By Embracing Bitcoin, My Favorite Music Festival Could Help Secure Its Long-Term Future

This is an opinion editorial by BitcoinActuary, an actuary based in the U.K.

I’ve recently returned from spending a long weekend with around 200,000 others at one of the loves of my life, Glastonbury Festival. The 2023 version of this annual music festival was peppered with sets from big name acts — Elton John, Guns N’ Roses and Foo Fighters, to name a few — but the inevitable media focus on these tends to mislead those viewing it from the outside. Glastonbury is a phenomenon of vast scale; it could be described as 10 festivals wrapped into one. Nearly everyone who goes will tell you they’ve had a great time, but probably all for different reasons.

So, what links Glastonbury with Bitcoin? Some cursory research and my own trips to the festival in recent years suggest that very few have ever made a link at all, barring this typically-scathing Guardian effort from a couple of years back.

Indeed, many probably see the two as polar opposites. Glastonbury is famously left wing — there remains the Left Field tent, which houses talks and debates by activists and union members, led by the ever-present, “broadly leftist” Billy Bragg. The pyramid stage field featured grass coloring this year to display the giant message: “We Stand With The NHS” in support of the U.K.’s National Health Service.

Bitcoin, by contrast, is often characterized as a technology that appeals to the right wing. David Golumbia went about as far as it’s possible to go in his 2016 book “The Politics Of Bitcoin: Software As Right-Wing Extremism.”

Secondly, the festival is environmentally conscious and has long supported Greenpeace. By contrast, Bitcoin is constantly criticized for its supposedly-wasteful energy use. Greenpeace’s U.S. arm has been responsible for its infamously poor “change the code, not the climate” campaign against Bitcoin, funded to the tune of $5 million by Ripple’s Chris Larson.

But are Glastonbury and Bitcoin really irreconcilable? Not at all.

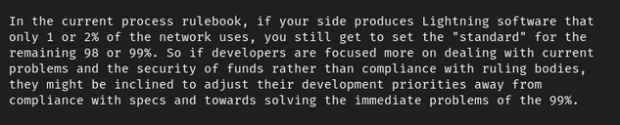

Firstly, on the political front, Bitcoin itself is actually apolitical. It is a set of rules without rulers. Anyone who attempts to argue otherwise tends to mischaracterize it, and often relies on typecasting the average Bitcoiner as right wing. In response, I’d encourage readers to take a longer-term look at monetary history, and to ask the likes of Golumbia what it is about this open-source, universally-accessible, optional, non-coercive protocol that is so detestable. The smartest shortcut response to this hypothetical comes from Natalie Smolenski: “Being an enemy of a technology is a fairly dumb way to waste your time because you’re not in charge of whether a technology is adopted at any meaningful scale.”

Moreover, those from the “progressive” end of the political spectrum are beginning to make their voices heard and show that Bitcoin has universal appeal. Reminder: Bitcoin is for enemies.

Onto Bitcoin’s environmental impact. As argued here and here, all is not what it initially seems when evaluating Bitcoin’s ongoing energy use. In reality, Bitcoin is operating with ever-increasing efficiency and it drives behavioral change by lowering an individuals time preference, which can be a vital step in reducing the rampant and wasteful consumerism that we see in the world today.

In summary, on both the political and environmental fronts, Bitcoin and Glastonbury are not the polar opposites that many would assume. There are commonalities, too. Both suit a libertarian outlook. Each has one-word brand recognition. Both would appear to sell themselves — Bitcoin, of course, has seen explosive growth with no formal marketing department, while Glastonbury tickets over the previous decade have generally sold out in less than an hour and around eight months before the event is actually held. Bitcoin has memes, Glastonbury has memes on flags.

So, how might Glastonbury embrace Bitcoin?

This past year, it was striking just how many payments were being made by card versus only a few years earlier, when cash reigned supreme. With many small merchants at the festival, it could hugely reduce fees of anywhere between 1.5% and 3.5% currently levied on every purchase, by embracing Bitcoin’s Lightning Network as an added payment option. In the U.K., I’d suggest checking out the excellent work done by CoinCorner and Bridge2Bitcoin in driving forward the Lightning Network as a low-cost payment mechanism for merchants.

In addition, bitcoin could represent a natural, long-term treasury reserve asset for Glastonbury — a long-term holding in bitcoin could help ride out any rough times in future. Indeed, the festival is no stranger to the pernicious nature of inflation: Ticket prices were £105 in 2003 and had increased to £335 in 2023, which no doubt reflects the many increases in costs faced.

Glastonbury have long been ahead of the curve in making sweeping changes ahead of others. In 2007, it eliminated ticket touts and scalpers in one fell swoop by including festival goers’ photos on tickets. In 2019, it banned single-use plastic bottles entirely from the site, and in 2023, around 22,000 tickets were sold specifically for festival goers traveling by bus. Might it also get ahead of the curve in embracing Bitcoin?

Admittedly, probably not, based on any current evidence. But I would say to Michael and Emily Eavis, the organizers of the event: Dig a little deeper than the current, skewed output on display from mainstream publications in the U.K. There is much more to Bitcoin than first meets the eye.

Michael Eavis confirmed in this year’s festival program that the local council has now issued a license for them to hold the festival in perpetuity. This must feel particularly sweet, given his struggles with them over the years. For Glastonbury, it seems, there will always be another year. And so too for Bitcoin.

This is a guest post by BitcoinActuary. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.