Central Bank Digital Currencies: A Technocratic Fallacy

CBDCs are antithetical to bitcoin and represent repression as opposed to freedom.

You may have heard of central bank digital currencies (CBDCs) and have had a slight read over what they are and the reasons for their current or proposed existence. Many people aren’t interested in it, to be frank. Maybe it’s the boring acronym, maybe it’s just another thing in a failing system that needs no long-term attention.

CBDCs are bigger than most think. They are the fundamental mechanism for the “Great Reset” in my eyes and will affect close to everyone on this planet in a plethora of ways.

There is quite a bit of scope to talk through and so I thought it best to approach it in an elevator-pitch style:

- What are the problems with the current monetary system?

- What are CBDCs?

- What problems are CBDCs solving?

- What is the cost of all of this?

- CBDCs versus Bitcoin

1. The Problems With The Current Monetary System

The biggest problem with money, in my eyes, is the debasement of its value.

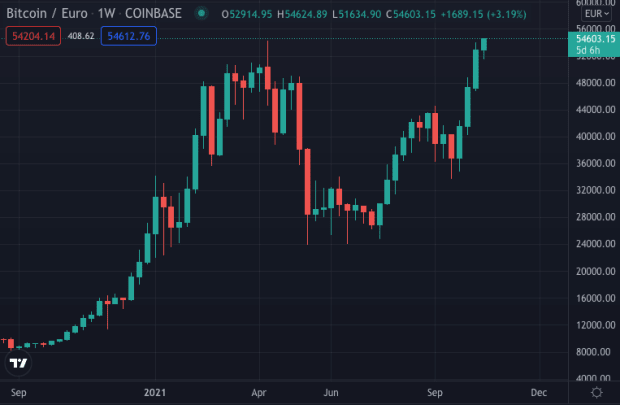

There are direct and indirect factors that have caused fiat currencies around the world to lose most of their value in a relatively short time frame. The recent trend of money printing will undoubtedly catalyze this debasement. Cantillionaires will continue to increase their wealth via hard assets and the poor, who mostly hold cash, will end up poorer.

The net result: The global inequality rate grows. This causes socioeconomic issues which then stem into many other problems. Sounds simple, but there’s a lot more to it.

Government bonds globally are yielding close to 0%. There has been a trend to zero over the past 30–40 years and we’ve finally reached critical mass. This type of asset essentially has demand through enforced regulations while organic demand has dwindled — for obvious reasons. Governments need to pay off debt and so they have moved to relentless money printing. This causes inflation and the debasement of their currencies through inflation.

Governments need to control inflation at an average target of 2%. This is quite hard where there is pressure on the supply side (money printing) and an imbalance on the demand side (consumption).

Governments need to increase consumption, decrease latency of money and increase money velocity. They believe this can be effected through absolute control of the money itself. They believe that internal processes can be controlled in a better manner through “programmable money” and the inefficiencies of international trade can also be improved.

Finally, governments want a controlled system, with a controlled instrument to do all of the above. Most importantly, there is a phased-approach that they will likely take to eventually control the populace through money itself — we will discuss this later.

OK, enough of the problems, let’s talk about central bank digital currencies now.

2. What Are CBDCs?

CBDCs are an instrument borne by the central bank of a nation, using the central bank’s balance sheet as the primary account.

OK, but don’t they do this now anyway?

Yes and no. Currently, central banks create money, lend it to banks through repo rates and the banks take over the flow of funds from there.

What is different this time, is that whatever happens with the flow of CBDCs, there will inevitably be debits and credits to the central bank’s ledger itself at the source. In other words, other parties can utilize the central bank’s balance sheet and liquidity, other than banks.

How is this possible? This is possible through “programmable money” that has a set of global rules built into it and is utilized through predetermined frameworks.

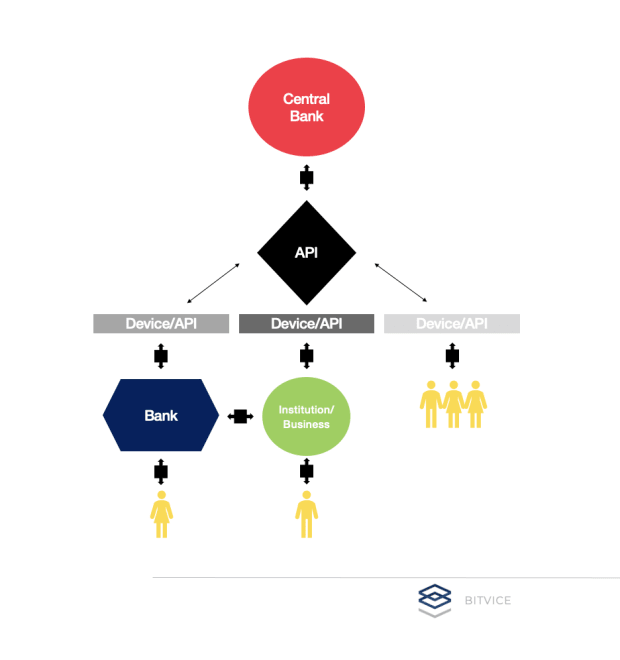

Below are three of the most common models that have been hypothesized and even launched globally. Remember, CBDCs are live in China and are in the pilot stage (or close to it) in various countries such as Ghana, the U.K., the Bahamas, Lebanon, South Africa and many more.

But what is the difference between digital currencies and the ZAR or USD?

It is programmable money.

What is programmable money?

These are digital packets of code that have a set of rules that can be defined by the creator and even an authorized distributor.

Imagine a digital dollar that is equal to one U.S. dollar. This digital dollar could:

- Be tracked across every movement, where the account that is credited appends that information to the digital dollar, in perpetuity.

- Be stopped, returned to the source, returned to the previous account or even destroyed at any moment.

- Have a set of inherent rules at the source, such as a lifespan of one year, and a specified amount of depreciation per unit of time.

- Can be credited to only certain accounts, such as users who have a social credit score of > X.

The rules are endless, because they are determined at will by the creator in an arbitrary manner or via fiscal or monetary policies set by the government or central banks.

What are the different models of CBDCs?

There are three models in this diagram that aggregate what is most likely to roll out in many countries. There will be differences here and there per country, but the three models should cover most bases.

Looking from left to right:

Central bank to bank

This is when the central bank cooperates with private or commercial banks to distribute the currencies. This will likely be the first phase of many rollouts to fit into current methods of credit provision that won’t harm economies with immediate disruption.

In the current system, commercial banks are the providers of credit at interest. This is their fundamental revenue generator but, with digital currencies that are directly linked to the central bank’s balance sheets, this may not be the case.

The intermediary banks may just become the “front-end” distribution tool that is completely attached to the central bank’s backend: its liquidity, balance sheet and overall database.

These intermediary banks may just earn fees on distribution while all interest payable by consumers goes straight to the central bank, with the intermediary bank taking a cut.

There will be less latency issues on credit provision, as credit is provided from one central source via a distributed network of agents (intermediary banks).

Once again, this may be rolled out in increments as this model goes against banks’ incentives.

Central banks to private institutions

These private institutions will also be connected to the central bank’s “back end” in a similar manner and become distribution nodes for the digital currencies as well.

These intermediaries can work alongside private banks in a competitive manner if the latter chooses to work within this system as well.

The difference here is that these intermediaries, such as fintechs, might create their own synthetic CBDC that is entirely backed by the central bank’s currency.

For example, FinTech may have FinCoin that is 1-to-1 backed by a CBDC. Similar to what we see with Tether (USDC) and other stablecoins working on blockchains such as Ethereum and Tron.

The incentive here will still be to directly settle with the central bank’s balance sheet on a regular basis and, for Fintech to adopt the preset, parent rules of the programmable money determined by the central bank. These funds need to be consistently tracked across all accounts to the end user — no matter what.

Thus, in the end, these FinCoins may just be the same code as the CBDCs, with a different branding that is marketed in a unique manner.

There may even be interesting methods of placing premiums on these FinCoins, payable to the central bank. If any fintech-determined rules need to be implemented on to their synthetic currencies, there may be a premium payable to the central bank by the intermediary.

Central bank to the consumer

This is the most interesting model of all three and will likely be rolled out in most countries in some shape or form.

To put it simply, you and I, as the consumer, can have a government- or central bank–owned app on our phone that allows the central bank to distribute the digital currencies straight to us.

With no intermediaries, this fixes latency issues and using this technology, the central bank can easily distribute credit straight to the consumer without any repo-related conundrums in between.

One of the biggest drivers for this is the inability for central banks to increase nationwide interest rates anymore. Right now, if they were to do this, markets would likely collapse.

What if the central bank could distribute credit to Frank, a 60-year-old male with a solid credit record, at a fairly low yet normalized rate? What if the bank could distribute credit to Thandi, a 21-year-old female who has just started her job, at a higher rate due to the risks?

Interest rates could be targeted at realistic levels and aggregated above 0% over time and increase in an incremental and organic manner as domestic credit demand increases. Sounds like a solid hypothesis, right?

How could the central bank app work?

What we have seen in many countries around the world is the digitization and centralization of identity. Phase 1 is through bank apps on a cross-border acceptance level. This allows governments to have a mandatory digital identification process in place to set the foundation for CBDCs.

It starts with private bank apps (which most banks already have) in a central application (a singular “bank/identity” app), but this central app can then be used for:

- Enabling citizens to confirm who they are, to anyone

- Allow the citizen to store all identification documents in one place

- Allow the citizen to use the application as a digital signature

- Allowing the government to provide their ‘services’ in one portal

- Allowing the citizen have cross-border identity

- And finally, to link payments to identification

The pieces of the puzzle are slowly coming together.

This application will, of course, be owned by the government who would also want to link the “payments” side of the application to the central bank. They wouldn’t want to privatize this arm through private banks.

Thus comes other potential mechanisms of the app, such as social credit scores (similar to what China has now).

When the central powers have your identity and they control the flow of money in an absolute manner; they will undoubtedly be able to control your behavior going forward.

A better social score, based on who knows what, could lead to lower interest rates. Maybe it could lead to some subsidies every year, straight from the government for “being good.” These hypothetical situations are not too far-fetched.

3. What Problems Are CBDCs Solving?

The rules help the rulers

When looking at these models, one thing is clear: the money must be controlled by the creator and not the user — it’s that simple.

With programmable money across different models there are a wide variety of “positives”:

- Inherent and efficient reporting for the central banks and intermediaries. This does work in favor of the institutions and providers. It brings down operational costs, as well as compliance costs which are a heavy burden for most institutions due to financial regulations.

- Repo and reverse repo thresholds and automations controlled from the central bank to intermediary banks (if this model is chosen).

- Plugin optionality to an agnostic back end that is interoperable across all service providers. In the current environment, a private company will spend an enormous amount of time, scope and cost to integrate with a banking partner for some product or joint venture.

If all parties involved are working with one interoperable system, there will be smaller barriers to entry and this may even allow increased innovation in the fintech space.

- Enforced depreciation of the funds will make the end user feel like they have a “hot potato” in their hands. This will cause a hypothetical increase in purchasing and consumption as people wouldn’t want to keep cash in hand, thereby driving the economy forward. Inflation wouldn’t be a hidden force anymore.

- Social credit scores and control of funds could lead to a more “controlled” populace with less protests, crime and the “overall betterment of society.”

- Direct credit provision and even automated loan terms may drive the growth of small businesses and increase job growth plus innovation internally.

- Updates to financial regulation, monetary and fiscal policy could be implemented quite quickly into the system and programmable money, bypassing bureaucracy and previous inefficiencies.

- Fraud and financial crime could be mitigated via the new system where money is controlled through all processes. If a hacker steals one’s funds, it could easily be returned without the need for the hacker’s permission.

- Most importantly, with programmable money, the demand side of the spectrum can theoretically be manipulated via the digital asset. Right now, the supply side of money is controlled by the central powers, but the demand side (consumption) is very hard to control. If user behavior and consumption is enforced through the instrument itself, central banks could stave off recessions in a controlled manner.

- The velocity of money could be manipulated and the one’s most in need could get money way more efficiently than they do now.

- The systems that the money works in can also be controlled in crises. What if the stock market could be frozen? There would be no one able to sell, thus, keeping prices in place until temperatures cool down.

The control of everything may sound like a grand idea but unfortunately this has been tried before.

4. What Is The Cost Of All Of This?

Debt is still debt

If the CBDCs are rolled out prudently and in an incremental manner that does not affect the current banking or financial system too dramatically, it is plausible to say that consumption could increase, thereby driving inflation down. But for how long? Do the short-term and long-term debt cycles suddenly disappear with this concept? No one knows.

Yes, market collapses could be avoided in the short term, but Austrian economists would then ask the question: If the market is not a free market anymore, what would drive demand?

Even though this system may seem new, innovative and unwavering, it is naive of us to think this is the case.

The overall system is still one and the same. Every 1 unit of CBDC = 1 unit of debt. The continuous growth of debt is a fundamental issue in the world we live in today. Eventually, debtors won’t be able to pay up, causing a cataclysmic effect and an end to the long-term debt cycle. Perhaps CBDCs delay this, but I just don’t see it delaying it forever.

The inefficiencies of centralization

What happens after the efficient, singular interest rates are enforced? How do you control these over the long term, efficiently? If rolled out properly, credit can be provided in an individual manner, straight from the source. Now, in the central bank to consumer model, it does not have a network of agents to control the operational complexities that come with having millions of users.

How do the central banks then control the continuous management of each user, one by one. There are efficiencies with centralization but inefficiencies as well. That is what we saw in the Soviet Union years ago, where the central powers controlled the pricing of millions of goods and services in the economy. Undoubtedly, this was one of the biggest factors to its downfall. Without free market principles in place, supply and demand will never be balanced.

The same applies to one power controlling the rules for millions of users. There are unknown risks here that can be easily compared with the Soviet example.

A monopoly on innovation

We’ve watched cryptocurrencies grow into a “big beast” these past few years. I am not referring to bitcoin, but the vast amount of altcoins that invade our social lives, online and offline.

These cryptocurrencies are driven by large marketing schemes and a “VC mentality” of get in early and get out early too. Buy in early, market the product and get out via dumping on the retail market. Work fast, break things and soon they will come right. In other words, the Silicon Valley way of thinking.

That is why a lot of people struggle with understanding Bitcoin’s mentality of slow and steady. It is very likely these central banks will adopt the former way of thinking and partner with altcoin teams and/or technologies.

We have seen central banks do “thorough” research and prudent pilots, but COVID-19 may just be a catalyst that drives the central powers to rush this product out to market. Whatever shape or form of their model, millions of users will be reached in a much quicker time than the standard adoption rate of private products. The risk of getting something wrong, when so many are reached, is one of the biggest known risks in my eyes.

Could it lead to a liquidity crisis?

If the central banks choose to manipulate the demand side of the economy through enforced depreciation of these currencies, would this lead to events that spiral out of control?

What if people immediately choose to “consume” or move these currencies into harder assets? There would be short-term velocity, no liquidity, stock markets would become dangerously parabolic, which all points toward a liquidity crisis.

Most people don’t understand or see the hidden effects of inflation. If the currencies are self-destructive over time, people will do everything possible to not hold CBDCs. There are a smorgasbord of issues that could stem from this. Perhaps this would lead to the central banks “printing” more and more money which only exacerbates inflationary issues in the long term.

Privacy and security

Some of the other big risks, in my opinion, are privacy and security.

Firstly, it should not be accepted that your money has no right to privacy. What you buy, where your money flows and what you choose to do with your money is synonymous with your overall privacy.

Sadly, governments have normalized the fact that you have no privacy when it comes to your money. We are verified in basically every transaction in our daily lives (private bank apps). The centralization of this verification is about to become a very real thing.

And the centralization of everyone’s money and data is a perfect honeypot for hackers, fraudsters and the corrupt. Just Google how many times Facebook has been hacked and ask yourself whether your data is safer with a central bank? However, the data that the government and central bank will own will be everything about you. Your absolute identity. Now think what happens if someone were to get a hold of this information?

5. CBDCs versus Bitcoin

From what I have explained, it is easy to see that CBDCs are:

- A way for others to control your money.

- A way to control money and the populace through one-sided permission.

- A digitized currency that has no limits to the amount of units that can be created or, in other words, has an endless supply.

- Has a set of one-sided rules determined by the creators and/or providers.

- Centralized and less secure.

- Amenable and are easily changed based on monetary policy or even arbitrary rules.

- An innovation that can maybe solve a lot in the short term but close to nothing in the long term.

- Is the best path for absolute control by governments.

Then we have Bitcoin where:

- Only the owner of a coin can produce a signature to authorize transactions. No one else but the owner can control it.

- Anyone can transact without permission in a pseudo-anonymous manner.

- Has a limited supply of 21 million bitcoin that can never be changed.

- Everyone can verify the rules that are set in stone and accepted by everyone. Bitcoin is a set of rules with no rulers.

- It is decentralized globally and distributes its risk through this. Its inherent security stems from this.

- It is completely immutable and finds stability through this.

- It is the best weapon we have to maintain self-sovereignty.

Can CBDCs and Bitcoin live in the same world together?

We can only hope that governments do not ban Bitcoin upon the rollout of CBDCs. The mere fact that a vast amount of institutions are adopting it, only strengthens its foundations into our current financial system.

However, if they do ban it, this will affect the poor and unbanked heavily and the Cantillon effect will continue to flourish. Bitcoin will probably win in time, but if bitcoin is used as a legal asset to store one’s wealth, alongside CBDCs, then it will continue its current adoption curve in time.

The pain points of fiat to bitcoin or vice versa will still be there and might continue to grow as well. Governments want control and, as soon as one’s funds are in Bitcoin, they lose this. Perhaps regulation will drive “synthetic” bitcoin offerings over time — where custodians hold bitcoin on retail’s behalf — which means there is still a sense of control over this asset by the regulators. Getting one’s private keys may become harder and harder.

Nonetheless, we will likely see peer-to-peer markets keep growing over time, even with CBDCs.

Bitcoin Is The “Great Reset”

To conclude, we can see that CBDCs are pretty much the complete antithesis of Bitcoin. One instrument is a set of controls and the other, a key to freedom.

There are plausible reasons for rolling out CBDCs, but its long-term paradigm is obtuse at best.

A centrally manipulated market will never be as efficient as a free market in the long term and we simply do not know if this will actually fix anything at all.

Sovereign wealth and domestic consumption might increase with CBDCs, but the units of account still remain as something backed by nothing but a set of centrally planned rules.

It does not fix the inherent problem: the value of money itself. It only fixes the “efficiency” of money in the controller’s eyes.

Governments will always think that government-created problems can be solved with more government. They need control of their money to fund their increasing deficits through lack of long-term incentives.

If their money is backed by something that is universally accepted, appreciates in time and cannot be controlled by any central government:

- Poor people can finally get into an asset that does not depreciate, that is accessible to everyone.

- Free market principles can play out.

It is only through holding your private keys and bitcoin that you can have self-sovereignty and privacy. No one can take that away from you if you handle it in a secure manner and more importantly, no one can debase that wealth.

This is what freedom is. Freedom in your wealth means freedom in everything else.

This is a guest post by Brandon van Niekerk. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.