California Assembly Considers Exempting Some Digital Assets From State Securities Law

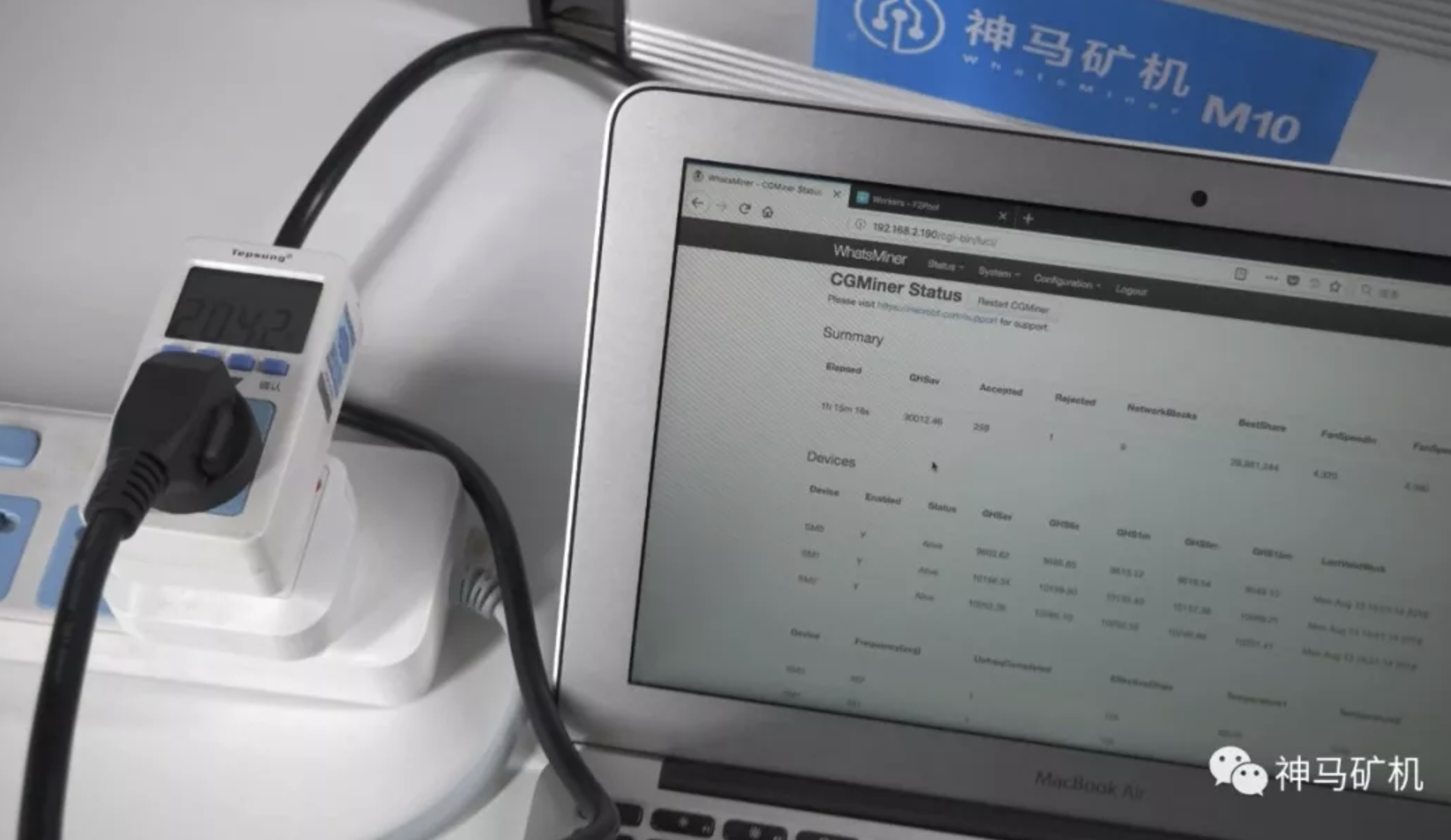

Majority Leader Ian Calderon has proposed a framework for determining whether digital assets are investment contracts, and therefore securities. (Credit: Lerna Shirinian)

California Assembly Considers Exempting Some Digital Assets From State Securities Law

A key lawmaker in the California Assembly has proposed exempting a narrow set of digital assets from the state’s definition of corporate securities.

The proposal, introduced Tuesday as an amendment to legislation first submitted by Majority Leader Ian Calderon (D-57), would free “digital assets” that are “presumptively not an investment contract” from the definition of security and all the regulatory baggage that label carries.

Exactly how to separate digital assets from securities law has been a resoundingly inconclusive debate in the U.S., where officials define the vast ecosystem of crypto products in different, sometimes contradictory ways from one agency to the next. Those differences have led to multiple court battles over the applicability of the “Howey test” to digital assets.

Calderon’s legislation tries to end that debate, according to Michael Magee, a legislative aide.

“It addresses one of the most common instances of ambiguity with cryptocurrency and the law: how to determine if a digital asset is an investment contract, and therefore subject to securities laws,” Magee said to CoinDesk in an email.

If passed, Calderon’s legislation set what appears to be a clear framework for determining whether digital assets are investment contracts – at least on the state level.

The asset must not be acquired in exchange for payment, fiat or otherwise; it must be used on a “fully operational network” for a “consumptive purpose;” and its value “does not rely on the managerial effort of others” (a key feature of the Howey test).

Within that last point, the legislation points to decentralized consensus as evidence of whether a digital asset is independent from an “identifiable person, project team, or management entity” that would otherwise contribute “managerial efforts.” Network-led software changes and proof-of stake voting rights must be present.

Disclosure Read More

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.