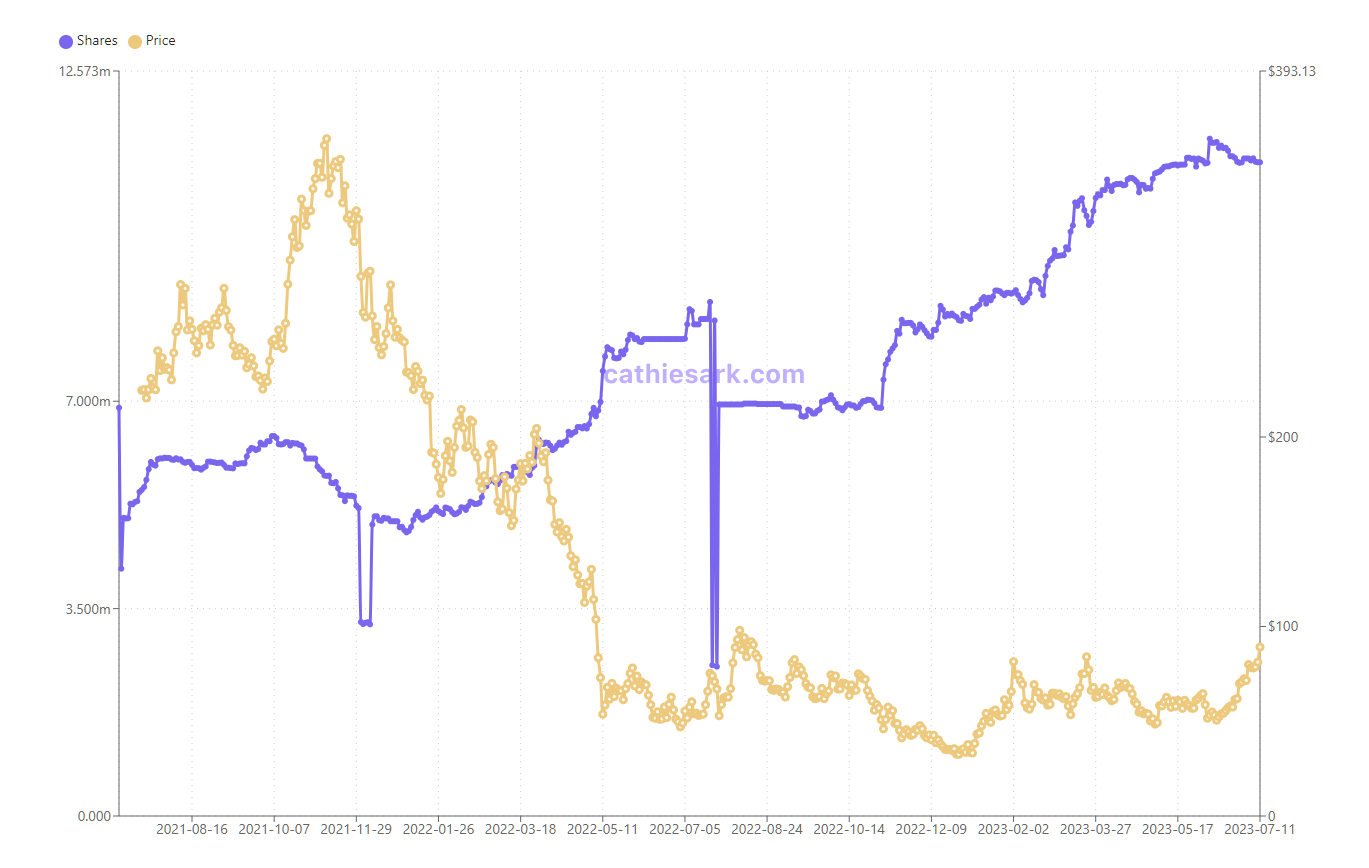

Cathie Wood’s ARK Sells $12M Coinbase Shares as COIN Nears Yearly High

Cathie Wood’s ARK Invest has sold $12 million worth of Coinbase’s (COIN) shares as the stock races to a near one-year high after the exchange announced a surveillance-sharing agreement with five spot bitcoin (BTC) exchange-traded fund (ETF) applicants.

As previously reported, Coinbase stock closed up 16% after the announcement on Thursday. Previously, the Securities and Exchange Commission (SEC) had inferred that comprehensive surveillance-sharing agreements were critical to getting spot bitcoin ETFs approved.

Across all of ARK’s funds, the tech-focused investment manager owns close to 11 million shares of Coinbase, making it one of the largest holders of the stock. Overall the Coinbase holding represents 6.2% of the total fund weightage for ARK.

The estimated cost average for COIN across the various funds are, $239.60 for the Ark Fintech Innovation ETF (ARKF), $254.65 for Ark’s ARK Innovation ETF (ARKK), and $242 for ARK Next Generation Internet ETF (ARKW), according to market data.

COIN closed nearly 10% higher at $89.15 on Tuesday and the stock is up 72% since the SEC sued the exchange on June 6.

Edited by Parikshit Mishra.