Cardano Will Soon Have Its First Stablecoin

Software development company COTI announced a few hours ago the issuance of the first stablecoin designed to run on Cardano.

The news was first revealed by Charles Hoskinson, leader of Cardano, and Shahaf Bar-Geffen, CEO of COTI Group, at the Cardano Summit stage in Laramie, Wyoming.

The Djed stablecoin will be issued on Cardano and will promote the growth of its nascent ecosystem, especially now that the blockchain is beginning to support smart contracts and markets have strong expectations about the possible development of DeFi platforms on a blockchain that has been touted as the future Ethereum Killer.

What is Djed and Why Does Cardano Needs a Stablecoin?

A stablecoin is a cryptocurrency designed to maintain a stable value with respect to a reference. The best-known stablecoins are cryptocurrencies like USDT or Stasis, which are pegged to fiat currencies such as the dollar or the Euro. However, there are cryptocurrencies whose value is pegged 1:1 to other commodities such as gold (like Digix) or even to other cryptocurrencies or baskets of cryptocurrencies.

There are several methods to achieve this relationship, ones more effective than others. The most popular is the holding or blocking of an amount of the reference asset that supports the issuance of a proportional amount of the correspondent stablecoin: For example, the market capitalization of USDC is $3,677,063,935 because there are 3,677,063,935 USDC tokens in circulation and Circle holds $3,677,063,935 in collateral.

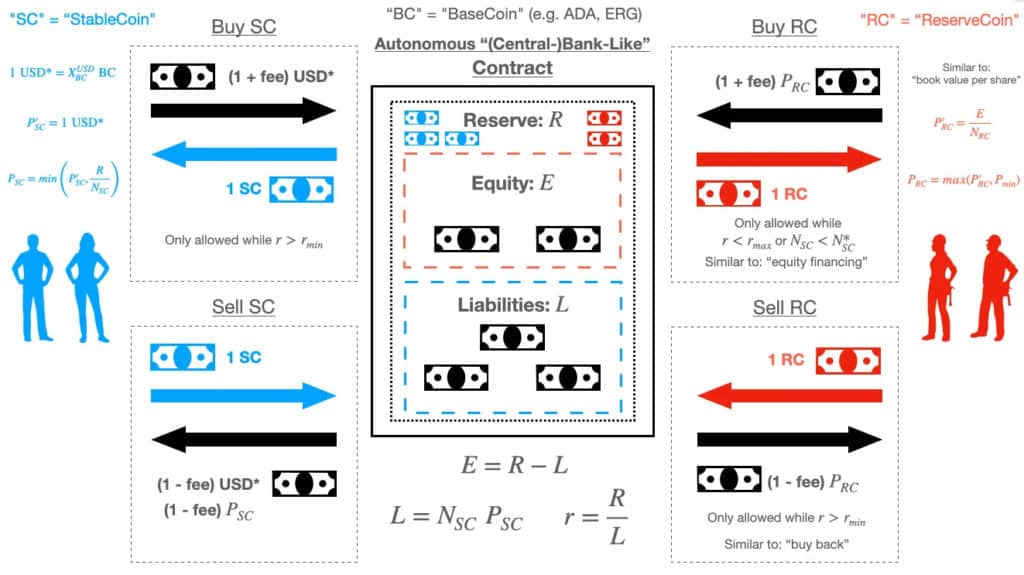

In the case of Djed, the value is kept stable by an algorithmic design, which leverages smart contract design on the Cardano blockchain to maintain a price as close as possible to $1. To achieve this, Djed maintains a reserve of base coins while mining and burning other stable assets and reserve coins to counter fluctuations.

According to its whitepaper, there will be two versions of Djed: a minimal one, designed primarily to serve as a medium of exchange, and an extended one whose smart contract uses a continuous pricing model and dynamic fees to react faster to external events, ensure an optimal level of reserves and provide even more security when performing complex operations such as those performed in DeFi protocol transactions.

A Promising Development

Shahaf Bar-Geffen, chief executive of COTI Group, said at the conference that the use of a stablecoin such as Djed will allow users to maintain greater control over their transactions, thanks to its stable value and low fees.

Blockchain participants are using stablecoins to engage in everyday transactions because they allow monetary value to be exchanged in a seamless manner, regardless of the sender and recipient’s location. I believe that adding the Djed stablecoin to the Cardano blockchain will significantly improve how transactions are settled on the platform.

For his part, Charles Hoskinson was enthusiastic about this new project as it would be one of the most ambitious implementations aimed at strengthening the Cardano ecosystem.

The Djed stablecoin could be a game-changer in the crypto space, appealing to an entirely new audience at a time when the industry is already experiencing astronomical growth. COTI has been a long-time partner of the Cardano ecosystem. It’s great to have them on board with this new venture.

This seems to be a major move for COTI. When its partnership with Cardano was first announced, COTI’s token spiked 50%, hitting an all-time high (ATH) of $0.60 in a couple of hours.