California Society of CPAs Pushes for Accounting Clarity for Cryptocurrencies

The California Society of Certified Public Accountants (CalCPA) is pushing for accounting clarity and disclosure rules regarding bitcoin and other cryptocurrencies.

The lack of specific rules in the U.S. Generally Accepted Accounting Principles (GAAP) led to confusion and demands for clarity among the CalCPA group. The 54 member community is mainly concerned about the different reporting methods used because companies who itemize cryptocurrencies on their financial statements have varying ways in which they view digital assets.

Alternate Tax Solutions co-founder Andrew Parrish said that on balance sheets, cryptocurrencies can be reported as anything from an investment to commodity. Some even view them as working capital, which further complicates the situation and increases confusion.

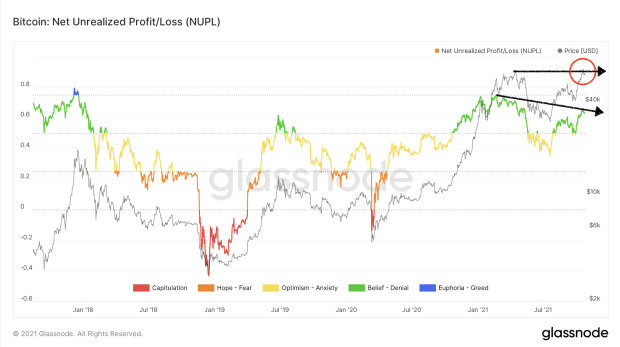

Parrish said that a balance sheet is a snapshot; every asset carries the risk of changing in price tomorrow and banks also have the potential to go bankrupt.

CalCPA concerns include whether varying approaches reflect the nature and risk of holding cryptos. Cryptocurrencies can be recorded at “lower of cost or market” at fair value or as intangible assets, depending on the circumstances.

Parrish said that GAAP policies accurately reflect the risks associated with holding cryptocurrencies. CalCPA believes that added rules would address currencies that have an active market and are held by an entity as a medium of exchange or investment.

Where an asset is accounted for determines the value, liabilities and equity, as well as whether it is subject to impairment costs and whether it will affect income statements and cash-flow statements.

According to the Financial Accounting Standards Board (FASB), many financial institutions interpret digital assets as indefinitely lived tangible assets under ASC 350 or as intangible goodwill, among other interpretations.

The FASB said it currently has no intention of providing guidelines because it expects cryptocurrency to be gone within five years.

In a letter to the FASB, chair of CalCPA’s accounting principles Nancy Rix said, “We believe the usage of cryptocurrencies will not diminish over time and will continue to expand in both volume and new fields of application.”

The post California Society of CPAs Pushes for Accounting Clarity for Cryptocurrencies appeared first on Bitcoin Magazine.