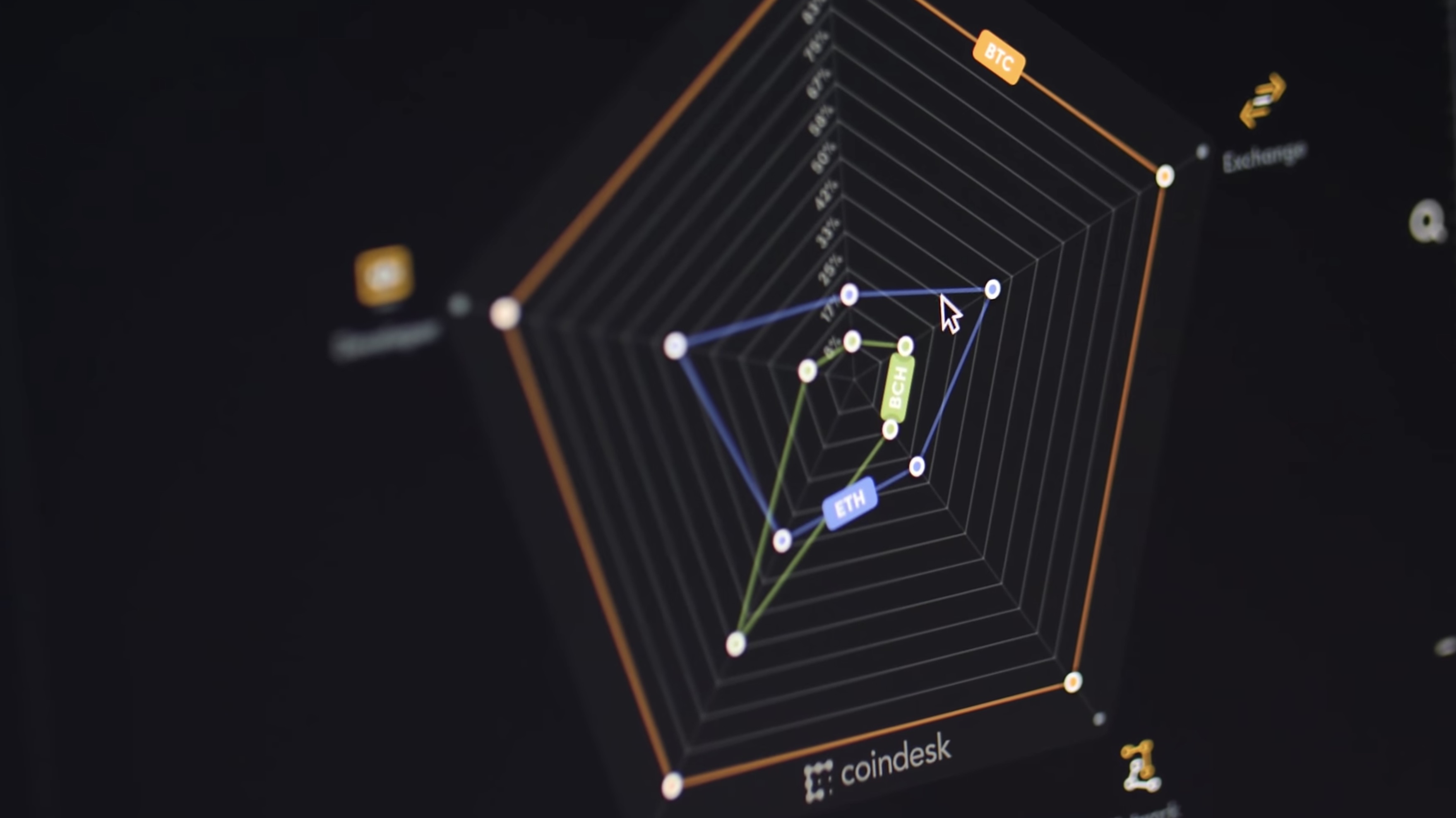

Bullish Sentiment for Bitcoin As Long Bets Near 11-Month Highs

Bullish bets on bitcoin, the world’s largest cryptocurrency by value, reached 11-month highs on Monday, according to the data from the cryptocurrency exchange Bitfinex.

The number of long positions on bitcoin’s US dollar-denominated exchange rate (BTC/USD) jumped to 38,237 BTC at 04:10 BTC – the highest level since March 30, 2018 – and were last seen at 36,176 BTC.

While long positions have risen by 35 percent in the last three weeks, short positions have remained largely unchanged. As a result, the long-short ratio, a barometer of market sentiment, has improved to 1.5 from 1.18.

The market mood has indeed turned bullish but hasn’t reached extremes, as long positions are still at least 8 percent short of the record high of 40,193 registered on March 26, 2018.

That said, BTC’s rally to 5.5-week highs above $3,900 has likely opened the doors to a convincing move above $4,000. That would only attract buyers, pushing BTC/USD longs to fresh record highs.

As of writing, BTC is changing hands at $3,912 on Bitfinex, the highest level since Jan. 10. The cryptocurrency would become vulnerable to “long squeeze” – a sudden pullback in prices due to an unwinding of long positions – if and when the bullish sentiment reaches extremes.

Disclosure: The author holds no cryptocurrency assets at the time of writing.

Bitcoin image via Shutterstock; charts by Trading View