Can Bank-Backed Exchanges Solve Crypto Trading’s Trust Problem?

This post is part of Consensus Magazine’s Trading Week, sponsored by CME. Dr. Bo Bai is the executive chairman and co-founder of MetaComp and the MetaVerse Green Exchange.

Last week, a jury of 12 found former FTX CEO Sam Bankman-Fried guilty on all seven fraud-related charges, bringing to a close months of industry navel-gazing. Following 2022’s slew of collapses and scandals, all owing to poor risk management, governance and oversight, the very fabric of the crypto industry has changed, leaving many to contemplate its future as a new cast of characters comes to the fore.

New, but also not so new: the very financial institutions that crypto initially sought to distance itself from now occupy the headlines. Financial giant Franklin Templeton fueled the flames for the tokenized real-world assets when it launched a tokenized money-market fund earlier this year while others, including Deutsche Bank and HSBC have signaled intent or have launched blockchain-based financial products in the market.

The rules of engagement are changing. “Institutional-grade” is the new norm. Investors are now more interested in tokenized equivalents of existing products than the previous allure of mechanisms such as yield farming, staking and more. Decentralized finance (DeFi), frankly, seems all but passé. So for those of us in the trading space, what does that actually mean?

Redefining institutional-grade

Previously, the concept of institutional-grade was a matter of product, rather than infrastructure — be it spot or margin trading capabilities, or even new contract types not previously seen for digital assets such as perpetual futures. After last year, it’s come to stand for something a little more pragmatic: safety.

In a post-FTX climate, the tides turned. Whether institutional or retail, it is now less about returns, guaranteed or otherwise, and more about whether an entity can be trusted. This is somewhat counterintuitive in an industry underpinned by blockchain, a technology that upholds trustlessness as a core tenet.

For bank-backed exchanges, trust is what draws in clients — trust in the brand, but also the existing regulatory and compliance frameworks associated with the exchange to their affiliations with financial institutions. This is, in reality, the only legitimate difference from other centralized exchanges operating with the same licenses on the same turf.

In countries where there is a clear regulatory regime in place for digital asset trading — such as the United Kingdom or Singapore — the virtue of being bank-backed is but another foot in the compliance door.

This is especially apparent with regard to custody. The intensifying debate about the segregation of customer and corporate funds among exchanges hit a fever pitch this year, leading to increased scrutiny, especially among institutional clients assessing the safest trading venues. In fact, 90% of surveyed institutional investors trust TradFi firms more to keep custody of their digital assets. More often than not, these custody solutions are already fundamentally separate by design from their brokerage counterparts.

Standard Chartered Bank, for example, launched Zodia Custody, an institution-focused digital asset custodian, backed by SBI and Northern Trust. Its sister company, an institutional digital asset trading and brokerage venue, Zodia Markets, is a fully independent company with a different shareholding structure.

Within a robust regulatory regime, there are pathways to offering safe and trusted digital asset trading services via banks

Distinguished by its non-custodial trading capabilities, institutional customers choose from a network of trusted custodians where to hold their assets.

Knowing your customer

While bank-backed exchanges are meeting evolving demands and expectations of new customer segments in crypto, the reality is that they serve the needs of a limited few. From a variety of perspectives, they are not offering anything new in terms of products or accessibility.

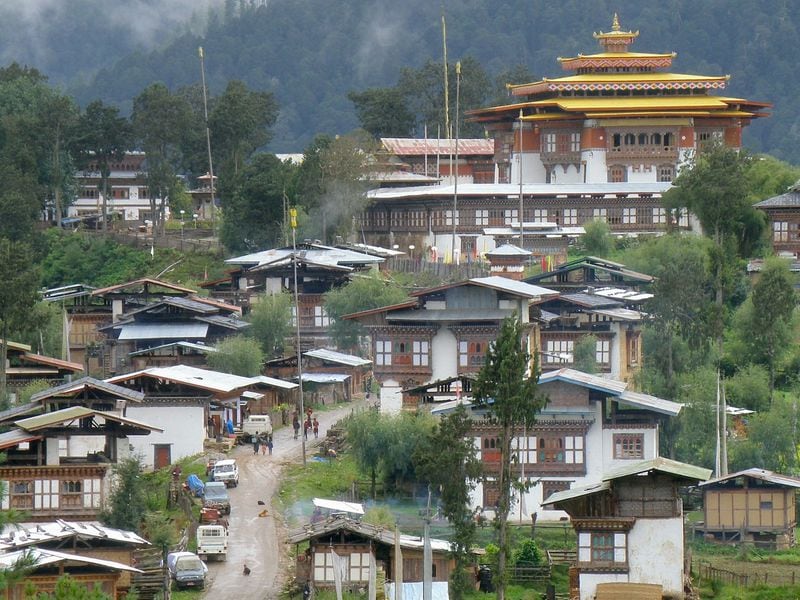

Southeast Asia’s largest bank DBS, is among the few financial institutions that have launched their own digital asset exchanges. However, it operates solely on a member-based structure, with participation limited to financial institutions, corporate accredited investors and professional market makers.

Individual investors can only trade on DBS’s exchange via a member entity, such as the bank’s private banking unit. Restrictions aside, its popularity has grown. Earlier this year, its BTC trading volumes were up by 80%, according to a bank statement.

Naturally, what has made DBS’ model so successful is the unique paradigm under which it operates, in a city-state that has long favored private-public sector dialogue. Within a robust regulatory regime, there are pathways to offering safe and trusted digital asset trading services via banks.

Leveraging limitations

Earlier this summer, EDX Markets made waves when it launched in the United States, making it the closest thing to a bank-backed exchange state-side. Backed by financial heavyweights such as Charles Schwab, Citadel Securities and Fidelity Digital Assets, it looked to bridge the gap between financial institutions and digital asset natives.

Despite the mounting regulatory scrutiny from the U.S. Securities and Exchange Commission for the past year, the emergence of EDX Markets served as a bright spot amid all the enforcement actions that have taken place in the past year.

But until the dynamic shifts such that these bank-backed venues are in a position to accept retail players, my hunch is that the market will stay as is. These developments are less about operational choices and more to do with overcoming regulatory roadblocks.

Now, more than ever before, safety and trust are integral to crypto. However, purely leaning on the reputation of the traditional banking industry shouldn’t be the only solution. Blockchain is inherently the right technology to build a financial system that is less reliant on the morality and management of individuals, and we’re slowly seeing its benefits reemerge as the dust settles after a tumultuous year of industry scrutiny.

Exchanges built for crypto-native investors still have the edge over the latecomers. And if we’re all after a similar slice of the pie, the banks will need to get in line.

CoinDesk does not share the editorial content or opinions contained within the package before publication and the sponsor does not sign off on or inherently endorse any individual opinions.”