CBDCs Won’t Threaten Crypto, Morgan Stanley Reports

Although central banks are pushing the gas pedal in their race against decentralized technologies, it is very difficult for their CBDCs to really threaten cryptocurrencies. At least, this was the conclusion reached by banking giant Morgan Stanley.

Analysts at Morgan Stanley believe that while CBDCs may affect cryptocurrency markets as they enter the space, they are unlikely to be a threat to decentralized technologies. Digital, decentralized assets have other use cases that make them more appealing to investors and enthusiasts.

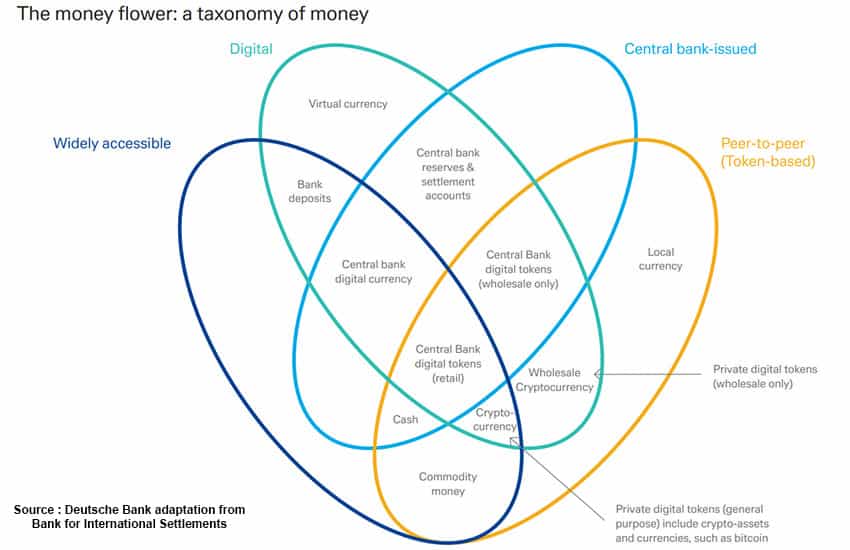

Different Products Don’t Compete With Each Other

According to statements by Morgan Stanley’s chief economist Chetan Ahya, the bank’s experts believe that decentralization has already permeated the mindset of many investors, and CBDCs cannot compete against crypto in many aspects precisely because of their decentralized and flexible nature:

“Cryptocurrencies will still exist, as they continue to serve other use cases. For instance, some cryptocurrencies can function as a store of value… as some segments of the public do not place their full faith in fiat currencies.”

Banks have mixed views regarding crypto. On the one hand, certain banks such as HSBC applied an anti-cryptocurrency policy (HSCBC started censoring certain transactions associated with the purchase and sale of digital tokens). On the other hand, banks like BNY Mellon announced services for cryptocurrencies traders and hodlers, adapting to the new times.

Morgan Stanley believes that the innovators will win out in the end. The report explains that current macroeconomic conditions have led to massive interest in cryptocurrencies:

“Investors’ interest in cryptocurrencies has risen alongside the unprecedented monetary and fiscal policy response to the pandemic”

Are CBDCs an Evolution of Money, Or Are They Just… Money?

Unlike ordinary banks, central banks see things through a different lens. While it is practically impossible to see cryptocurrencies replacing fiat in almost any country globally, governments are interested in using the underlying technology of cryptocurrencies to their advantage.

CBDCs are digital, centralized versions of a fiat currency. For example, some countries use blockchain technology, like France, which is studying issuing a currency on the Tezos blockchain. At the same time, other central banks did not adopt blockchain technology at all – such as China and its DCEP.

CBDCs promise to facilitate transactions, making them faster, cheaper and safer. The use of blockchain technology has the potential to almost completely eliminate the possibility of currency counterfeiting and makes some error-checking processes faster in case of payment problems.

But this approach has some disadvantages: Some experts argue that CBDCs grant too much power to central banking, which would already have real-time monitoring of its users’ money flows, being able to control and censor any transaction by controlling absolutely all means of value transmission.

And these disadvantages are the reason why Morgan Stanley believes that CBDCs will not be able to kill cryptocurrencies.