning to launch a DeFi lending protocol using the Authority of the Financial Market (AFM) sandbox.