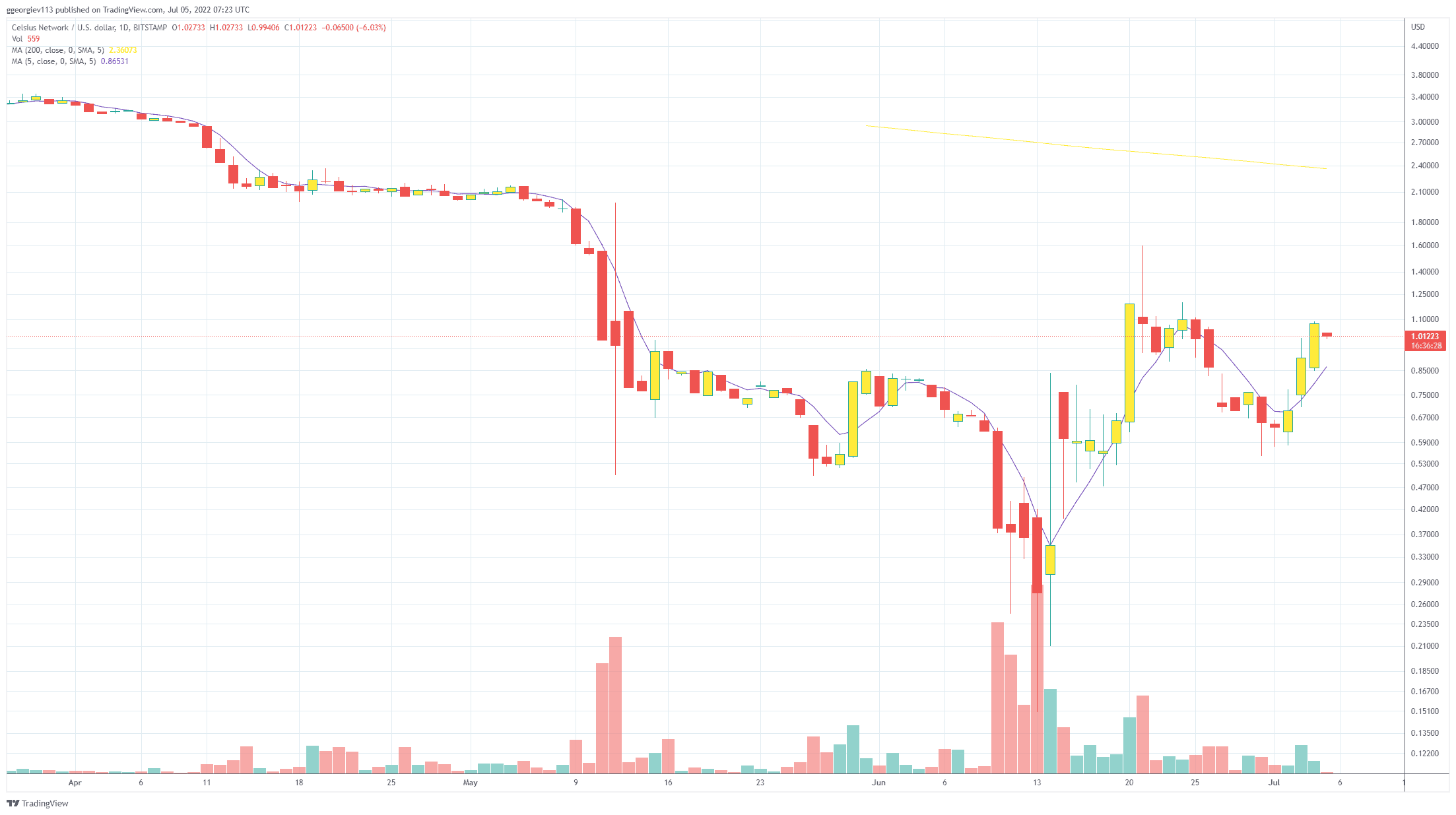

Celsius’ Bitcoin Loan Liquidation Price Below $5K as Company Repays $120 Million in Debt

Celsius Network has made several loan repayments to reduce the threshold at which it would be forcibly liquidated.

The loan paybacks have been witnessed on vault #25977, which is said to belong to the firm. According to DeFi Explore, the company began making a string of repayments starting June 14. The latest, which is also the biggest payment (64 million DAI) since that period, happened just yesterday.

In the past couple of days alone, Celsius repaid some $120 million to Maker, while crypto researcher Plan C also indicated the firm paid a combined $67 million in debt to Aave and Compound on July 2. The vault now has an outstanding loan of over $82 million. Its collateralization ratio has also risen to 577.81 percent, meaning less risk to its lenders.

Celsius Settles Loans, Liquidation Price Drops

With the latest indemnifications, Celsius has now lowered its liquidation price to just $4,967. On June 13, the same day that the firm froze withdrawals, its liquidation price was dangerously close to BTC’s price range of at the time.

Celsius’s efforts to help its case seem to have yielded fruit, considering the firm hired restructuring lawyers and reported working with regulators.

This month, other than its loan repayments – amounting to $142.8 million – Celsius has also cut back its workforce by 150 personnel.

Community and CEL React

While its latest actions offset the risk of insolvency, the community wonders whether they mean the firm will reopen withdrawals. The biggest question in the room has been where the company is getting funds to reimburse its lenders. Recall that investors showed no interest in bailing out the company.

The latest repayments have been well-received as is further evidenced in the price of the firm’s native cryptocurrency – CEL, up over 17% in the past 24 hours alone.