Central Bank Digital Currencies And The Orwellian New World Order

The proposed authoritarian evolution of centrally issued digital currencies takes the world closer to dystopia.

Central Bank Digital Currencies (CBDCs) have received increasing interest since Facebook’s failed launch of Libra and China’s recent announcement that they are moving forward with the digital yuan after an early trial period. This is “why we Bitcoin”: because the damage, destruction, and inequality brought about by fiat money will only be magnified with the proliferation of CBDCs.

Although some manifestations of the US dollar are already digital, there are inherent differences in what can be done with these new digital currencies. First, money can be time-based, and the issuer (the People’s Bank of China in the case of the digital yuan) can set an expiration date for your money. Money can also be “fine-tuned” to be sector-based, meaning that it can be designated to only be spent in certain sectors or stores. Finally, China has already implemented a draconian social credit score system, and that the digital yuan could end up tying into the social credit score. For centralized governments, CBDCs have huge benefits over both the current fiat system and a decentralized, neutral currency. However, that is not the case for the sovereign individual.

With CBDCs, the central government has the ability to attach an expiration date to money. Following the economic shutdowns of 2020, many people questioned whether the stimulus payments would circulate into the real economy or whether they’d just stay on the sidelines as savings or debt payments. Enter CBDCs. The U.S. Federal Reserve’s initial interest in a CBDC was as a way to influence the velocity of money.

When the U.S. government granted stimulus payments to its citizens to keep the economy afloat, there was no guarantee that the recipients would use them as the government intended. Those payments were meant to help people who lost jobs make ends meet and otherwise keep the economy moving. Saving that money for a rainy day, paying off debt, and investing it all run counter to the desires of a government that desires inflation.

The U.S. government (along with most governments around the world) is in a tremendous amount of debt, and at this point, the only solution for a government as indebted as that of the U.S. is inflation. Inflation is often sold as a necessity for the economy, with its proponents insisting that it goes hand-in-hand with economic growth: it increases the prices of goods and services but comes with the benefit of a more productive economy that produces more of those goods and services. In reality, the only reason why inflation is “necessary” is because without it, the government would be unable to meet its debt obligations. Politicians would not be reelected because they would fail to provide the handouts on which they campaigned, but more importantly, the government and global reserve currency would default, causing untold levels of economic damage worldwide.

So, the government’s desire for inflation drives the desire for money to which they can add an expiration date. When inflation is the goal, money needs to be circulated quickly, and CBDCs allow for that. With programmable money, the central bank could issue money through some sort of helicopter money program (universal basic income [UBI], stimulus, etc.) and require that the money be used by a certain date, or else it would simply vanish. That would prevent people from saving it (the neo-Keynesian sin of “hoarding”) and ensure that the money circulates into the economy. By adding money into the economy and removing the ability to save that money, the Federal Reserve (or any other central bank) could more easily achieve its inflation targets, thereby ensuring the desired destruction of our wealth at an average rate of 2%/year.

With the stimulus payments, the Fed is most closely targeting inflation. They purchase the government issued bonds which enable the legislative and executive branches of the U.S. government to issue stimulus. With CBDCs in the picture in a situation similar to the COVID lockdowns, people would be unable to make their own decisions about what to do with their stimulus payments. In many cases, this is money that the government is giving people because it took away their ability to earn a living. Yet, individuals would be stuck having to spend it when they might think they would be better off paying down debt or saving for a more long-term purchase.

If we consider a possible future with UBI, money with an expiration date could reduce lower-income individuals to a role as pure consumers: they would exist as vessels to spend money to keep the economy moving, but they would have no ability to save to start a business or improve their lifestyle. The psychology inherent in a money giveaway program would incline people to maintain their lifestyle, never advancing, but growing more agitated as others advance around them; Thomas Sowell believes that this would exacerbate social strife.

One of the problems with attaching an expiration date to money is that more restrictions are needed to produce the desired inflation. In a stagnating economy, individuals typically want to save, invest, and pay off debt because they are concerned about keeping their jobs and making ends meet (see Milton Friedman’s “permanent income hypothesis”). Although setting an expiration date on money prevents saving, more restrictions are needed to prevent people from investing and paying off debt with their newfound helicopter money.

Central banks would need to be able to fine-tune money to prevent certain uses (investing and paying off debt) to ensure that the newly printed money is put directly into the economy. However, at that point, it is not a long stretch to restrict the new money to being spent in specific sectors and businesses. Agustin Carstens, general manager of the Bank for International Settlements, has stated that the bank wants to have “absolute control” over the use of money. This idea should ring authoritarian alarm bells.

Some dystopian capabilities come with the government’s ability to fine-tune money. Anyone who has read The Bitcoin Standard or allowed Bitcoin to change their time preference knows that the mere existence of a fiat monetary system changes people’s behavior, generally in a negative manner. They are more likely to take on debt, spend outside of their means, overwork themselves, and reduce their time with their families. The ability for programmable CBDCs to change people’s decision making would be dramatic.

With programmable CBDCs, central banks would have the ability to force individuals to finance political pet projects. For example, because of the growing concern around climate change, a central bank could manipulate the money so that it could only be spent on “green” businesses. If the right person had enough influence, perhaps the next round of stimulus would not be able to be spent on beef, but perhaps only on vegetables, edible bug paste, and pod-based real estate. Regardless, the money system would quickly become a tool wielded by the most influential to pursue their goals, some of which you may share but others of which you may dramatically oppose.

Although this may seem like a dire possibility, it does not even consider the possibility of tying the concept of a social credit score to a future CBDC. The possibilities of controlling the population could definitely be expanded if that were to happen: central planners would be in a position to encourage certain behaviors by individuals who receive stimulus payments or UBI. If average employees are referred to as “wage slaves” today, then what are they when the government can remove their ability to access the goods and services if they don’t stay in line?

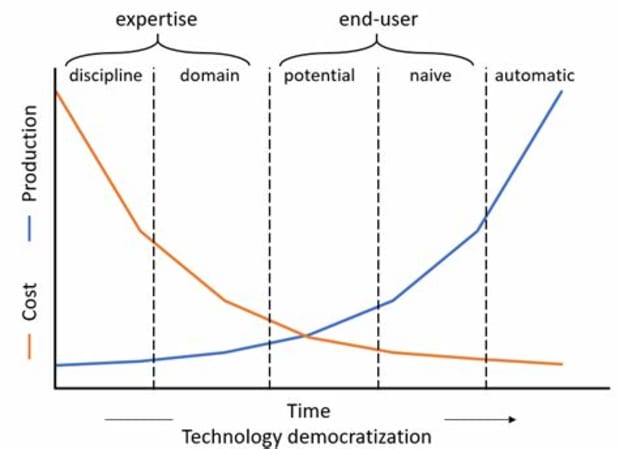

So far, we’ve focused primarily on the use case of CBDCs as UBI, stimulus, or other helicopter-type payments. However, there is also the possibility that a government could apply the same controls to all money entering the system, including wages. That would give the central bank even more control over the citizenry, but such controls could not be implemented immediately because they could be seen as too much of a shock.

This is why we Bitcoin: we are now in a race to wield a monetary weapon against a corrupted system. We don’t desire to control others, we just desire not to have others control us. A neutral, permissionless money is needed to prevent government’s continuing creep and overreach, and it has arrived just in time. If CBDCs are implemented in the near future, it will be necessary for Bitcoiners to be ready with solutions to exchange goods and services for bitcoin. Fortunately, there are solutions available, and they are improving every day.

When it comes to the tyrannical possibilities of CBDCs, bitcoin is truly freedom money. Will the U.S. and the West follow the path of China, which intends to implement a highly authoritarian monetary system to further control its populace, or will they embrace a neutral, permissionless option that is in line with the foundations on which the United States was built?

Here is a video further explaining CBDCs.

This is a guest post by James Holloway. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.