Centralized Stablecoins Are Problematic. Is a Decentralized Alternative on the Way?

Join the most important conversation in crypto and Web3 taking place in Austin, Texas, April 26-28.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/2654afdb-5706-41ee-aa8b-1b645e8effd8.jpeg)

Riyad Carey is a research analyst at Kaiko.

Join the most important conversation in crypto and Web3 taking place in Austin, Texas, April 26-28.

Stablecoins have become an indispensable component of the cryptocurrency ecosystem, denominating 80% of centralized exchange (CEX) trades and playing a crucial role in the rapidly expanding world of decentralized finance (DeFi). Providing a stable store of value and enabling seamless transactions in a volatile market, stablecoins act as a vital link between fiat and crypto – their importance cannot be overstated.

Riyad Carey is a research analyst at Kaiko.

However, recent developments reveal a troubling trend: The most transparent stablecoins are shrinking, while their opaque counterparts are thriving. This not only undermines the trust the industry desperately needs but also poses a significant threat to the future of the crypto market.

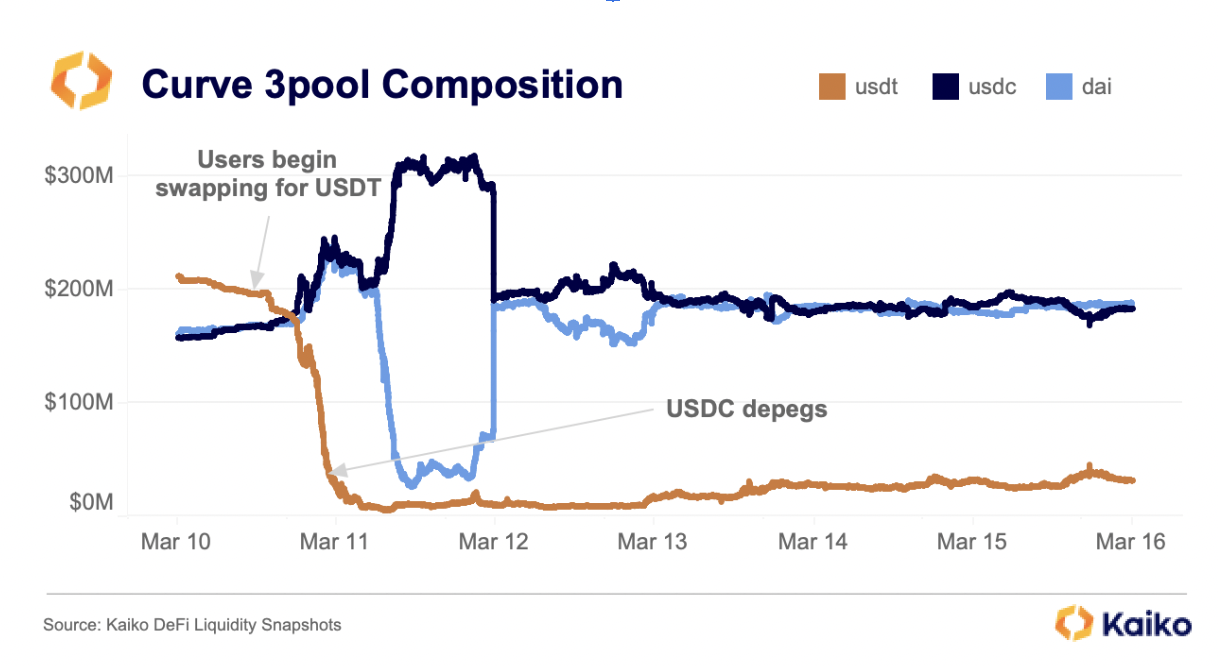

A bad year for stablecoins

Just one month ago, USDC, the second-largest stablecoin by market capitalization, depegged from the U.S. dollar and dropped to 80 cents after the asset’s issuer, Circle, confirmed it had exposure to the failed Silicon Valley Bank. This price collapse can be illustrated through on-chain data; below is a chart showing how the popular stablecoin swapping pool on Curve (3pool) saw the balance of tether (USDT), the largest stablecoin, drop as rumors of a banking crisis swirled. Users were selling USDC and DAI for USDT, causing the latter’s balance to fall.

(Kaiko)

In a more general sense, this chart also shows a flight from two stablecoins that are transparent about their backing, USDC and the closely related DAI token from MakerDAO, into the perceived safety of a stablecoin that hasn’t released an independent reserve report this year, USDT. Last year, USDT’s issuer, Tether, was fined by the Commodities and Futures Trading Commission (CFTC) for lying about its reserve assets meant to back USDT.

USDC has since returned to its peg and the 3pool has moved closer into balance. However, USDC’s market cap has continued to fall while USDT’s is approaching all-time highs.

Earlier this year, Paxos was forced to halt issuance of BUSD after the New York Department of Financial Services (NYDFS) stated the issuer hadn’t met its obligation to conduct risk assessments and due diligence to prevent “bad actors” from using the platform. Despite some confusion over the difference between the Paxos-issued BUSD and the wrapped versions that live on multiple chains called “Binance-Peg BUSD,” the former was one of the most transparent centralized stablecoins. Paxos was regulated by the NYDFS and published monthly independent attestations.

Before this regulatory action, the Binance exchange promoted BUSD as its stablecoin of choice, and I believed there was a decent possibility Binance would eventually delist USDT (the exchange, the world’s largest by trading volume, delisted USDC last year).

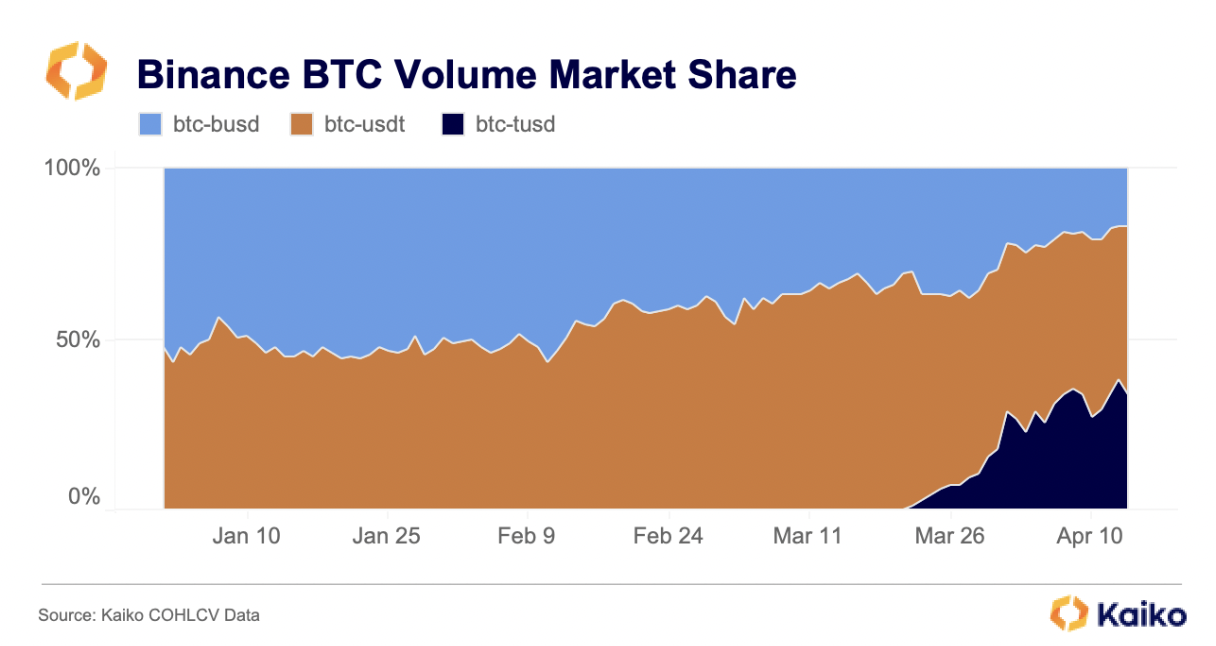

With BUSD on its way out, Binance has instead turned to trueUSD, making BTC-TUSD its only no-fee BTC trading pair. In February, TUSD had a market cap of under $1 billion. Today, as a direct result of Binance’s backing, its market cap is over $2.5 billion and accounts for over one-third of BTC trading volumes on the exchange.

(Kaiko)

A quick scan of TUSD’s website is not comforting. It states that TUSD is the “first regulated stablecoin fully backed by the U.S. dollar.” The question is: Regulated by whom? TUSD’s white paper says that TrueCoin, LLC (which does business as TrustToken) is a money service business registered by the Financial Crimes Enforcement Network (FinCEN). That’s well and good, but after some digging it appears that TrustToken isn’t the issuer of TUSD, Archblock is.

I’m left wondering why Binance, which is currently being sued by the CFTC, is promoting a stablecoin to which it has no public ties. The lack of transparency makes it hard to tell how much we can trust TUSD, and therein lies the problem.

It’s not totally surprising that two of the most regulated and transparent stablecoins have been punished this year. It’s reflective of an age-old business problem in which companies are incentivized to grow at all costs. This trend was supercharged in the Web2 era, when tech companies sought to “move fast and break things” and deal with the fallout later. But much of the appeal of crypto – or Web3 – is its potential to write the wrongs of an internet that grew quickly without direction or cohesion.

An obvious, but so far intractable, solution to this problem would be a decentralized stablecoin. Or ideally stablecoins. Unfortunately, most of the top DeFi-native stablecoins depegged along with USDC, a centralized and censorable asset that makes up a significant portion of supposedly decentralized asset’s backing. LUSD, for instance, tied to the Liquity protocol, has been the most successful, truly decentralized stablecoin – unfortunately, it’s not that stable (it was trading above $1.01 at time of writing).

Luckily, there is some exciting innovation on the way. The obvious contender is crvUSD, created by Curve Finance, which can rightfully be considered a stablecoin kingmaker. This stablecoin will seemingly be backed with decentralized collateral like ether (ETH) and should benefit from extremely deep liquidity. There are others, too, like dinero from Redacted Cartel, which will be mostly backed by ETH. While we haven’t yet cracked the decentralized stablecoin problem, I’m confident that builders are taking steps to bring us closer.

In the meantime, centralized stablecoins will maintain their dominance. Exchanges must bear the brunt of responsibility by listing only trustworthy and transparent stablecoins. So too should institutions carefully consider which stablecoins they use.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/2654afdb-5706-41ee-aa8b-1b645e8effd8.jpeg)

Riyad Carey is a research analyst at Kaiko.