Cboe’s BZX Exchange Files to Launch Ark 21Shares, VanEck Spot Ether ETFs

Cboe’s BZX exchange is hoping to launch the first spot ether exchange-traded funds in the U.S., filing the paperwork for products tied to Ark 21Shares and VanEck.

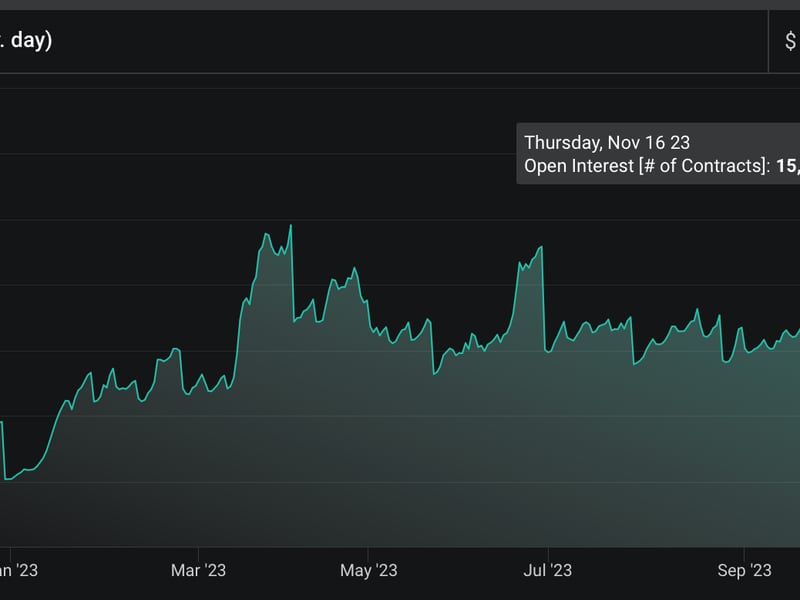

The exchange filed 19b-4 documents on Wednesday, formally kicking off a review process. Once the U.S. Securities and Exchange Commission (SEC) acknowledges the filings, it will start a 240-day clock for a final decision. The SEC will have a number of intermediary deadlines to make a decision, but has traditionally taken the maximum number of days possible to review applications.

Coinbase will act as the surveillance-sharing partner for both products, similar to the role it expects to play with a broad swath of spot bitcoin ETF applications currently working their way through the SEC review process. The crypto exchange will also act as the custodian for the ether held by the Ark 21Shares trust. VanEck did not disclose the name of its custodian.

Should one or both of these applications be approved, it would mark a first for the U.S. At present, there are no spot crypto ETFs, though traditional financial luminaries like BlackRock and Fidelity have recently started bids to get a spot bitcoin ETF approved by securities regulator. Several asset managers have recently filed to launch ether futures ETFs as well.

The SEC has always rejected spot bitcoin ETF applications, but recently suffered a setback after an appeals court ruled that its rejection of a bid by crypto trust overseer Grayscale was “arbitrary and capricious” given the existence of bitcoin futures ETFs.

The assets underlying a bitcoin futures ETF have a high degree of correlation with the assets that would underpin a spot bitcoin ETF, the unanimous ruling said. Grayscale is a subsidiary of Digital Currency Group, CoinDesk’s parent company.