CBDCs Are Not That Stable And May Eventually Kill Bitcoin, Says Financial Expert

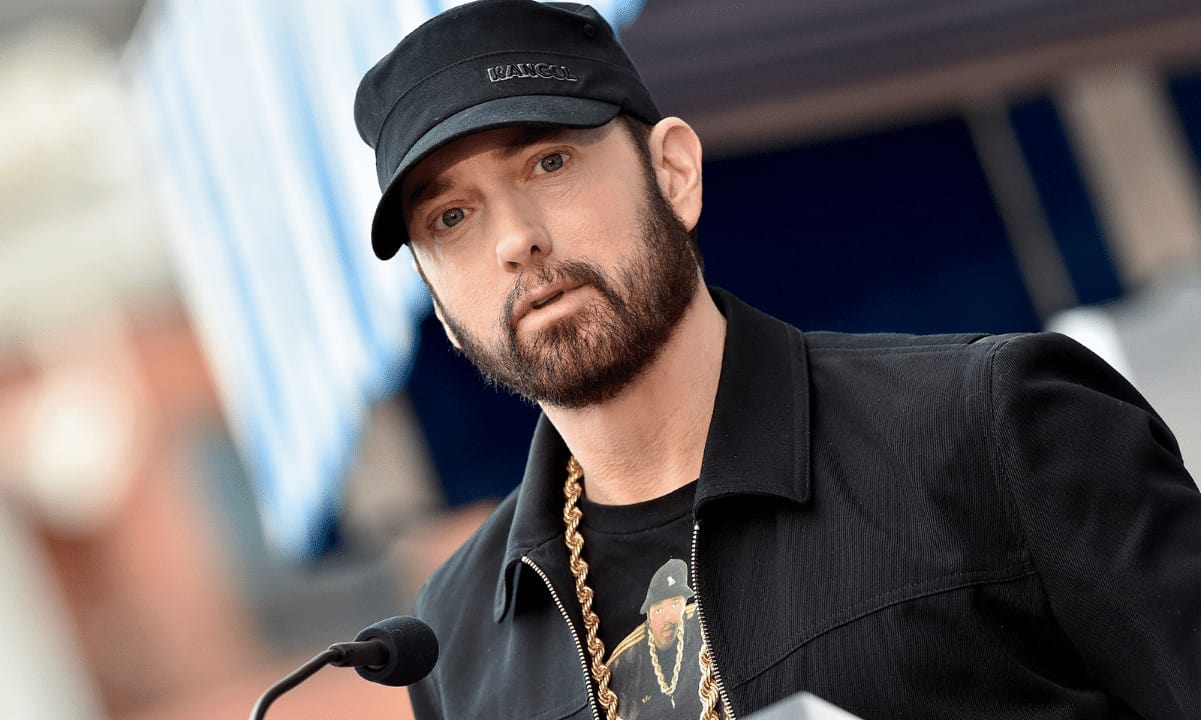

Edward Chancellor – a British journalist and financial historian, explained that the first central bank digital currencies are likely to raise inflation which can lead to the destruction of Bitcoin. He agreed that CBDCs are ”cool” but certainly not stable.

CBDCs Would Mean The End Of BTC

Nowadays, many central banks of numerous leading economies such as China, Japan, and the US, are researching the option of launching their own CBDC. In a recent interview for Reuters, Edward Chancellor opined that central bank digital currencies are highly risky projects.

He said that CBDCs might even kill Bitcoin. Chancellor explained that it is much easier to distribute and ”print” digital currencies rather than cash, and that will cause an utterly high level of inflation.

He then added that in order to solve the issue, the governments and central banks would have to fix the emission of their digital coins – which number would be much higher than 21 million bitcoins:

”When banks get it right with CBDCs this will kill Bitcoin.”

The historian analyzed that changes in the form of money are normal and have happened multiple times in the past. As an example, he pointed to the paper money which once replaced metal coins. Chancellor predicted that in the process of the financial revolution, digital currencies would invade the world, but he opined that Bitcoin would not be among one of them.

In conclusion, the journalist said that central bank digital currencies are ”cool” as a project but can not qualify as stable.

Deutsche Bank on CBDCs

Recently, the multinational investment banking giant – Deutsche bank – shared similar thoughts. The CIO of the German institution – Christian Nolting – predicted that CBDCs could damage Bitcoin’s role as a payment instrument. He also suggested that the primary cryptocurrency could serve as a store of value.

According to Nolting, the crypto industry is ”here to stay.” On the other hand, he warned that ”governments and more digitally-aware populations might ultimately prefer to go with CBDCs,” instead of relying on the decentralized nature of BTC. Furthermore, some potentially harming legislative frameworks developed by world regulators could reduce digital assets’ chances of serving as international payment instruments:

”A widespread introduction of CBDCs accompanied by higher regulation of cryptocurrencies could create a more challenging environment for crypto assets as some of their advantages compared to traditional financial assets would fade in the longer term.”