Can El Salvador Duplicate Singapore’s Road To Success?

Few stories in global development are as compelling as that of Singapore, a small city-state that moved “From Third World to First” within just a few decades. The strategic vision of its founding father, Lee Kuan Yew, combined with the country’s commitment to a robust business environment, education, and stringent anti-corruption measures, all contributed to this remarkable transition.

El Salvador, a country currently grappling with significant political and economic changes, is arguably on a parallel course. Its recent political developments, particularly the adoption of Bitcoin as legal tender under President Nayib Bukele, is a daring move that could either be a game-changer or an uncalculated risk. This article presents a comparative analysis of the political transitions in Singapore and El Salvador, with a particular focus on Bitcoin’s potential implications for El Salvador.

When Singapore gained independence in 1965, it faced significant challenges, including a lack of natural resources, racial tensions, and little capital. The People’s Action Party, under the leadership of Lee Kuan Yew, was instrumental in shaping Singapore’s developmental trajectory. Through pragmatic economic policies, stringent anti-corruption measures, and a relentless focus on public education, the small city-state transformed into a global economic powerhouse.

An export-oriented industrialization policy was the backbone of Singapore’s strategy. It attracted multinationals, positioning the country as a significant node in the global trade network. The Economic Development Board (EDB) was established to attract and facilitate foreign investment, thereby boosting industrialization and providing employment opportunities.

Singapore adopted a zero-tolerance policy towards corruption, fostering a transparent, predictable, and efficient business environment. Simultaneously, it built a robust education system geared towards equipping its citizens with the necessary skills to thrive in a knowledge-based economy.

El Salvador’s political landscape saw a significant shift with the election of Nayib Bukele in 2019. Known for his charismatic leadership and bold policies, Bukele aims to disrupt the status quo, primarily through technological innovation and attempts to root out corruption.

One of the most revolutionary developments under Bukele’s administration is the adoption of Bitcoin as legal tender, making El Salvador the first country to do so. The decision is hailed as an innovative move to attract foreign investment, bolster economic growth, and promote financial inclusion among the country’s unbanked population.

In a country where over 70% of the population doesn’t have access to traditional banking services, Bitcoin could potentially unlock economic opportunities. By enabling easier remittances, which form a significant part of the country’s GDP, Bitcoin could help streamline the transfer of money from abroad and reduce costs associated with these transactions.

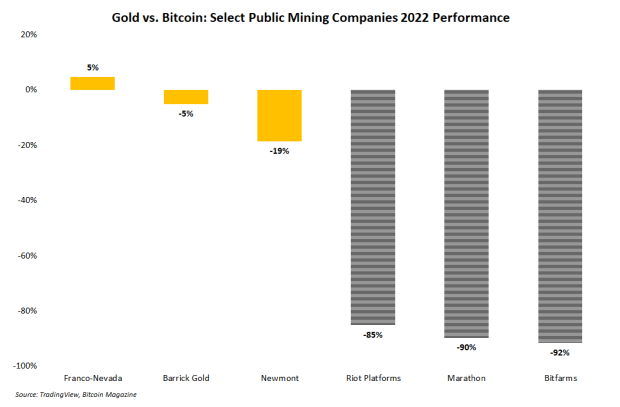

However, adopting Bitcoin is not without its risks. Fluctuations in Bitcoin’s value can lead to financial instability, and critics argue that the move could further exacerbate economic inequality if the adoption primarily benefits the technologically literate and leaves behind those without access, or understanding of digital currencies.

The political trajectories of Singapore and El Salvador bear some similarities, particularly the leaders’ focus on economic growth, anti-corruption, and openness to unconventional policies. However, the contexts and challenges they face are distinct. Singapore had the advantage of a relatively peaceful social and political climate, which played a crucial role in its transformation. On the other hand, El Salvador grapples with high crime rates and political instability, making its development trajectory more complex.

Singapore’s experience demonstrates the importance of creating a business-friendly environment, having a strong, corruption-free administration, and investing heavily in education. Adopting these strategies could benefit El Salvador, particularly in facilitating the adoption and benefits of Bitcoin.

The decision to make Bitcoin legal tender is a bold move that echoes Singapore’s openness to risk-taking for economic advancement. However, to fully reap the potential benefits of Bitcoin, El Salvador will need to ensure widespread access to technology, digital literacy, and regulatory transparency.

While the political and socio-economic contexts of Singapore and El Salvador differ, Singapore’s success story offers valuable lessons. Anti-corruption measures, an open and regulated business environment, and investment in human capital are critical building blocks for any country aspiring to transition from third-world to first.

El Salvador’s Bitcoin experiment is a high-stakes bet that could potentially pay off in significant economic growth and increased financial inclusion. However, it also needs to navigate the risks associated with cryptocurrency, ensuring that it doesn’t exacerbate inequality or financial instability. As the world watches this intriguing experiment unfold, El Salvador’s journey serves as a reminder that the path from third world to first is often uncharted and requires boldness, innovation, and an unwavering commitment to equitable development.