CEL Token Pumps Over 300%, Then Instantly Dumps

The native token for crypto lending platform Celsius has abruptly skyrocketed following bullish news regarding its efforts to address liquidity issues. On-chain data shows that the company has received substantial DAI stablecoin contributions, which its already used to pay back its loans.

- According to Etherscan, Celsius received multiple DAI transactions worth over $28 million in total at about 10:50 am EST.

- These funds were immediately transferred to an Ethereum contract address representing its loan with Oasis, helping to pay back some of the debt it owes.

- These funds pushed down the liquidation point on Celsius’s loan to $15,152.

- The company has hastily been retrieving liquidity to shield its $534 million worth of collateral on the loan from being liquidated.

- Alongside DAI, Celsius has deposited thousands of wrapped Bitcoin (WBTC) as additional collateral as crypto prices continue falling.

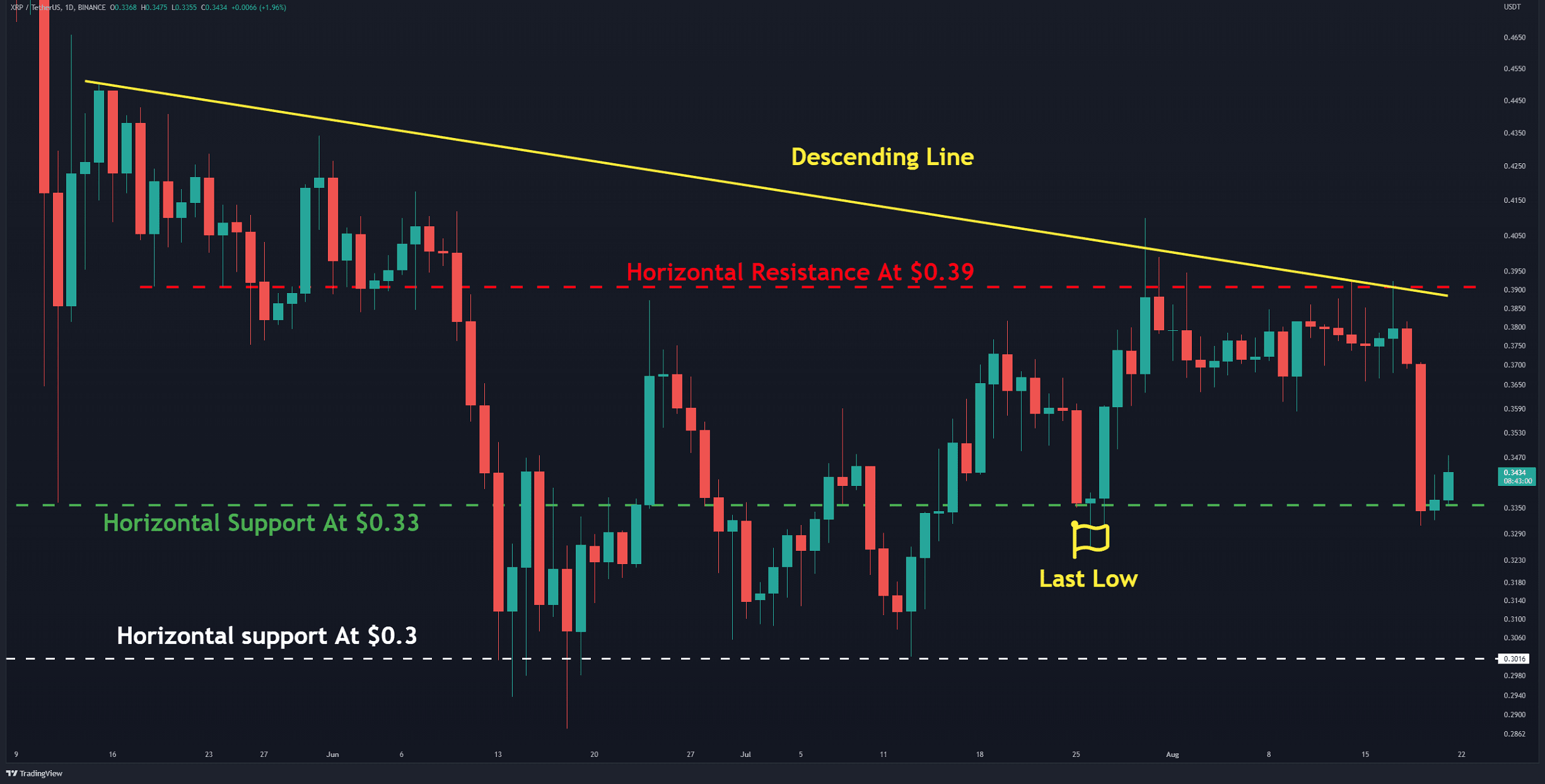

- Following the news, CEL – a token that helps Celsius users earn additional payouts on Celsius – pumped drastically. Sitting at just $0.33 at 10:54 am EST, it shot to $1.42 by 12:04 pm EST according to CoinGecko.

- The coin fell sharply immediately afterward, however. At the time of writing, CEL now rests at just $0.56.

- Celsius recently came under hot water after freezing withdrawals from its platform due to liquidity issues. The company uses lending in the defi space to generate yield on behalf of its customers, who deposit their funds with the platform.