Can BTC Hold Above $60K With $1.3B Bitcoin Options Set to Expire?

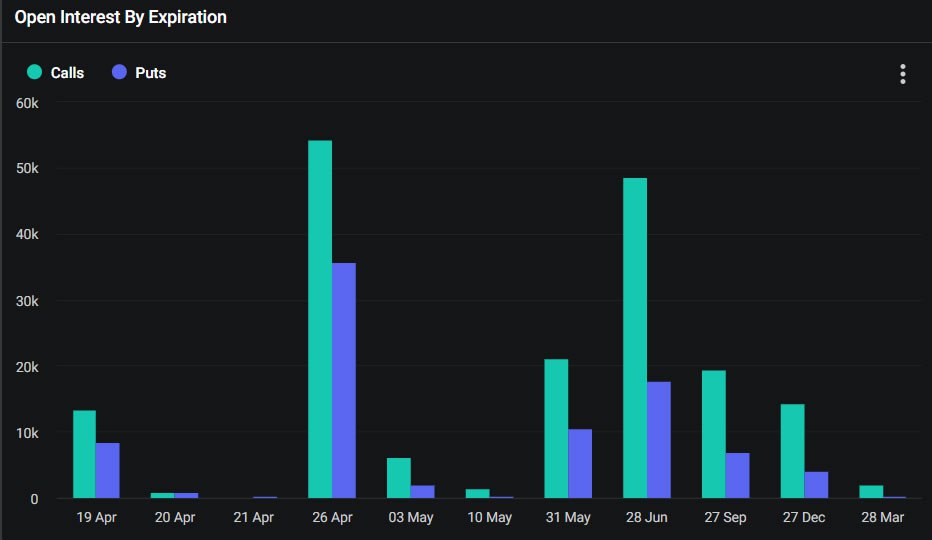

There are approximately 21,800 Bitcoin options contracts due to expire on Friday, April 19.

These derivatives have a notional value of around $1.33 billion, which is marginally lower than last week’s expiry event.

Moreover, crypto markets have been tanking hard all week, with Bitcoin poised to lose its psychological price level of $60,000.

Bitcoin Options Expiry

Today’s expiring batch of BTC contracts has a put/call ratio of 0.63, which means there are almost twice as many call (long) contracts expiring as puts (shorts).

The bulls still appear to be dominating derivatives markets with the most open interest at the $80,000 strike price, according to Deribit. There is $881 million worth of long contracts at this level with more than $700 million in OI at both $70,000 and $75,000 strike prices.

Just $453 million in OI is at $60,000, which is closer to the maximum pain point and current spot prices.

Crypto derivatives tooling provider Greeks Live commented that despite the “extreme panic spreading in the market” this week, with BTC losing $60,000 and ETH losing $3,000, major term options implied volatility is falling significantly.

Implied volatility (IV) refers to future measures of market volatility derived from expiring derivatives contracts.

It added, “With Bitcoin’s long strength still intact and halving just this Saturday, the bulls still need Bitcoin to lead this month.”

In addition to today’s Bitcoin options expiry, 297,000 Ethereum options contracts will also expire. These have a notional value of $960 million and a put/call ratio of 0.42 as longs vastly outnumber shorts.

Greeks Live said that “the long side of Ethereum is more fragile and has limited ability to lead the market.”

Crypto Market Outlook

Total capitalization has remained flat on the day at $2.37 trillion but markets have started to turn south again during the Friday morning Asian trading session.

Bitcoin, which is still correcting, dipped sharply to $60,000, where it found support again and bounced back to $62,000 within an hour.

Ethereum has had a worse time, dumping to $2,876 before recovery but it had not reclaimed the psychological $3,000 level at the time of writing and was trading at $2,989.

The altcoins were predominantly in the red by various degrees aside from Toncoin (TON), which had gained 9% on the day.

The post Can BTC Hold Above $60K With $1.3B Bitcoin Options Set to Expire? appeared first on CryptoPotato.