Cardano’s $35 Billion Market Cap Is Not Justified, Says Ethereum Proponent

Cardano (ADA) is once again in the spotlight as its price fails to follow the current downtrend in the cryptocurrency market. In fact, ADA is currently up on almost all time frames, and it has managed to once again claim the third spot in terms of market capitalization.

However, Anthony Sassano, one of Ethereum’s well-known proponents and investors, is of the opinion that it doesn’t have the fundamentals to be valued at 25% of Ethereum’s total capitalization.

Cardano (ADA) Bulls Don’t Stop

As CryptoPotato reported, this week has been somewhat tough in the cryptocurrency market. Bitcoin, as well as the majority of coins, are in the red, and this includes Ethereum. ETH is down more than 20% over the past seven days.

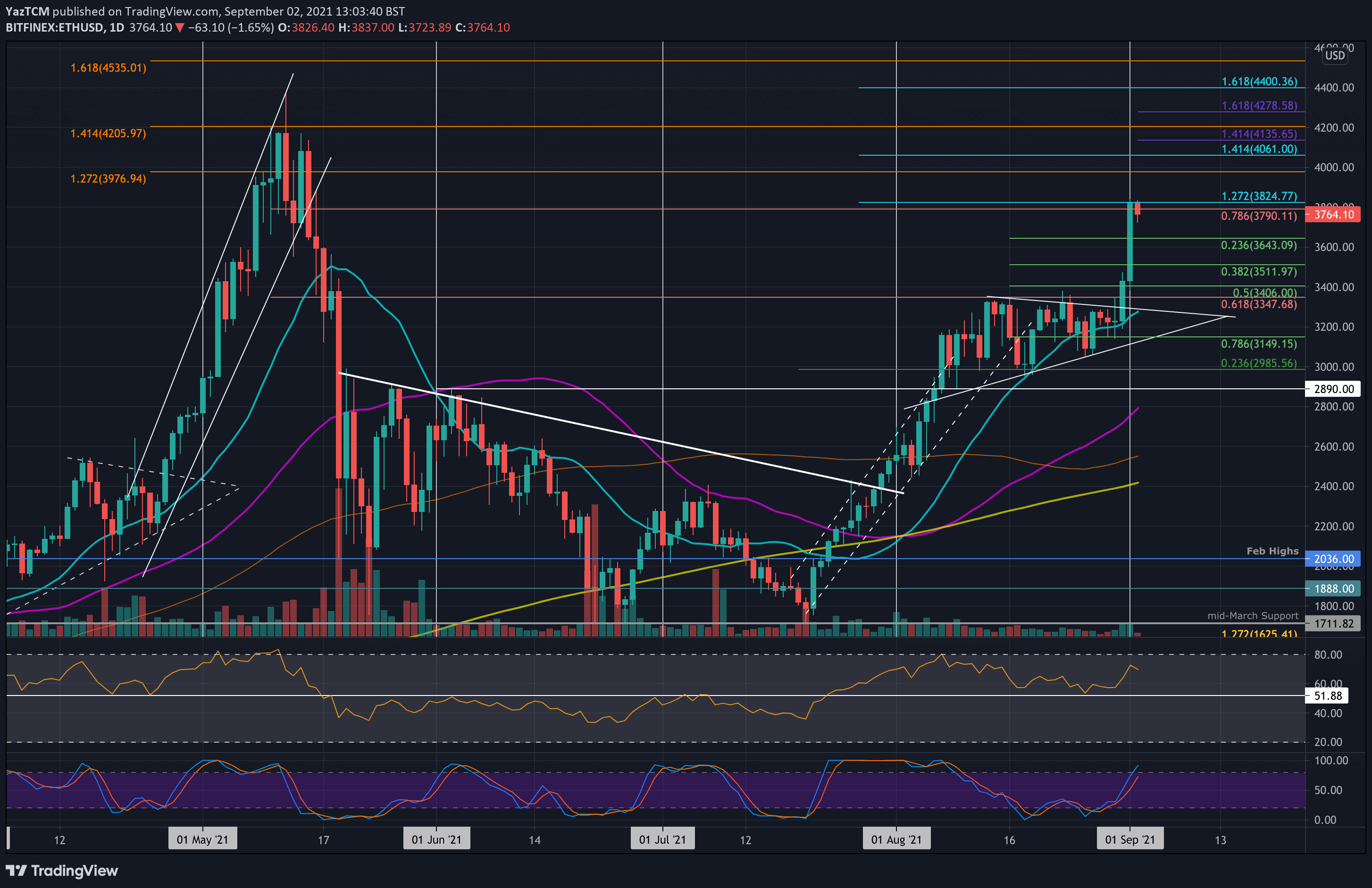

Cardano, on the other hand, shows no signs of slowing down. At the time of this writing, the cryptocurrency is in the green on every time frame, according to data from CoinGecko, for a total weekly increase of almost 30%.

As seen in the above chart, ADA has managed to recover from the recent correction in a brilliant manner and is already trading above the level from which it broke down.

This has made it the third-largest cryptocurrency by means of total market capitalization, as ADA’s share is now valued at $35 billion. This means that its market cap is currently worth around 21% relative to that of Ethereum.

Ethereum Proponent Says ADA’s Valuation Isn’t Justified

While ADA bulls rejoice, some fail to see the merits in the current market structure and valuation. According to Anthony Sassano, this is a clear example of why the cryptocurrency market runs on narratives more so than it does on fundamentals.

The fact that Cardano, a platform that doesn’t have smart contracts, is worth $35 bil based purely on narrative & promises is the perfect example of why crypto runs on 99% narratives, 1% fundamentals.

Even worse, the market is saying that Cardano is worth 25% of Ethereum…

Many in the comments are of the consensus that retail investors are what drive the price of ADA up. There could be some merit to this, especially given the most recent developments.

Just a few days ago, Gene Simmons, the legendary bassist of the band KISS, revealed that he had purchased $300,000 of the cryptocurrency on the grounds that “cryptocurrencies like Bitcoin […] are beyond the reach of most people. […] I like ADA because anyone can invest.”