CBDCs: The Ultimate Corruption Of Money

This is an opinion editorial by Josef Tětek, a Bitcoin analyst at Trezor.

Imagine this: It’s payday but before the money reaches your account, someone else has already decided what you’ll spend your money on — one third of your paycheck on housing, one third on food (only plant and insect protein allowed), 10% on transportation (with little allowance for gas), 10% on a mandatory pension plan (mostly allocated to government bonds) and the remaining 14% on clothing, alcohol and pharmaceuticals in state-licensed shops. Spending outside of these allocations comes with huge markups and, as if this isn’t bad enough, saving is impossible as this money comes with an expiration date: after three months, it simply disappears from your account.

This dystopian world is closer than you think. Central bank digital currencies, or CBDCs, could make it a reality. CBDCs are an attempt to duct-tape the failing monetary system back together, and in the process provide the State with nearly unlimited control over the financial system, and thus our spending habits and the way we lead our lives.

In this article, I explain the motivation for governments pursuing the CBDC programs, why it is one of the greatest threats to our freedoms today and what steps you can take to limit its impact on you and your family.

All Fiat Fails

Fiat currency is the only form of money most of us have known throughout our lives. It may seem natural and inevitable but when we look a bit farther into history, we find out that it’s anything but that; in fact, fiat currency seems more like a dead end in the context of monetary history.

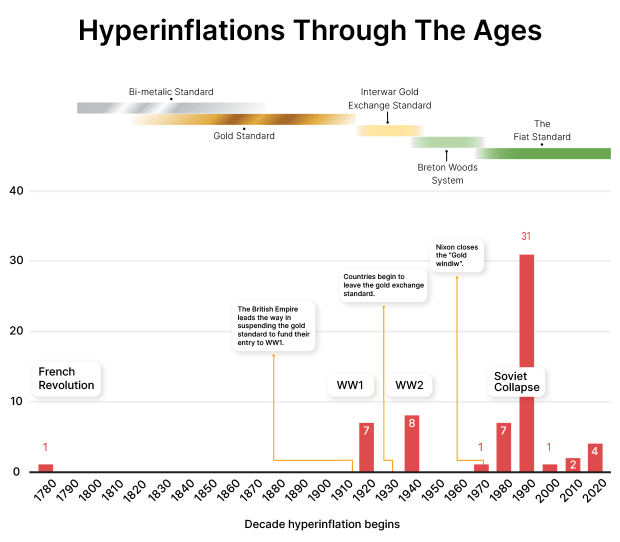

For thousands of years, mankind has converged to gold and silver as the dominant form of money. Only for the past 100 or so years have we diverged from this historic trend. And the results have been disastrous. As Joakim Book noted in his recent article on hyperinflations, 61 out of the 62 documented cases of hyperinflation happened in the past 100 years — in the era of fiat money, when the ties to precious metals were cut.

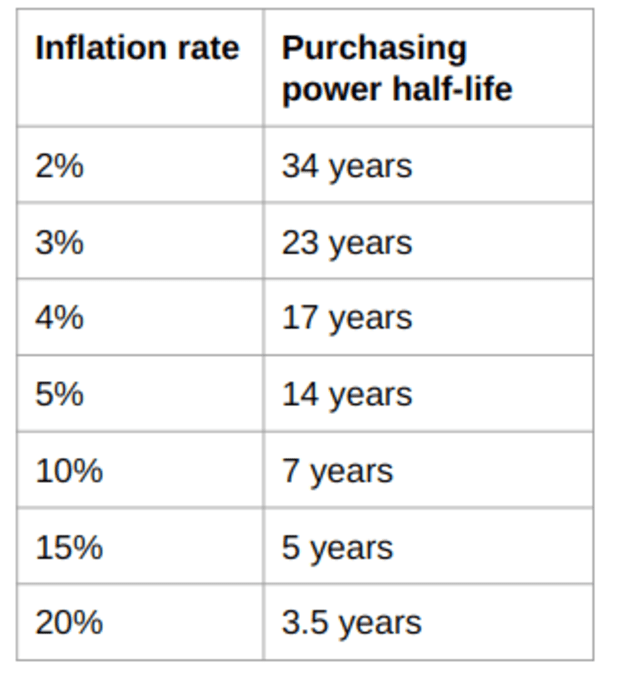

Even when a currency isn’t undergoing hyperinflation, people and economies still suffer. A “regular” inflation in single or double digits is sufficiently destructive through its cumulative effect. Per my own calculations, inflation of 2% — a common inflationary target that many central banks aim for — halves the purchasing power of the given currency in about 35 years, while the recent inflation rates around 10% manage to do so in seven years.

In short, fiat currencies either die quickly or evaporate slowly. In the end, they all fail.

Why CBDCs Now?

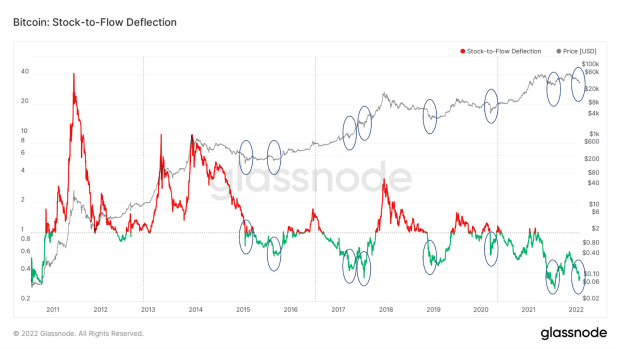

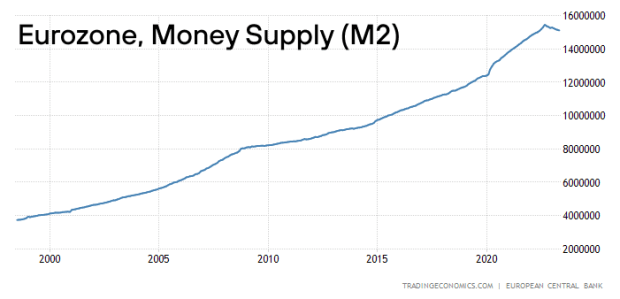

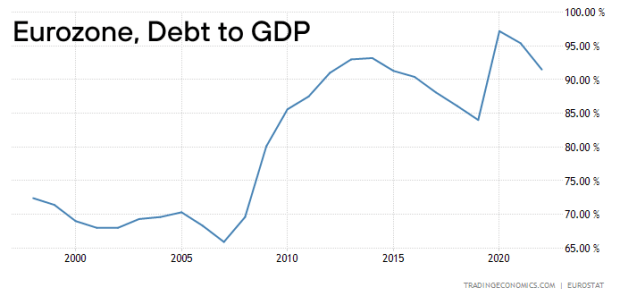

Some policy makers are aware of this intrinsic nature of fiat currencies, and try to duct-tape their monetary systems through a reform — instead of letting the currency die in a spectacular hyperinflationary episode, they euthanize it instead and replace it with another fiat currency. This is in essence what happened across Europe at the turn of the century, when the euro was rolled out: smaller currencies suffering from high inflation rates (such as the Italian lira, Greek drachma and Spanish peseta) were overhauled into a new fiat currency that, at least until recently, allowed the establishment to kick the can down the road via rampant money printing and ballooning debts, as demonstrated in the chart below.

The situation looks strikingly similar all around the world: money supplies inflating, purchasing power steadily declining, debt levels ballooning. The outcomes are the same, because the cause is the same: monetary systems based on currencies that can be printed at will are failing.

Some governments reform their currency in a very naive way, by simply removing a couple of zeros from the existing denominations and calling it a day. A typical example of such a reform was the 2016 overhaul of the Belarusian ruble, during which the government simply scratched off four zeros from the currency.

Using central bank digital currencies is a slightly more sophisticated attempt at reforming failing monetary systems, though they won’t change fiat currencies in any fundamental way. If anything, CBDCs are putting more power in the hands of governments and will likely lead to an even greater erosion of the purchasing power of ordinary citizens.

The Ultimate Corruption Of Money

One of the most efficient ways to enslave a society is to destroy a currency’s two main functions: its roles as a store of value and as a medium of exchange.

Fiat currencies already ceased working as a reliable store of value a long time ago, through an intentional policy of permanent inflation. Preventing citizens from saving independently and incentivizing society to go into ever-deeper debts leads to a greater dependence on the state and its policies. Fiat currencies lead to debt slavery, and CBDCs won’t reverse this trend.

CBDCs As A Store Of Value

To understand why CBDCs will likely lead to a much greater erosion of the store-of-value function of money, let’s look at how today’s financial systems operate. Let’s take the U.S. banking system as an example (most financial systems around the world are structured in pretty much the same way).

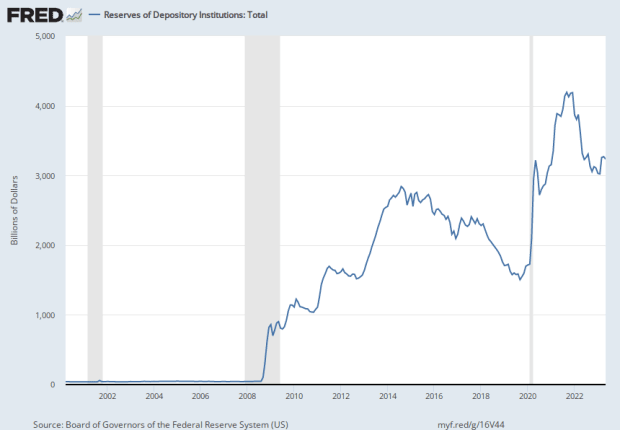

The Federal Reserve, the U.S. central banking system, regulates the financial system and executes monetary policies. During and after the 2008 financial crisis, the Fed implemented a very loose monetary policy with interest rates near zero to stimulate the economy. This is where we get to a second crucial element of the U.S. financial system, in the form of commercial banks. Banks were unwilling to lend out the new inflow of money and instead deposited trillions of dollars with the Fed, as we can see on the chart below. This, in part, limited the effectiveness of the central bank’s policies.

Now, if a CBDC was in place, it would be possible for the Fed to go around the commercial banks and deposit the newly-created money straight into the accounts of ordinary citizens, who would most likely spend it right away instead of saving it for a rainy day. Sounds great, right? Free money! But that’s precisely the problem: such money would be made out of thin air and would only contribute to an accelerated erosion of everyone’s purchasing power.

In terms of the store-of-value function of money, CBDCs would be worse than anything before, allowing the central bank to digitally “print” money at a pace previously unimaginable, depositing it straight into people’s accounts, and possibly even implementing an expiration date to the currency units.

CBDCs As A Medium Of Exchange

The freedom to transact is a prerequisite to pretty much all other freedoms. This might sound counter-intuitive, but keep in mind that money is used in half of all the economic transactions in a society — every single exchange of goods or services requires a handover of money. If money is under the full control of the State, then the State in turn gains control of almost everything that goes on in that society. Up until now, even the most totalitarian governments haven’t really had full control over all the transactions, as they haven’t found a way for the respective societies to function without cash. But CBDCs are meant as a full-fledged replacement of cash, and with the penetration of smartphones over 80% in developed countries, a fully-cashless society running solely on a State-managed CBDC is in sight.

Also, current payment systems, while offering some degree of control, are still quite decentralized. In the U.S. and EU, the national payment system is made up of dozens of commercial banks, payment providers, credit card companies and other services that comprise the payment ecosystem. Censoring payments in such environments is possible, but isn’t simple to execute and usually only happens when serious crime is suspected.

If CBDCs work as envisioned, a single entity — the central bank — would have full control over the national payment system, potentially allowing for simple interventions in terms of blocking the payments of anyone, realizing a totalitarian’s dream. It is precisely for these reasons that China has the most advanced CBDC program in the world; should that be an example for the Western world?

How Seriously Are Governments Pursuing CBDCs?

Per No Bullshit Bitcoin, 130 countries representing 98% of global GDP are currently pursuing a CBDC program. According to the Atlantic Council CBDC Tracker, which closely follows the progress of individual programs, 11 countries have already launched their respective digital currencies, 21 are in a pilot stage and the remainder are in various stages of research and development.

CBDC Progress In The U.S.

On its website, the Fed states that it is exploring the potential benefits and risks from all possible angles. On the same page, it says that “as a liability of the Federal Reserve, however, a CBDC would be the safest digital asset available to the general public, with no associated credit or liquidity risk,” failing to acknowledge that while a CBDC might be superficially “safe” from the counterparty risk, the risk related to an inflationary policy would stay at least the same as with today’s cash. That is a common theme across the central banks’ communications on the topic of CBDCs — the elephant in the room in the form of pervasive inflation remains unaddressed. Obviously, a CBDC would be a continuation of the inflationary monetary policy.

We can also observe a growing opposition to a CBDC rollout, with Ted Cruz (a U.S. senator representing Texas) introducing an anti-CBDC bill, while Florida and North Carolina have outright banned the use of a federal CBDC in their borders.

CBDC Progress In The EU

In the eurozone, the efforts to introduce a digital euro — the official term for Europe-wide CBDC — seem more serious and less opposed. All of the progress reports and other relevant documents can be found on the European Central Bank’s (ECB’s) website; an interesting one is a recent speech by Fabio Panetta (a member of the ECB board), in which he strongly rails against bitcoin and stablecoins and warns against public support for independent cryptocurrencies, advising the public sector to “instead focus its efforts on contributing to the development of reliable digital settlement assets, including through their work on central bank digital currencies.”

According to some of the latest information, the ECB will make a decision on whether to roll out the digital euro in October 2023.

CBDC Progress In The U.K. And The Public Survey On “Britcoin”

Trezor has recently conducted a survey among Britons to assess the level of awareness about the U.K.’s version of CBDC, colloquially called “britcoin.” The findings point out that the majority of the public is concerned about potentially-restricted access to their funds, imposed time conditions on the viability of the digital currency units and government control over which goods and services can be bought.

It’s unclear when a CBDC in the U.K. will be launched, but per the Bank of England’s website, the intention to do so is palpable. The British central bank also makes a veiled threat to bitcoin there, with its statement that “there are also new forms of money on the horizon. Some of these could pose risks to the UK’s financial stability.”

Mitigating CBDCs

If the above-described prospects for central bank digital currencies concern you, I’ve got some good news: There’s plenty you can do to mitigate the risks of CBDCs.

First of all, it’s good to stay informed about CBDCs and alert others to the threat of such monetary reform. Ignorance is the main asset of central banks and governments: if the public feels that CBDCs are just a cosmetic change to existing systems and are better left to expert officials, that’s a major victory for the establishment. You can inform your friends and family about the dangers of full-fledged statist control of our money in understandable terms; everybody should understand the problem with the state defining what you can and cannot spend your money on, and the insanity of setting an expiration date to a currency unit.

Second, use cash whenever possible. One of the popular arguments for CBDCs is that people are no longer using cash and it needs to be replaced by a digital currency managed — and surveilled — by the central bank. Prove them wrong by using cash at every occasion. Cash is awesome: cash transactions are fully private, instantly settled and have no processing fees for the merchant.

Third, use bitcoin. Right now, bitcoin is mostly used for preserving purchasing power (at the time of writing, bitcoin has appreciated by about 80% against the dollar since the beginning of the year), but if CBDCs are launched and cash is banned, bitcoin will likely become the only way to spend your money freely. Bitcoin is permissionless and fully usable without any intermediary, and will remain so even after CBDCs are rolled out. It’s also quite likely that CBDCs won’t be freely convertible into bitcoin, so getting some bitcoin now while fiat is still convertible might be a good idea. Just keep in mind that you only truly own bitcoin if you hold the private keys. A bitcoin balance on an exchange isn’t owning bitcoin. For the best security, store your bitcoin in an open-source hardware wallet with a proven track record.

Conclusion

Under a CBDC regime, the statist monetary policies would continue the current trends of devaluation and censorship, with a limited means of escape if the introduction of that CBDC is accompanied by a cash ban. While a black market for currency, similar to those that exist today in countries with strong currency controls, would likely emerge and alleviate the impacts, the better outcome would still be if CBDCs were strongly opposed by the general public and never launched. The only real way out of today’s monetary mess caused by decades of fiat policies is organic, bottom-up bitcoin adoption, as bitcoin has superior monetary characteristics to fiat and doesn’t need the state’s approval to function as proper money.

This is a guest post by Josef Tětek. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.