Cardano-Based DEX MuesliSwap to Open Refund Site ‘Soon’ as Some Users Voice Concerns

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

MuesliSwap, a Cardano-based decentralized exchange (DEX), would soon open its claims window to refund high slippage losses said to have been incurred over a 12-month period, the team told CoinDesk in an X message on Thursday.

Concerns around the refunds resurfaced last week as some members, such as @beaumont_dvd, said they were waiting for the self-claim refund site to open more than three months after MuesliSwap’s initial statements.

However, refunds for losses have been available and processed via opening a support ticket on the forum platform Discord MuesliSwap told @beaumont_dvd in a message viewed by CoinDesk. These would be processed by providing personal wallet details directly to the platform.

In contrast, the self-claim site would allow anyone to automatically connect to the Cardano network and receive the purported amount of Cardano’s ADA tokens said to be lost in the form of high fees.

The DEX is among the most-used platforms on the Cardano blockchain. It locks over $13 million in various tokens as of Thursday, data shows.

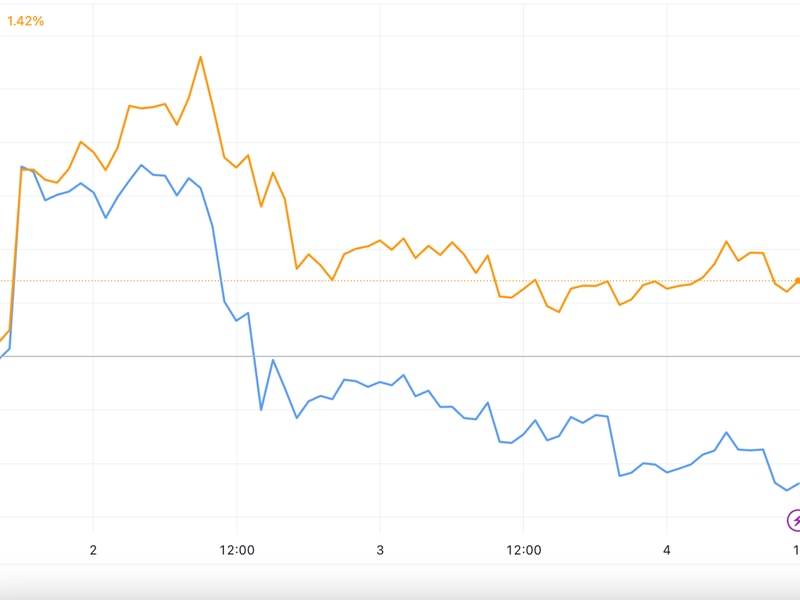

Scores of users in August reported they had been paying high fees in the form of slippage over a 12-month period, prompting an online backlash at the time.

MuesliSwap developers said then that the users lost money due to a “misunderstanding” about how slippage on the platform worked.

Market makers — or trading participants who fill buy and sell orders — were able to “fill the limit order and choose whether to return the additional slippage amount or retain the difference at their discretion, the team said at the time.

In trading, slippage refers to a market participant receiving a different trade execution price than intended due to factors such as available liquidity. On DEXs, users can manually set a slippage level they are comfortable with.

Edited by Parikshit Mishra.