Bullish? Bitcoin Outflows From Spot Exchanges Reached a Yearly High: Analysis

Bitcoin investors have halted depositing their assets onto cryptocurrency exchanges and have actually started to withdraw substantial quantities, says on-chain data. Furthermore, it showed that most of the withdrawals came from retail investors, but whales and institutions have also accumulated BTC lately.

Exchange Withdrawals to Early Highs

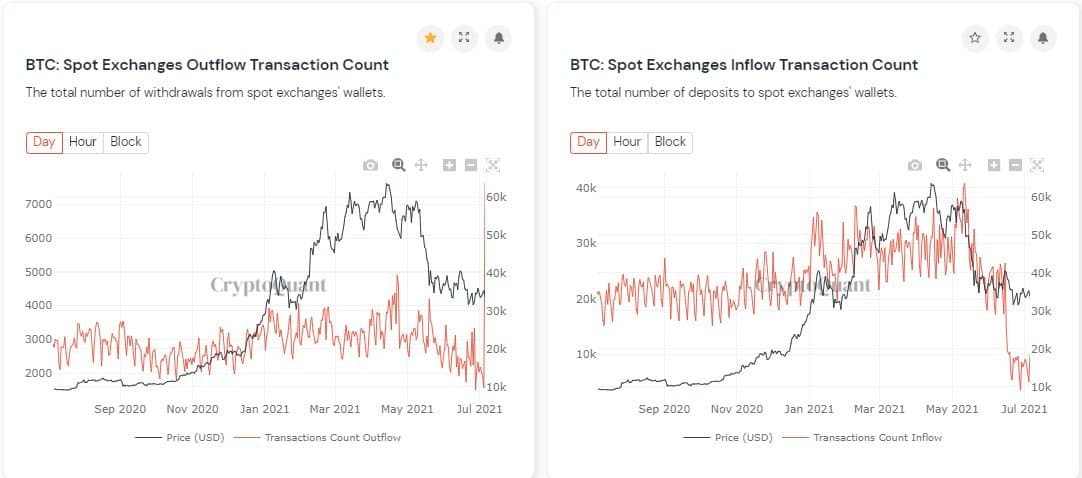

Data from CryptoQuant highlighted the recent trends in terms of BTC investors’ withdrawals and deposits from and to cryptocurrency exchanges.

Somewhat expectedly, their behavior has a lot to do with price movements as well. Generally, holders send their coins from cold wallets to trading venues when they intend to sell and transfer them back when they plan to HODL for a more extended period.

As such, the deposits skyrocketed to new highs in mid-May following the FUD prompted by Elon Musk and China. At that point, the price of bitcoin had already started to retrace, but it fell by another $20,000 to around $30,000.

As the dust settled, most investors reduced their deposits, but it seems they had a complete change of mind lately, as the graph below demonstrates.

At the same time, the number of withdrawals has surged now, suggesting that investors could be looking to HODL their coins now instead of panic selling as it happened in May.

Interestingly, the analytics company also asserted that “a majority of outflow transaction counts (5,800) were from Gate_io,” and all of them came from retail investors because of their relatively small size (less than one BTC).

Whales and Institutions Also Buy

Apart from smaller investors purchasing and withdrawing bitcoins from exchanges, other recent reports indicated that the so-called whales have started doing the same as well.

After a short pause and even sell-off in June, wallets containing between 100 and 10,000 bitcoins accumulated roughly 60,000 coins in just one day at the start of July. As a result, their total stash increased to more than nine million BTC.

The demand for Canada’s first Bitcoin ETF also urged the company behind it – Purpose Investments – to buy sizeable portions of the asset. CryptoPotato reported recently that its holdings increased by 30% in a few weeks, and the Purpose BTC ETF had roughly 22,500 coins.