Centralization Comes to DeFi as Group Behind MIM, SPELL Tokens Mull Legal Shakeup

Centralized business structures are continuing their creep into decentralized finance (DeFi), with the builders of tokens Magic Internet Money (MIM) and SPELL on Wednesday pitching a traditional legal structure to supplant the DAO overseeing the stablecoin with a nearly $700 million market cap.

In a forum post, a project leader called on Abracadabra DAO to support a “transition of power” to a centralized entity complete with lawyers, jurisdictions and trustees. Those trappings of a traditional corporation are seemingly antithetical to the notion of a DAO, the form of crypto-based business governance in which token holders directly call the shots.

“Despite our commitment to decentralization, we’ve recognized the importance of introducing a certain degree of centralized legal structure,” the AbracadabraTeam account wrote. “The purpose here is not to disrupt the decentralized nature of Abracadabra; in fact, it’s to protect it.”

Abracadabra DAO is the latest crypto project swapping the lofty idealism of decentralized governance for some degree of centralization, alongside SushiSwap and other projects. The reasons for these transitions range from heightened regulatory scrutiny to more mundane business concerns.

For Abracadabra DAO, the publicly-shared reasons seem to tilt toward vanilla. AbracadabraTeam said the centralized entity would manage the DAO’s intellectual property as well as server expenses “while still keeping control in the hands of SPELL token holders.”

Holders of SPELL (Abracadabra DAO’s governance token) will vote the project through three phases of transition, starting with picking a jurisdiction for the new entity. Four countries are on the table: Switzerland, Singapore, Malta and Bermuda.

Phases two and three will define what the new entity’s roles are and how it will operate, according to the post.

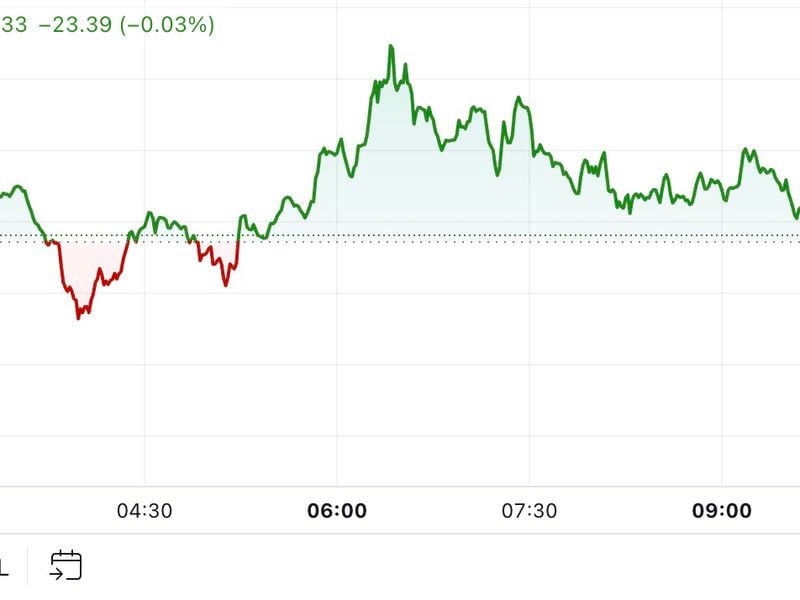

At press time, the SPELL token was trading 2.8% lower over the past 24 hours.

Edited by Nick Baker.