Bulls vs. Bears: Over $1.1 Billion Shorts and Longs Liquidated in the Past 24 Hours

The past 24 hours on the cryptocurrency market have been particularly intense. This time around, the action doesn’t seem to come from Bitcoin, which has been taking a breather.

Altcoins, on the other hand, are going parabolic. As CryptoPotato reported, they added almost $40 billion to the total market cap. Despite this increase, both long and short liquidations are off the charts.

Over $1.1 Billion Liquidated in a Day

As it’s oftentimes the case, when Bitcoin stops its advance, alternative cryptocurrencies take advantage and start to pop. This is what has been happening over the past couple of days. The primary cryptocurrency declined in value, which allowed room for others to step in.

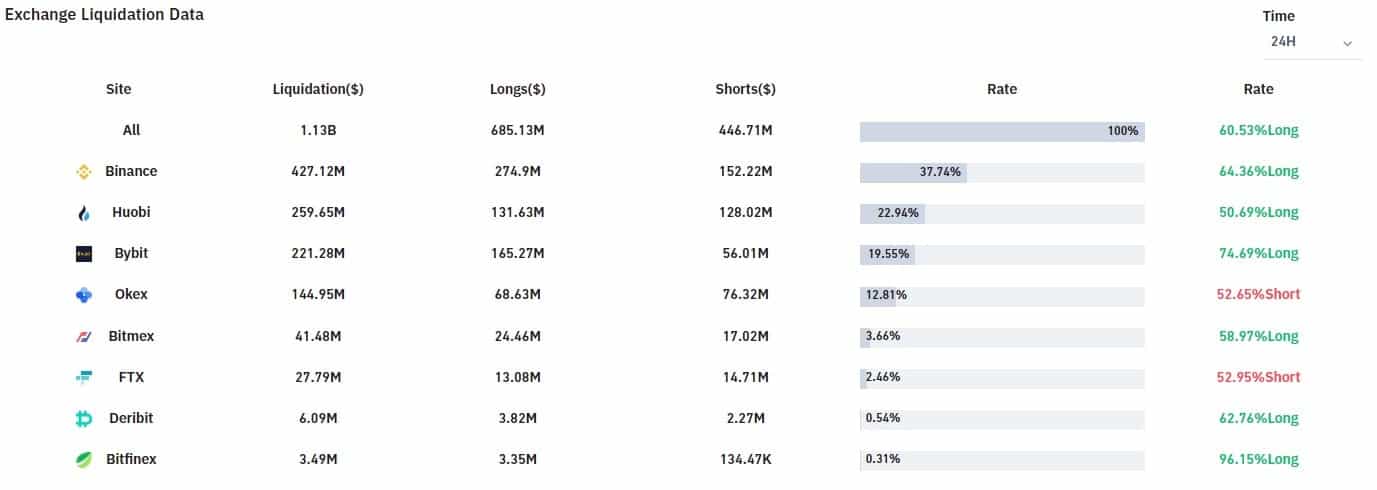

The total trading volume in the past 24 hours alone surged to just shy of $400 billion. In the same period of time, more than $1.1 billion worth of short and long positions were liquidated. This translates to almost 120,000 traders on the major exchanges.

The largest single liquidation order over the past hour took place on Huobi and had a face value of the whopping $12.92 million. Over the same period of time, about $31 million worth of long and short positions were liquidated.

As seen in the above chart, the majority of positions were long, accounting for a total of $685 million. Leading the way is Binance, which doesn’t really come as a surprise. Next in line are Huobi, Bybit, and OKEx.

A Zero-Sum Game

Trading is a zero-sum game. This means that for one to win, another has to lose. It’s a paramount principle that needs to be kept under close consideration when stepping into a market as volatile as this one.

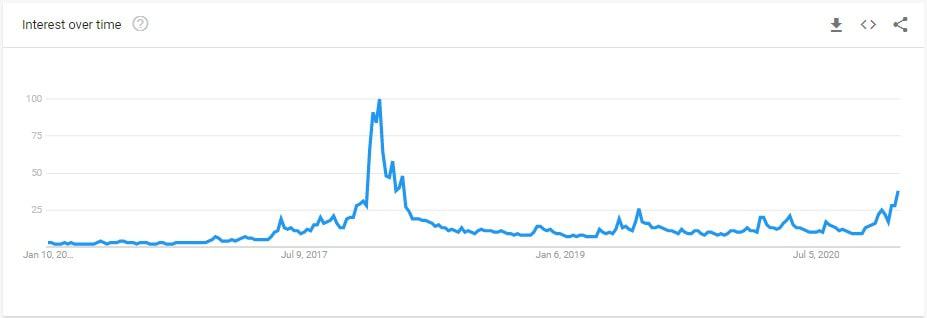

This is especially true for newcomers. Data from Google Trends reveals that the interest in Bitcoin has increased substantially over the past month.

It’s obvious that the current levels are nowhere near their peak from back in 2017, but the massive volatility can cause serious capital loss unless risk management and proper principles are in place.