Bybit Beginner’s Guide & Exchange Review

What is Bybit exchange? Please welcome the newest hit of the cryptocurrency derivatives margin trading platforms, which was established in March 2018. It’s headquartered in Singapore and has offices in Hong Kong and Taiwan.

Quick Navigation:

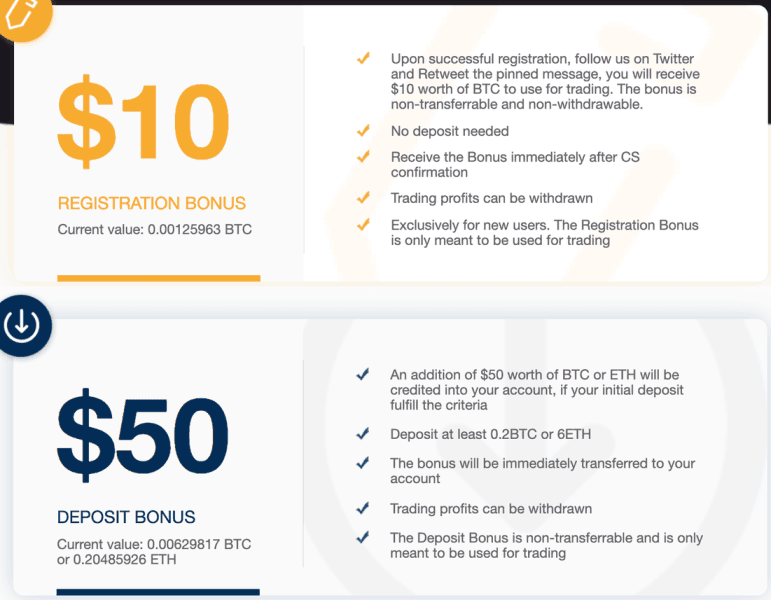

- Bybit welcome $10 and $60 bonus for new users

- How to register on Bybit

- How to deposit and withdraw on Bybit

- How to trade on Bybit

- Bybit margin trading – how to set leverage

- Isolated margin and auto margin replenishment

- What are Bybit trading Fees?

- Security: Is Bybit Safe?

- Bybit Support

- Bybit regulation status and KYC

According to Bybit, the exchange hosts traders from all over the world, including North America, Europe, Japan, Russia, South Korea, and Southeast Asia.

The exchange prides itself on delivering multilingual online support to its customers and is committed to delivering a transparent and efficient trading experience.

At the time of this writing, the products on the platform include BTC/USD, ETH/USD, EOS/USD, and XRP/USD perpetual contracts. A perpetual contract resembles a traditional futures contract in many ways. Its main difference, however, is that it doesn’t have an expiry date. Hence, traders are allowed to hold their positions for as long as they need to.

Another thing that needs to be noted is that the exchange boasts a 100,000 TPS state of the art matching engine. While a lot of its competitors have suffered from repeated overload problems, this high-performance matching engine makes it possible for Bybit to stand above the competition.

In addition, in order to provide a better trading experience, the exchange is planning to integrate TradingView.

How to Register on Bybit

Before you start trading on Bybit, you’ll need to sign up for an account. Fortunately, doing so is very simple. As you enter the platform’s website, you will notice a “Register” button on the top navigation bar. As soon as you click it, you’ll see this form.

Once you enter an email address and password, you will receive a confirmation code. Once you put that in, you’re good to go.

Security first: At this early stage, it’s very important to make sure that you properly secure your account. Therefore, once you get registered, you should go into your account settings and click the “Account & Security” tab. There, you can set up email authentication, SMS authentication, as well as Google authentication (2FA).

Bybit has done a good job of simplifying the user experience, as the top navigation bar contains everything you’ll need to utilize your account, including trading as well as monitoring your assets and current market prices.

Moreover, upon successful registration, users can take advantage of a free $10 worth of BTC to begin their trading adventures on the platform.

How to deposit and Withdraw on Bybit

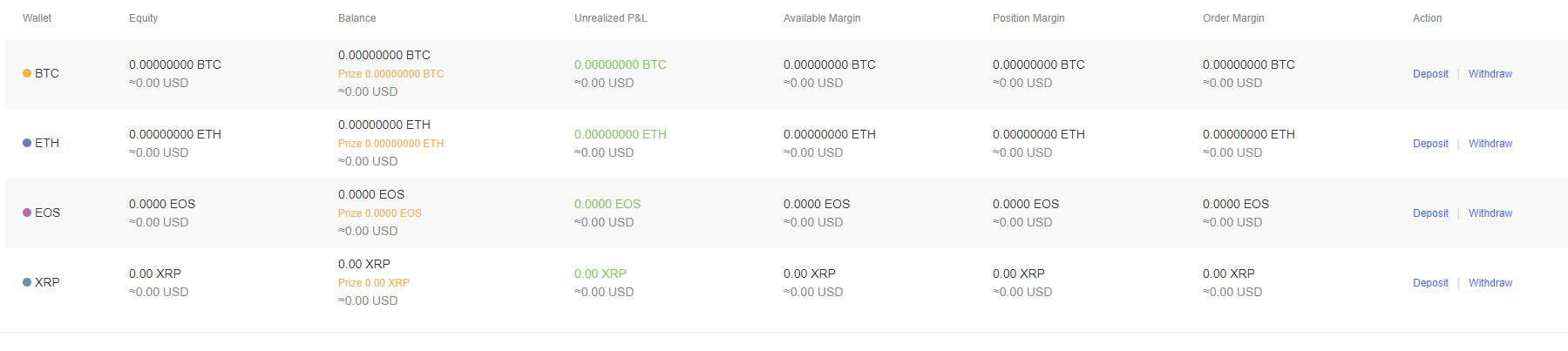

Naturally, in order to trade on Bybit, you’ll first have to deposit funds. Select the “Assets” tab on the top navigation bar and you will see all of the available perpetual contracts listed neatly. Bybit is a crypto-based platform; hence you can only deposit cryptocurrencies.

Here you can also track all the important metrics for measuring the performance of your positions, including Unrealized P&L, Available Margin, and Position Margin. On the right side, you’ll also see options to deposit and withdraw.

By clicking the Deposit button, you’ll be presented with a box containing your Bitcoin (BTC) deposit address as well as its corresponding QR code.

The withdrawal process is also fairly simple. For your own safety, withdrawals require your account to be verified and have 2FA turned on.

How to Trade on Bybit

Bybit is basically a crypto futures platform, and the exchange allows its users to place both long and short positions. Place a long order if you think the price will rise, or place a short order if you think the price will tumble.

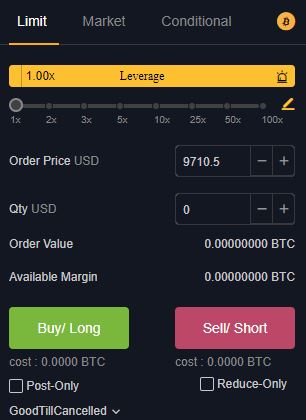

Additionally, there are many advanced order types: Limit, Market, and Conditional.

Limit Order

With a limit order, you can set the price at which your order will be executed. Let’s say Bitcoin is currently trading at $9,800 and you want to long it, but you feel the price is too high. You can set a limit order to buy Bitcoin at $9,700, and when the market drops to that price, your order will be filled.

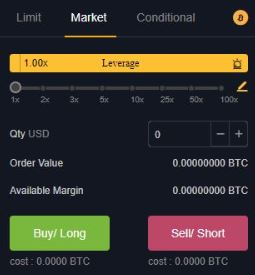

Market Order

This is the simplest order type. You select an amount of Bitcoin (for example) that you wish to buy or sell and then hit the Long or Short button, respectively. The order will be executed at the best available price of Bitcoin on the order book.

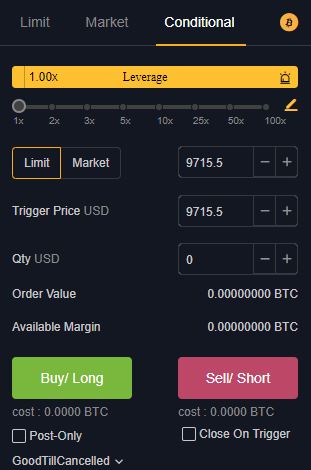

Conditional Order

Conditional orders are best suited to more experienced traders. When you set a conditional order, you have toenter a trigger price along with the limit price. The trigger is the price at which your order will enter the order book. So, when the trigger price is reached, only then will the order be delivered to the market (whether it’s limit or market).

Bybit margin trading – how to set leverage

Before you enter the position quantity, you’ll have to select a margin level. Once you do this, your position will be re-calculated and you’ll be ready to go. Bybit allows a margin level of up to 100x. This means that you can trade each $1 for $100; however, as the margin increases, your position’s stop-loss tightens.

Opening and Closing a Position

As you can see, opening a position on Bybit is fairly straightforward. After you’ve chosen the order type you wish to place, all you have to do is enter the desired metrics. Once you’ve done so, you open your position by clicking on the “Buy/Long” or “Sell/Short” button, depending on whether you want to long or short the cryptocurrency at hand.

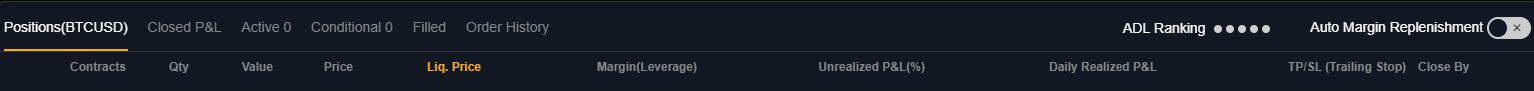

After you’ve done so, you will see your position appear in a designated space where you can monitor its performance.

Here you can check the more important metrics of your position and activate Auto Margin Replenishment (AMR), which you can read more about below. Your position can be closed in a few ways. First, you can always close the position at the spot price. However, you can also set an order that’s opposite to your current one.

Isolated Margin and Auto Margin Replenishment

Margin trading is gaining popularity in the cryptocurrency space, and more and more exchanges seem to be offering it. Before we dive into Bybit’s offerings, it’s important to understand that margin trading contains serious risks. While it can accelerate your profits, it can also seriously damage your capital.

You have two options when it comes to margin trading on Bybit: Isolated Margin and Auto Margin Replenishment.

Isolated Margin

This is the default margin mode, and if you haven’t touched it, it’s what’s activated on your account. In this mode, your position’s margin is completely isolated from your account balance. The exchange won’t extract any additional margin from your available balance. This is recommended for less-experienced traders who wish to minimize their risk and limit their losses.

Auto Margin Replenishment (AMR)

This mode automatically adds margin to existing open positions in order to avoid liquidation. Once you enable AMR, if the margin level on your position is about to reach the maintenance margin level, Bybit will replenish the margin from your available balance. It’s perhaps best to use this option with care in light of the volatility of the cryptocurrency market.

What Are the Fees on Bybit?

Bybit charges two types of fees depending on whether you qualify as a market maker or a market taker.

Market Makers: The fee here is 0.025% of your trade. To qualify as a market maker, your order must be placed on the order book waiting to be filled. This is the case when you decide to place a limit order.

Market Takers: The fee here is 0.075%. When you are a market taker, your order is filled immediately without being placed on the order book. That applies when you decide to place a market order.

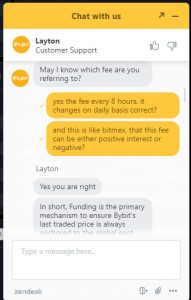

On top of the above, there is a funding fee, which is exchanged between buyers and sellers, and calculated every 8 hours – 00:00 UTC, 08:00 UTC and 16:00 UTC.

Bybit Security: Is Bybit Safe?

In it’s short life, Bybit had been proven to be a secure place to trade on. Bybit operates a sort-of insurance fund to deal with shortfalls in contract settlements.

Regarding personal account security, Bybit offers 2-FA authentication, provided by the Google Authenticator app.

Bybit Support

Bybit was found to provide great support, which is uncommon compared to other margin exchanges. Bybit provides Chat support 24-hours every day, which is something that differentiates it from a lot of competitors.

When tested, the queue lasted roughly one minute, and the support representative was kind answering all of our questions, providing all necessary information.

Bybit Regulation and KYC

Just like most of the other crypto margin exchanges, Bybit doesn’t require KYC in order to trade:

“Due to the evolving nature of the blockchain and cryptocurrency industry, most countries have yet to establish regulations and jurisdictions to govern cryptocurrencies.”, as said to CryptoPotato by Bybit team.

“However, that being said, Bybit understands the importance of being licensed and is currently actively seeking avenues to obtain any relevant regulatory license.”, Bybit adds.

As of writing these lines, Bybit is not regulated under any country, and its headquarters are based in Singapore and registered in British Islands.

The post Bybit Beginner’s Guide & Exchange Review appeared first on CryptoPotato.